Free Asset Manager Agreement (Template & Builder)

What is Asset Manager Agreement?

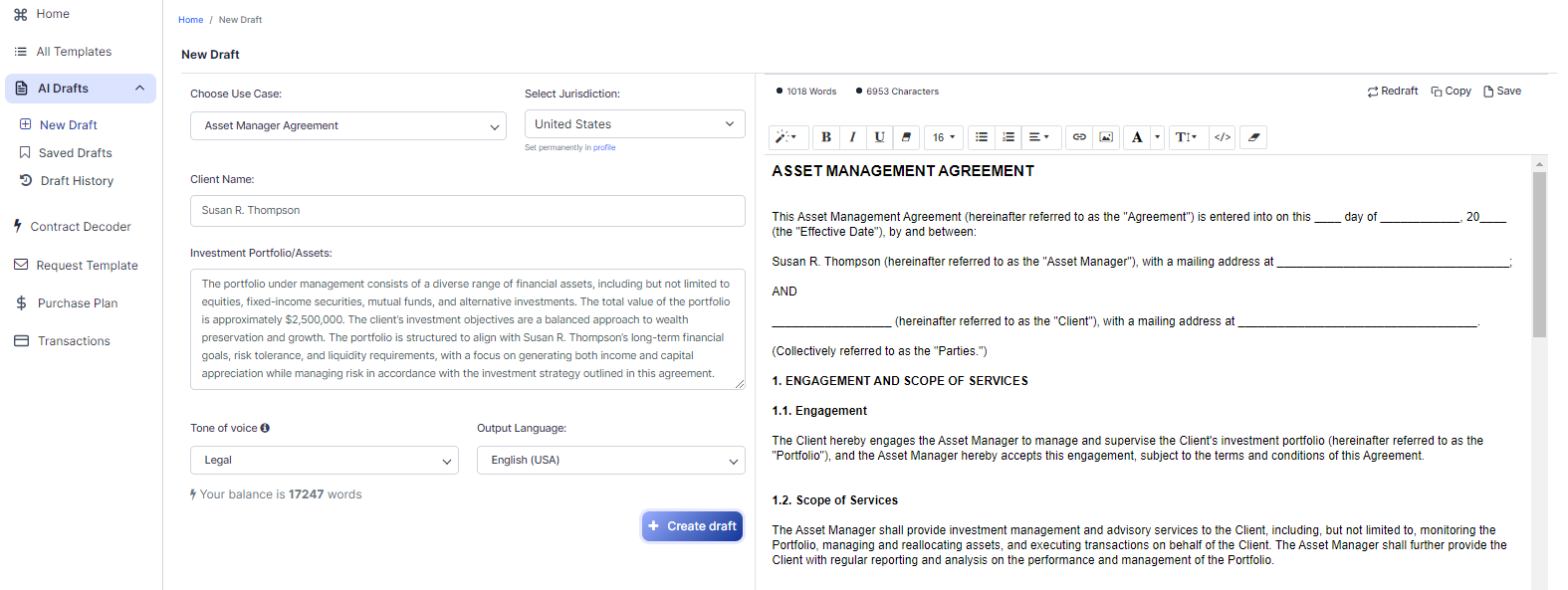

Asset Manager Agreement An Asset Manager Agreement outlines the terms for managing investment portfolios or assets, specifying fees, performance expectations, and the scope of asset management services.

Sample template (2026):

ASSET MANAGEMENT AGREEMENT

This Asset Management Agreement (hereinafter referred to as the "Agreement") is entered into on this ____ day of ____________, 20____ (the "Effective Date"), by and between:

Susan R. Thompson (hereinafter referred to as the "Asset Manager"), with a mailing address at ___________________________________;

AND

__________________ (hereinafter referred to as the "Client"), with a mailing address at ____________________________________.

(Collectively referred to as the "Parties.")

1. ENGAGEMENT AND SCOPE OF SERVICES

1.1. Engagement

The Client hereby engages the Asset Manager to manage and supervise the Client's investment portfolio (hereinafter referred to as the "Portfolio"), and the Asset Manager hereby accepts this engagement, subject to the terms and conditions of this Agreement.

1.2. Scope of Services

The Asset Manager shall provide investment management and advisory services to the Client, including, but not limited to, monitoring the Portfolio, managing and reallocating assets, and executing transactions on behalf of the Client. The Asset Manager shall further provide the Client with regular reporting and analysis on the performance and management of the Portfolio.

2. INVESTMENT OBJECTIVES AND STRATEGY

2.1. Investment Objectives

The Client's investment objectives are a balanced approach to wealth preservation and growth, with a focus on generating income and capital appreciation, while managing risk in accordance with the investment strategy outlined in this Agreement.

2.2. Investment Strategy

The Asset Manager shall develop and implement an investment strategy for the Portfolio, which shall be in line with the Client's investment objectives, risk tolerance, and liquidity requirements. The investment strategy shall include a diverse range of financial assets, including, but not limited to, equities, fixed-income securities, mutual funds, and alternative investments. The total value of the Portfolio is approximately $2,500,000.

3. ASSET MANAGEMENT FEES

3.1. Fee Schedule

The Asset Manager shall be entitled to receive an annual management fee, calculated as a percentage of the average daily net asset value of the Portfolio during the billing period. The management fee shall be payable quarterly in arrears and shall be based on the following schedule:

- For the first $1,000,000 in assets under management: __% per annum;

- For assets under management above $1,000,000 and up to $2,500,000: __% per annum;

The Asset Manager may change the fee schedule upon 60 days written notice to the Client.

