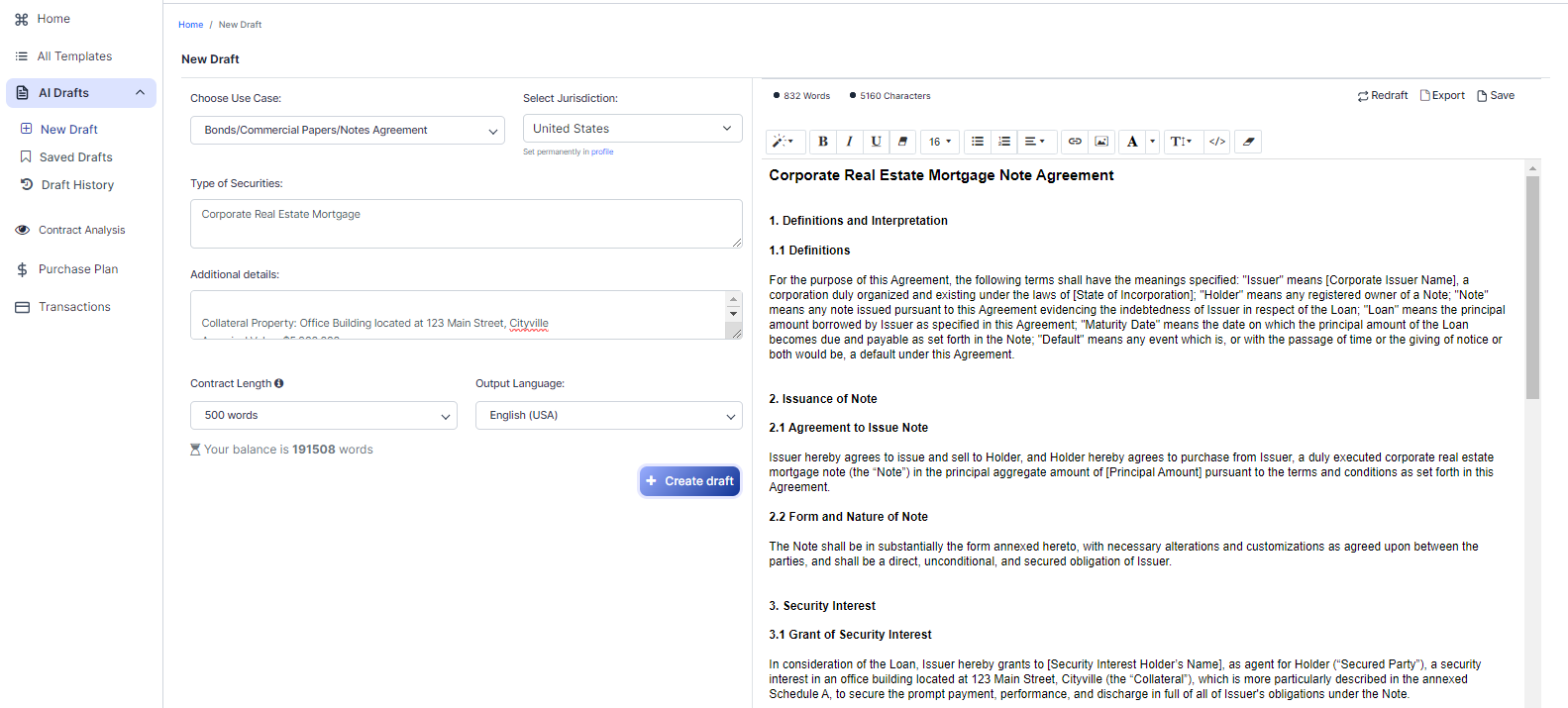

Free Bonds/Commercial Papers/Notes Agreement (Template & Builder)

What is Bonds/Commercial Papers/Notes Agreement?

Bonds/Commercial Papers/Notes Agreement Bonds, Commercial Papers, and Notes Agreements define the terms of debt securities, including issuance terms, interest rates, and repayment conditions, often used for fundraising by entities.

Sample template (2026):

Senior Unsecured Convertible Notes Agreement

1. Issuance of Convertible Notes

1.1. Offering and Sale of Convertible Notes

This Senior Unsecured Convertible Notes Agreement (the "Agreement") is entered into by and between the undersigned issuer ("Issuer") and the undersigned purchaser ("Purchaser") as of the date of acceptance. Issuer hereby offers to sell to the Purchaser, and the Purchaser hereby agrees to purchase from the Issuer, the principal amount of the Senior Unsecured Convertible Notes (the "Convertible Notes") set forth in the relevant purchase order, subject to the terms and conditions contained in this Agreement.

2. Terms of Convertible Notes

2.1. Maturity Date

The Convertible Notes shall mature and become due and payable, together with accrued and unpaid interest, on the date (the "Maturity Date") which is five (5) years after the date of issuance.

2.2. Interest Rate

The Convertible Notes shall bear interest at the rate of six percent (6%) per annum, payable semiannually on June 30 and December 31 (each, an "Interest Payment Date") in arrears, commencing on the first Interest Payment Date following the date of issuance.

2.3. Conversion Rights

At any time prior to the Maturity Date, the Purchaser shall have the right, at its option, to convert all or any portion of the outstanding principal amount and accrued and unpaid interest of the Convertible Notes into fully paid and non-assessable shares of common stock of the Issuer ("Common Stock") at the conversion rate in effect on the relevant conversion date (the “Conversion Rate”).

