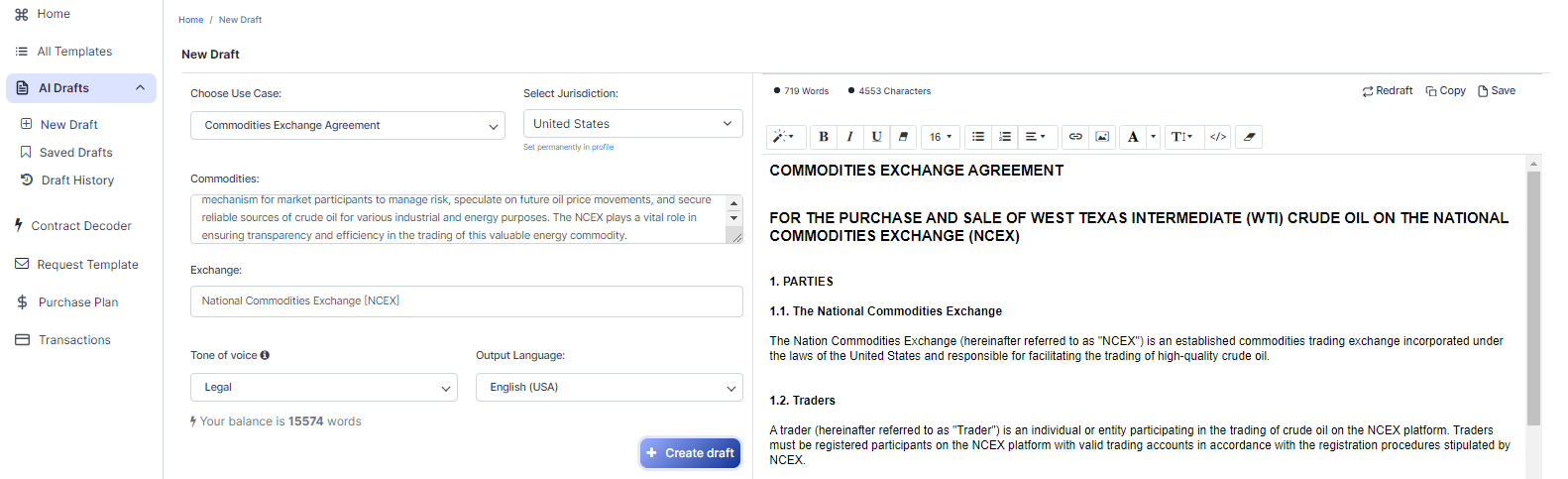

Free Commodities Exchange Agreement (Template & Builder)

What is Commodities Exchange Agreement?

Commodities Exchange Agreement A Commodities Exchange Agreement governs the trading of commodities on an exchange, specifying trading rules, fees, and delivery obligations.

Sample template (2026):

COMMODITIES EXCHANGE AGREEMENT

FOR THE PURCHASE AND SALE OF WEST TEXAS INTERMEDIATE (WTI) CRUDE OIL ON THE NATIONAL COMMODITIES EXCHANGE (NCEX)

1. PARTIES

1.1. The National Commodities Exchange

The Nation Commodities Exchange (hereinafter referred to as "NCEX") is an established commodities trading exchange incorporated under the laws of the United States and responsible for facilitating the trading of high-quality crude oil.

1.2. Traders

A trader (hereinafter referred to as "Trader") is an individual or entity participating in the trading of crude oil on the NCEX platform. Traders must be registered participants on the NCEX platform with valid trading accounts in accordance with the registration procedures stipulated by NCEX.

2. TRADING AND CONTRACTS

2.1. Trading

All trading on NCEX shall be subject to the rules and regulations established by NCEX and in compliance with the applicable United States laws and regulations. Traders involved in the purchase and sale of crude oil contracts shall execute trading activities in a transparent and efficient manner.

2.2. Standard Contracts

A standard contract for the delivery of West Texas Intermediate (WTI) crude oil on the NCEX shall consist of 1,000 barrels. Traders shall buy and sell these contracts to manage risk, speculate on future oil price movements, and secure reliable sources of crude oil for various industrial and energy purposes.

