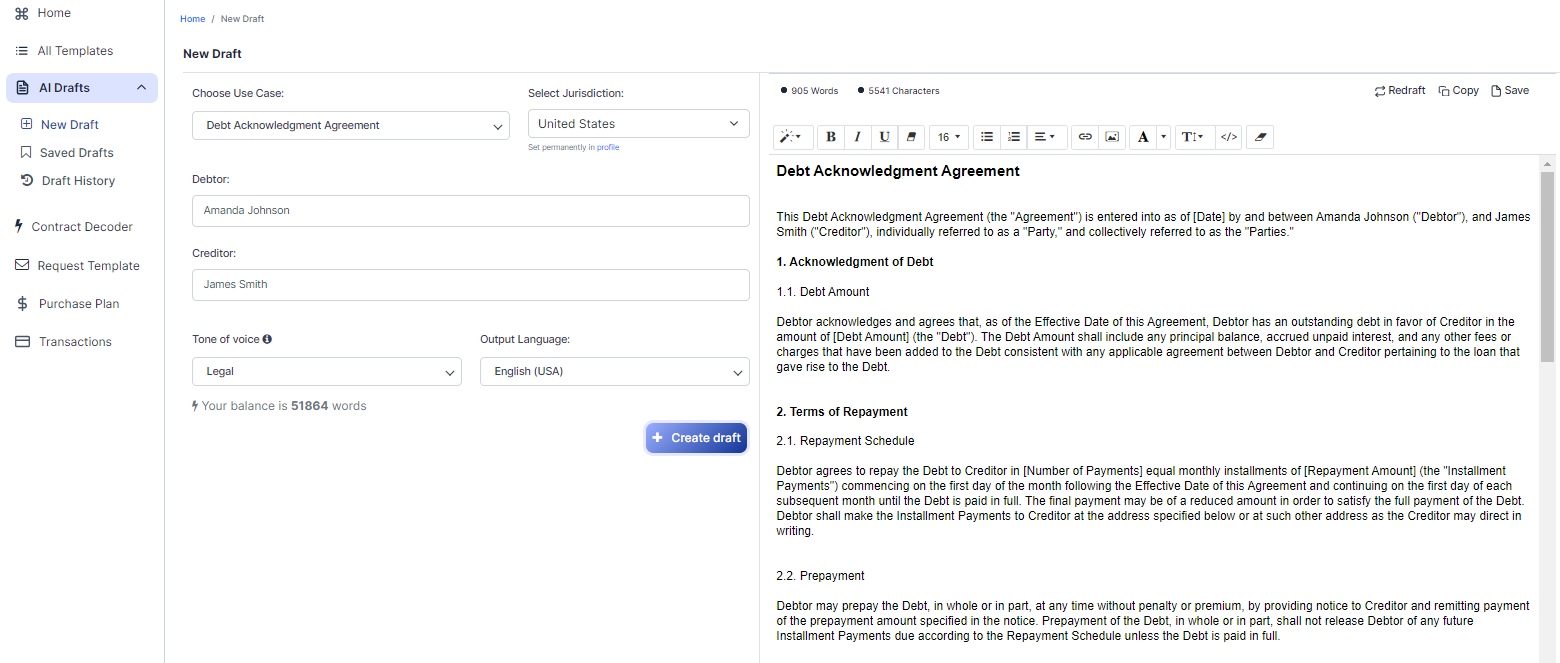

Free Debt Acknowledgment Agreement (Template & Builder)

What is Debt Acknowledgment Agreement?

Debt Acknowledgment Agreement An agreement acknowledging a debt, specifying the debt amount, terms of repayment, and acknowledgment of the debt's existence.

Sample template (2026):

Debt Acknowledgment Agreement

This Debt Acknowledgment Agreement (the "Agreement") is entered into as of [Date] by and between Amanda Johnson ("Debtor"), and James Smith ("Creditor"), individually referred to as a "Party," and collectively referred to as the "Parties."

1. Acknowledgment of Debt

1.1. Debt Amount

Debtor acknowledges and agrees that, as of the Effective Date of this Agreement, Debtor has an outstanding debt in favor of Creditor in the amount of [Debt Amount] (the "Debt"). The Debt Amount shall include any principal balance, accrued unpaid interest, and any other fees or charges that have been added to the Debt consistent with any applicable agreement between Debtor and Creditor pertaining to the loan that gave rise to the Debt.

2. Terms of Repayment

2.1. Repayment Schedule

Debtor agrees to repay the Debt to Creditor in [Number of Payments] equal monthly installments of [Repayment Amount] (the "Installment Payments") commencing on the first day of the month following the Effective Date of this Agreement and continuing on the first day of each subsequent month until the Debt is paid in full. The final payment may be of a reduced amount in order to satisfy the full payment of the Debt. Debtor shall make the Installment Payments to Creditor at the address specified below or at such other address as the Creditor may direct in writing.