3.2. Limited Power of Attorney

The Client hereby grants to the Asset Manager a limited power of attorney, solely for the purpose of debiting the Client's account for the payment of asset management fees and any other expenses authorized under this Agreement.

4. REPORTING

4.1. Periodic Reporting

The Asset Manager shall provide the Client with written reports concerning the performance and management of the Portfolio on a periodic basis, no less frequently than quarterly.

4.2. Ad Hoc Reporting

The Asset Manager shall be available to the Client to provide reports and address any questions or concerns related to the Portfolio on an as-needed basis.

5. REPRESENTATION AND WARRANTIES

Both Parties represent and warrant that they have the authority to enter into this Agreement and perform their respective obligations hereunder. The Asset Manager represents and warrants that its services shall be conducted in a professional manner and in compliance with applicable laws and regulations, including those of the United States of America.

6. CONFIDENTIALITY

Both Parties agree to maintain the confidentiality of any non-public information obtained pursuant to this Agreement, and to use such information only in connection with the performance of their respective obligations under this Agreement.

7. TERM AND TERMINATION

7.1. Term

This Agreement shall be effective as of the Effective Date and shall continue until terminated by either Party in accordance with the provisions of this Section 7.

7.2. Termination without Cause

Either Party may terminate this Agreement without cause upon 30 days written notice to the other Party.

7.3. Termination for Cause

Either Party may terminate this Agreement for cause upon written notice to the other Party, if the other Party materially breaches this Agreement and fails to cure such breach within 30 days of receiving written notice thereof.

8. INDEMNIFICATION

Each Party agrees to indemnify and hold harmless the other Party, its affiliates, and their respective officers, directors, employees, and agents from and against any and all losses, claims, damages, liabilities, and expenses (including reasonable attorney fees), arising out of or resulting from any breach of this Agreement by the indemnifying Party, except to the extent such losses, claims, damages, liabilities, and expenses are attributable to the gross negligence, willful misconduct, or breach of this Agreement by the indemnified Party.

9. GOVERNING LAW AND DISPUTE RESOLUTION

This Agreement shall be governed by and construed in accordance with the laws of the United States of America. Any dispute, controversy, or claim arising out of or relating to this Agreement, or the breach, termination, or invalidity thereof, shall be settled by arbitration in accordance with the commercial arbitration rules of the [INSERT ARBITRATION BODY], and judgment upon the award rendered by the arbitrator may be entered in any court having jurisdiction thereof. The place of arbitration shall be [INSERT JURISDICTION].

10. MISCELLANEOUS

10.1. Entire Agreement

This Agreement constitutes the entire agreement and understanding of the Parties with respect to the subject matter hereof, and supersedes all prior and contemporaneous agreements, proposals, negotiations, understandings, and representations, whether oral or written, relating thereto.

10.2. Amendment

No modification, amendment, or waiver of any provision of this Agreement shall be effective unless in writing and signed by both Parties.

IN WITNESS WHEREOF, the Parties have executed and delivered this Agreement as of the Effective Date.

________________________ __________________________

Susan R. Thompson Client

Asset Manager

Ready to Create your own Asset Manager Agreement?

Sections of an Asset Manager Agreement

In this Asset Manager Agreement, you will see the following sections:

- Engagement and Scope of Services

- Investment Objectives and Strategy

- Asset Management Fees

- Reporting

- Representation and Warranties

- Confidentiality

- Term and Termination

- Indemnification

- Governing Law and Dispute Resolution

- Miscellaneous

Going indepth - Analysis of each section:

- Engagement and Scope of Services : This section explains that the client is hiring the asset manager to manage their investment portfolio. The asset manager will provide services such as monitoring the portfolio, managing assets, executing transactions, and providing regular reports and analysis on the portfolio's performance.

- Investment Objectives and Strategy : This section outlines the client's investment goals, which include a balanced approach to wealth preservation and growth, focusing on generating income and capital appreciation while managing risk. The asset manager will develop an investment strategy that aligns with the client's objectives, risk tolerance, and liquidity requirements, using a diverse range of financial assets.

- Asset Management Fees : This section details the fees the asset manager will charge for their services, based on a percentage of the average daily net asset value of the portfolio. The fees are payable quarterly and can be changed with 60 days written notice. The client also grants the asset manager limited power of attorney to debit their account for payment of fees and other authorized expenses.

- Reporting : The asset manager will provide the client with written reports on the portfolio's performance and management at least quarterly. They will also be available to address any questions or concerns the client may have on an as-needed basis.

- Representation and Warranties : Both parties confirm they have the authority to enter into the agreement and will perform their obligations professionally and in compliance with applicable laws and regulations.

- Confidentiality : Both parties agree to keep any non-public information obtained through the agreement confidential and use it only for performing their obligations under the agreement.

- Term and Termination : The agreement is effective from the specified date and continues until either party terminates it. Termination can occur without cause with 30 days written notice or for cause if a party breaches the agreement and fails to remedy the breach within 30 days of receiving written notice.

- Indemnification : Each party agrees to indemnify and hold the other harmless from any losses, claims, damages, liabilities, and expenses resulting from a breach of the agreement, except in cases of gross negligence, willful misconduct, or breach by the indemnified party.

- Governing Law and Dispute Resolution : The agreement is governed by the laws of the United States of America. Any disputes will be settled through arbitration, with the arbitration body and jurisdiction specified in the agreement.

- Miscellaneous : This section states that the agreement is the entire understanding between the parties and supersedes any prior agreements or negotiations. Amendments or waivers must be in writing and signed by both parties.

Ready to get started?

Create your Asset Manager Agreement now