3. TRADING FEES

3.1. Trading Fees and Charges

Traders shall be subject to transaction fees, clearing fees, and other charges associated with the trading of WTI crude oil on the NCEX platform. The applicable fees and charges shall be established and updated by NCEX from time to time. Traders must fulfill their fee payment obligations in a timely manner to avoid disruptions in their trading activities.

4. DELIVERY OBLIGATIONS

4.1. Delivery of Crude Oil

Upon the expiration of a contract, the Trader who is the seller of the contract shall make available for delivery the specified quantity of West Texas Intermediate (WTI) crude oil to the Trader who is the buyer. The delivery process shall be guided by the delivery procedures established by NCEX.

4.2. Delivery Points and Procedures

The delivery points and procedures shall be specified by NCEX and must be in compliance with United States regulations governing the transportation and delivery of crude oil. It is the responsibility of both the buyer and the seller to ensure that all the requirements are fulfilled for smooth deliveries.

5. ADDITIONAL TERMS AND CONDITIONS

5.1. Compliance with Laws and Regulations

All Traders, in conducting activities on the NCEX platform, shall be subject to and must comply with the applicable United States laws, regulations and any other legal requirements governing the trading of commodities.

5.2. Amendments to the Agreement

NCEX reserves the right to amend the terms and conditions of this agreement at its sole discretion, in order to comply with legal or regulatory requirements, to improve the NCEX platform, or to better serve the interests of its participants. In the event of any amendments, NCEX shall promptly notify the Traders of the changes.

5.3. Dispute Resolution

Any dispute arising out of or relating to this agreement, including any question regarding its existence, validity, or termination, shall be first attempted to be resolved through amicable negotiations between the parties. If the dispute remains unresolved after fifteen (15) days, either party may seek recourse through arbitration in accordance with the rules of the American Arbitration Association. The place of arbitration shall be New York City, NY, and the language of the arbitration shall be English. The arbitral award shall be final and binding on the parties.

5.4. Governing Law

This agreement shall be governed by and construed in accordance with the laws of the United States.

5.5. Confidentiality

Traders shall ensure the confidentiality of the trade-related information and shall not disclose any such information, unless required by law or for the purpose of executing their contractual obligations.

Ready to Create your own Commodities Exchange Agreement?

Sections of a Commodities Exchange Agreement

In this Commodities Exchange Agreement, you will see the following sections:

- Parties

- Trading and Contracts

- Trading Fees

- Delivery Obligations

- Additional Terms and Conditions

Going indepth - Analysis of each section:

- Parties : This section introduces the two main parties involved in the agreement: the National Commodities Exchange (NCEX) and the Traders. NCEX is a commodities trading exchange, while Traders are individuals or entities participating in the trading of crude oil on the NCEX platform.

- Trading and Contracts : This section outlines the rules and regulations for trading on the NCEX platform. It also defines a standard contract for the delivery of West Texas Intermediate (WTI) crude oil, which consists of 1,000 barrels. Traders buy and sell these contracts for various purposes, such as managing risk, speculating on future oil prices, and securing crude oil sources.

- Trading Fees : This section explains that Traders are subject to transaction fees, clearing fees, and other charges associated with trading WTI crude oil on the NCEX platform. These fees and charges are established and updated by NCEX, and Traders must pay them in a timely manner to avoid disruptions in their trading activities.

- Delivery Obligations : This section details the delivery process for crude oil upon the expiration of a contract. The seller of the contract must make the specified quantity of WTI crude oil available for delivery to the buyer. The delivery process is guided by NCEX's delivery procedures, and both the buyer and the seller must ensure that all requirements are fulfilled for smooth deliveries.

- Additional Terms and Conditions : This section covers various additional terms and conditions, such as compliance with laws and regulations, amendments to the agreement, dispute resolution, governing law, and confidentiality. Traders must comply with all applicable laws and regulations, and any disputes that arise will be resolved through arbitration in New York City, NY. The agreement is governed by the laws of the United States, and Traders must maintain the confidentiality of trade-related information.

Ready to get started?

Create your Commodities Exchange Agreement now