2.2. Prepayment

Debtor may prepay the Debt, in whole or in part, at any time without penalty or premium, by providing notice to Creditor and remitting payment of the prepayment amount specified in the notice. Prepayment of the Debt, in whole or in part, shall not release Debtor of any future Installment Payments due according to the Repayment Schedule unless the Debt is paid in full.

2.3. Late Payments

Debtor agrees to pay a late fee of [Late Fee Amount] for any Installment Payment which is not received by Creditor within [Number of Days] days after its due date as set forth in the Repayment Schedule. Late fees will be assessed for each month the amount remains unpaid and shall be added to the Debt Amount.

3. Representations and Warranties

3.1. Capacity to Contract

Both Parties represent and warrant that they are of lawful age and have the legal capacity to enter into this Agreement, and are not under any legal impediments that would prevent them from fully performing their respective obligations under this Agreement.

3.2. Accuracy of Information

Both Parties acknowledge and agree that the information provided by each party to the other party in connection with this Agreement is true, complete, and accurate in all material respects.

4. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the United States and the laws of the state in which the Debtor resides (collectively referred to as the "Governing Law"), without regard to conflicts of law principles.

5. Amendments

This Agreement may be amended or modified only by a written instrument executed by each of the Parties.

6. Waiver

No waiver by any party of any of the provisions hereof shall be effective unless explicitly set forth in writing and signed by the party so waiving. No waiver by any party shall operate or be construed as a waiver in respect of any failure, breach, or default not expressly identified by such written waiver, whether of a similar or different character, and whether occurring before or after that waiver.

7. Severability

If any term or provision of this Agreement is found by a court of competent jurisdiction to be invalid, illegal, or unenforceable in any jurisdiction, such invalidity, illegality, or unenforceability shall not affect any other term or provision of this Agreement or invalidate or render unenforceable such term or provision in any other jurisdiction.

8. Entire Agreement

This Agreement constitutes the sole and entire agreement between the Parties pertaining to the subject matter contained herein, and supersedes all prior and contemporaneous agreements, representations, warranties, and understandings of the Parties pertaining to such subject matter.

9. Counterparts

This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

10. Notices

All notices and other communications required or permitted under this Agreement shall be in writing and shall be deemed duly given (i) when personally delivered, (ii) when sent by e-mail, with confirmation of receipt, or (iii) [Number of Days] days after placing the same in the United States mail, postage prepaid, certified or registered, return receipt requested, or by nationally recognized overnight courier, addressed, in each case, as follows:

To Debtor:

[Debtor's Address and Email]

To Creditor:

[Creditor's Address and Email]

or to such other address as either party may designate by notice pursuant to this Section 10.

IN WITNESS WHEREOF, the Parties hereto have executed this Debt Acknowledgment Agreement as of the Effective Date.

______________________________

Amanda Johnson

Debtor

______________________________

James Smith

Creditor

Ready to Create your own Debt Acknowledgment Agreement?

Main Sections of a Debt Acknowledgment Agreement

In this Debt Acknowledgment Agreement, you will see the following sections:

- Acknowledgment of Debt

- Terms of Repayment

- Representations and Warranties

- Governing Law

- Amendments

- Waiver

- Severability

- Entire Agreement

- Counterparts

- Notices

About each Section - Analysis and Summary:

- Acknowledgment of Debt : This section confirms that the Debtor (Amanda Johnson) owes the Creditor (James Smith) a specific amount of money, including any interest and fees. Think of it as the Debtor admitting they owe the Creditor money.

- Terms of Repayment : This section outlines how the Debtor will repay the debt, including the number of payments, the amount of each payment, and when the payments are due. It also covers prepayment options, late payment fees, and where to send payments. It's like a roadmap for paying back the money owed.

- Representations and Warranties : Both parties promise that they are legally allowed to enter into this agreement and that the information they provided is accurate. This is like both parties vouching for their ability to make and follow through on this agreement.

- Governing Law : This section states that the agreement will be governed by the laws of the United States and the state where the Debtor lives. It's like choosing the rulebook that will be used if there are any disputes about the agreement.

- Amendments : This section explains that any changes to the agreement must be in writing and signed by both parties. It's like saying that any changes to the agreement must be agreed upon by both parties and documented.

- Waiver : This section states that if one party chooses not to enforce a part of the agreement, it doesn't mean they are giving up their right to enforce it later. It's like saying, "Just because I let you slide this time, doesn't mean I'll let you slide every time."

- Severability : If a court finds any part of the agreement to be invalid or unenforceable, the rest of the agreement will still be valid. It's like saying that if one part of the agreement is broken, the rest of the agreement still stands.

- Entire Agreement : This section states that this agreement is the complete and final agreement between the parties and replaces any previous agreements. It's like saying, "This is the final word on our agreement, and anything we talked about before doesn't count."

- Counterparts : This section allows the agreement to be signed in separate copies, with each copy considered an original. It's like saying that each signed copy of the agreement is just as valid as the others.

- Notices : This section explains how and where each party should send any official notices or communications related to the agreement. It's like providing the correct mailing address and email for each party to stay in touch.

Ready to get started?

Create your Debt Acknowledgment Agreement now