Free Business Loan Agreement (Template & Builder)

What is Business Loan Agreement?

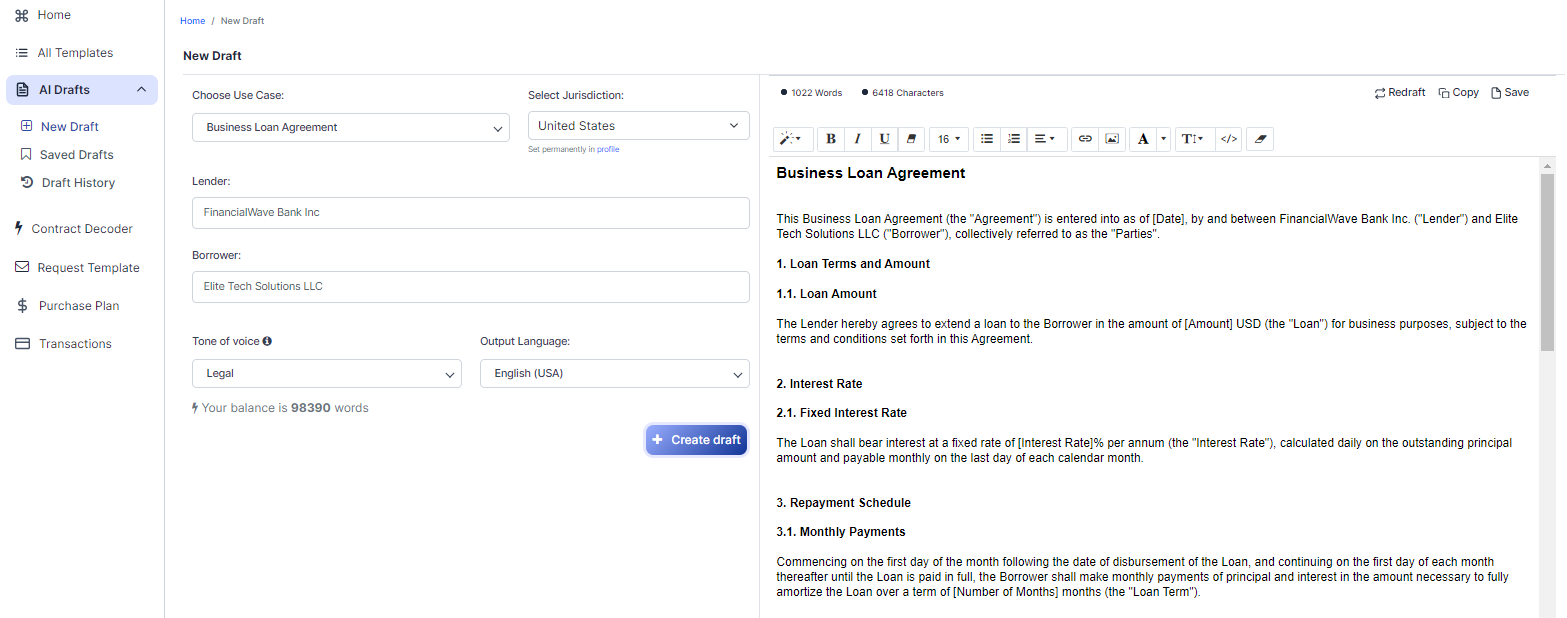

Business Loan Agreement A Business Loan Agreement outlines terms for loans to businesses, specifying loan terms, interest rates, repayment schedules, and loan conditions, including covenants and security interests.

Sample template (2026):

Business Loan Agreement

This Business Loan Agreement (the "Agreement") is entered into as of [Date], by and between FinancialWave Bank Inc. ("Lender") and Elite Tech Solutions LLC ("Borrower"), collectively referred to as the "Parties".

1. Loan Terms and Amount

1.1. Loan Amount

The Lender hereby agrees to extend a loan to the Borrower in the amount of [Amount] USD (the "Loan") for business purposes, subject to the terms and conditions set forth in this Agreement.

2. Interest Rate

2.1. Fixed Interest Rate

The Loan shall bear interest at a fixed rate of [Interest Rate]% per annum (the "Interest Rate"), calculated daily on the outstanding principal amount and payable monthly on the last day of each calendar month.

3. Repayment Schedule

3.1. Monthly Payments

Commencing on the first day of the month following the date of disbursement of the Loan, and continuing on the first day of each month thereafter until the Loan is paid in full, the Borrower shall make monthly payments of principal and interest in the amount necessary to fully amortize the Loan over a term of [Number of Months] months (the "Loan Term").

3.2. Maturity Date

The entire unpaid principal balance, plus any accrued and unpaid interest and other charges, shall be due and payable in full on or before the final payment date, which shall be [Maturity Date] (the "Maturity Date").

3.3. Prepayment

The Borrower may prepay the Loan, in whole or in part, at any time without premium or penalty. Any prepayment shall be applied first to accrued and unpaid interest, then to the outstanding principal balance, and then to any other amounts due and payable under this Agreement.