2.4. Conversion Rate

The initial Conversion Rate shall be the quotient of the principal amount of the Convertible Notes to be converted, plus any accrued and unpaid interest, divided by the conversion price (the "Conversion Price") in effect on the conversion date. The Conversion Price shall initially be equal to 120% of the average closing price of the Common Stock for the ten (10) trading days immediately preceding the date of issuance. The Conversion Price shall be subject to adjustment for stock dividends, stock splits, combinations, reclassifications, and other customary anti-dilution provisions as more fully set forth in the Convertible Notes.

3. Ranking

The Convertible Notes shall be senior, unsecured obligations of the Issuer and shall rank pari passu to all present and future unsecured and unsubordinated indebtedness of the Issuer, and senior in right of payment to all existing and future subordinated indebtedness of the Issuer.

4. Redemption

4.1. Optional Redemption

At any time after the date which is two (2) years after the date of issuance, the Issuer may, upon not less than thirty (30) days nor more than sixty (60) days prior written notice to the Purchaser, redeem all or any portion of the Convertible Notes at a redemption price equal to 105% of the outstanding principal amount thereof, plus accrued and unpaid interest to the redemption date.

4.2. Change of Control

Upon the occurrence of a Change of Control (as defined in the Convertible Notes), which occurs prior to the Maturity Date, the Purchaser shall have the right, at its option, to require the Issuer to redeem all or any portion of the Convertible Notes at a redemption price equal to 110% of the outstanding principal amount thereof, plus accrued and unpaid interest to the redemption date.

5. Representations and Warranties

Issuer and Purchaser each hereby represent and warrant to the other that (i) it has duly executed and delivered this Agreement, (ii) this Agreement constitutes its valid and legally binding obligation, enforceable against it in accordance with its terms, and (iii) it has the requisite power, authority, and legal capacity to enter into and perform this Agreement.

6. Governing Law; Jurisdiction; Waiver of Jury Trial

This Agreement, and all claims or causes of action related to this Agreement, shall be governed by and construed and enforced in accordance with the laws of the United States and the laws of the State of [Applicable State], without giving effect to any choice or conflict of law provision or rule. Any legal suit, action, or proceeding arising out of or related to this Agreement shall be instituted exclusively in the courts sitting in [Applicable State]. Each party irrevocably submits to the exclusive jurisdiction of such courts in any suit, action, or proceeding and waives any objection based on improper venue or forum non conveniens. EACH PARTY WAIVES ALL RIGHTS TO A TRIAL BY JURY IN CONNECTION WITH ANY DISPUTE RELATING TO OR ARISING OUT OF THIS AGREEMENT.

7. Counterparts; Electronic Signatures

This Agreement may be executed in any number of counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument. This Agreement may be executed by facsimile or electronically transmitted signatures and such facsimile or electronically transmitted signatures (including, without limitation, ".pdf", "TIFF" and "scan" formats) shall be binding upon and enforceable against the parties as if they were original signatures.

8. Notices

All notices, consents, and other communications hereunder shall be in writing and shall be deemed to have been duly given when delivered by hand or sent by overnight courier, by facsimile transmission with confirmation of receipt, or by electronic mail, addressed:

If to the Issuer: [Issuer's Address, Fax Number, and Email]

If to the Purchaser: [Purchaser's Address, Fax Number, and Email]

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date first above written.

ISSUER:

_____________________ ___________________________

Name: [Name] Title: [Title]

PURCHASER:

_____________________ ___________________________

Name: [Name] Title: [Title]

Ready to Create your own Bonds/Commercial Papers/Notes Agreement?

Sections of a Senior Unsecured Convertible Notes Agreement

In this Senior Unsecured Convertible Notes Agreement, you will see the following sections:

- Issuance of Convertible Notes

- Terms of Convertible Notes

- Ranking

- Redemption

- Representations and Warranties

- Governing Law; Jurisdiction; Waiver of Jury Trial

- Counterparts; Electronic Signatures

- Notices

Going indepth - Analysis of each section:

- Issuance of Convertible Notes : This section explains that the issuer is offering to sell convertible notes to the purchaser, and the purchaser agrees to buy them. It's like a store selling a product to a customer, with the product being the convertible notes.

- Terms of Convertible Notes : This section outlines the specific terms of the convertible notes, such as the maturity date (when they need to be paid back), interest rate, and conversion rights (the option to convert the notes into shares of the issuer's stock). It's like the instruction manual for the product being sold.

- Ranking : This section explains that the convertible notes are senior, unsecured obligations of the issuer, meaning they have priority over other types of debt in case the issuer goes bankrupt. It's like being first in line at a buffet.

- Redemption : This section describes the issuer's right to buy back the convertible notes before the maturity date and the purchaser's right to require the issuer to buy back the notes in case of a change of control (e.g., a merger or acquisition). It's like having the option to return a product before its warranty expires.

- Representations and Warranties : This section contains promises made by both the issuer and the purchaser, such as the legality of the agreement and their authority to enter into it. It's like a guarantee that both parties are following the rules and have the power to make the deal.

- Governing Law; Jurisdiction; Waiver of Jury Trial : This section specifies which state's laws will apply to the agreement and where any legal disputes will be resolved. Both parties also agree to waive their right to a jury trial. It's like choosing the rules of a game and where the game will be played.

- Counterparts; Electronic Signatures : This section allows the agreement to be signed in multiple copies and accepts electronic signatures as legally binding. It's like signing a contract online instead of in person.

- Notices : This section explains how and where any official communications related to the agreement should be sent. It's like providing a mailing address for important documents.

Ready to get started?

Create your Bonds/Commercial Papers/Notes Agreement now