4. Loan Conditions

4.1. Covenants

The Borrower hereby covenants and agrees to:

(a) Use the Loan proceeds solely for the business purposes described in the Borrower's business plan and approved by the Lender;

(b) Provide the Lender with annual financial statements, no later than ninety (90) days following the end of each fiscal year, prepared in accordance with generally accepted accounting principles (GAAP);

(c) Maintain at all times a debt service coverage ratio of at least [Ratio] to 1.00, as determined by the Lender based on the Borrower's financial statements;

(d) Comply with all applicable federal, state, and local laws and regulations;

(e) Preserve and maintain its existence as a limited liability company organized under the laws of the United States;

(f) Promptly notify the Lender of any material adverse change in the Borrower's financial condition, business or operations, or any event of default under this Agreement; and

(g) Receive Lender's prior written consent before incurring any additional indebtedness that would cause the Borrower's total outstanding indebtedness to exceed [Amount] USD.

4.2. Security Interest

To secure the performance of the Borrower's obligations under this Agreement, the Borrower hereby grants to the Lender a first priority security interest in and lien on all of its assets, tangible and intangible, including, but not limited to, accounts, inventory, equipment, and intellectual property (the "Collateral"), and the Borrower agrees to execute and deliver to the Lender any and all documents necessary to perfect and maintain the Lender's security interest in the Collateral.

5. Events of Default

An event of default under this Agreement shall occur if:

(a) The Borrower fails to make any payment when due under this Agreement;

(b) The Borrower breaches any covenant or other obligation under this Agreement;

(c) The Borrower becomes insolvent, files a petition for bankruptcy, or otherwise commences or becomes subject to any bankruptcy, insolvency, or similar proceeding;

(d) Any representation, warranty, or certification made by the Borrower in connection with this Agreement is found to be materially false or misleading; or

(e) The occurrence of any other event or circumstance which, in the Lender's reasonable judgment, materially and adversely affects the Borrower's ability to perform its obligations under this Agreement.

6. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the United States.

7. Miscellaneous

7.1. Notices

All notices, requests, or other communications required or permitted by this Agreement shall be in writing, and shall be deemed duly given when delivered personally or by an overnight courier service, or three (3) business days after being sent by certified mail, postage prepaid, return receipt requested, to the Parties at their respective addresses set forth at the beginning of this Agreement, or at such other address as may be designated by a Party in writing.

7.2. Entire Agreement

This Agreement contains the entire understanding of the Parties with respect to the subject matter hereof, and supersedes all prior and contemporaneous agreements, representations, and understandings between the Parties, whether oral or written.

7.3. Amendment

This Agreement may be amended only by a written instrument signed by both Parties.

7.4. No Waiver

No failure or delay by either Party in exercising any right, power, or remedy under this Agreement shall operate as a waiver of any such right, power, or remedy, nor shall any single or partial exercise of any right, power, or remedy preclude any further exercise thereof, or the exercise of any other right, power, or remedy.

7.5. Counterparts

This Agreement may be executed in counterparts, each of which shall be deemed an original, and all of which, taken together, shall constitute one and the same instrument.

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the date first above written.

___________________________ ___________________________

FinancialWave Bank Inc. Elite Tech Solutions LLC

By: [Authorized Representative] By: [Authorized Representative]

Title: [Title] Title: [Title]

Ready to Create your own Business Loan Agreement?

Main Sections of a Business Loan Agreement

In this Business Loan Agreement, you will see the following sections:

- Loan Terms and Amount

- Interest Rate

- Repayment Schedule

- Loan Conditions

- Events of Default

- Governing Law

- Miscellaneous

About each Section - Analysis and Summary:

- Loan Terms and Amount : This section outlines the total amount of money being borrowed (the "Loan") and the purpose for which it will be used. Think of it as the foundation of the agreement, specifying the basic details of the loan.

- Interest Rate : This part explains the interest rate that will be applied to the loan, which is the cost of borrowing the money. It's like the price tag for using someone else's money to fund your business.

- Repayment Schedule : This section describes how and when the borrower will pay back the loan, including the start date, monthly payments, and the final payment date (the "Maturity Date"). It's like a roadmap for paying off the debt.

- Loan Conditions : This part lists the specific requirements and promises the borrower must follow, such as using the loan for approved business purposes, providing financial statements, and maintaining certain financial ratios. It also covers the collateral used to secure the loan. Think of it as the rules and guidelines the borrower must follow to keep the loan in good standing.

- Events of Default : This section outlines the situations that would cause the borrower to be in default, or in violation of the agreement. Examples include missing payments, breaking covenants, or filing for bankruptcy. It's like a list of "don'ts" that could lead to serious consequences if not followed.

- Governing Law : This part specifies which country's laws will be used to interpret and enforce the agreement. It's like choosing the rulebook that will be used if any disputes arise.

- Miscellaneous : This section covers various additional details, such as how to send notices, the fact that the agreement is the entire understanding between the parties, and how to amend the agreement. It's like a collection of fine print and housekeeping items that help ensure the agreement runs smoothly.

Ready to get started?

Create your Business Loan Agreement now