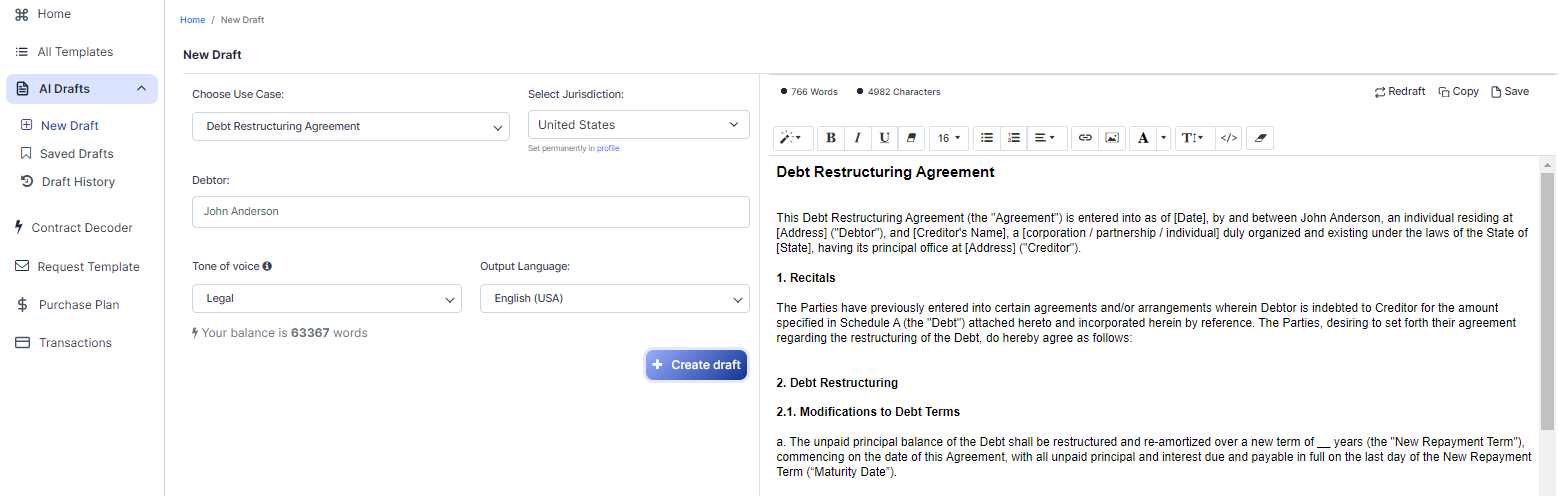

Free Debt Restructuring Agreement (Template & Builder)

What is Debt Restructuring Agreement?

Debt Restructuring Agreement An agreement restructuring debt, specifying new terms, interest rates, and repayment schedules for existing debt obligations.

Sample template (2026):

Debt Restructuring Agreement

This Debt Restructuring Agreement (the "Agreement") is entered into as of [Date], by and between John Anderson, an individual residing at [Address] ("Debtor"), and [Creditor's Name], a [corporation / partnership / individual] duly organized and existing under the laws of the State of [State], having its principal office at [Address] ("Creditor").

1. Recitals

The Parties have previously entered into certain agreements and/or arrangements wherein Debtor is indebted to Creditor for the amount specified in Schedule A (the "Debt") attached hereto and incorporated herein by reference. The Parties, desiring to set forth their agreement regarding the restructuring of the Debt, do hereby agree as follows:

2. Debt Restructuring

2.1. Modifications to Debt Terms

a. The unpaid principal balance of the Debt shall be restructured and re-amortized over a new term of __ years (the "New Repayment Term"), commencing on the date of this Agreement, with all unpaid principal and interest due and payable in full on the last day of the New Repayment Term (“Maturity Date”).

b. The annual interest rate applicable to the Debt shall be adjusted to __% per annum (the "New Interest Rate"), calculated on the basis of a 360-day year for the actual number of days elapsed. Interest on the Debt shall be due and payable monthly in arrears, commencing on the first monthly anniversary of the date of this Agreement.

c. During the New Repayment Term, Debtor shall make monthly payments (the "Monthly Payments") consisting of principal and interest, to be applied first to the accrued and unpaid interest and then to the outstanding principal balance, with each payment due and payable on the first day of each calendar month, beginning on the first monthly anniversary of the date of this Agreement.

3. Prepayment

Debtor reserves the right to prepay the Debt, in whole or in part, without penalty or premium, at any time upon fourteen (14) days prior written notice to Creditor, provided that any prepayment shall be accompanied by accrued and unpaid interest to the date of prepayment.

4. Security and Guarantees

All existing security interests, guarantees, and collateral securing the Debt, as well as any future security interests agreed upon by the Parties in connection with the Debt, shall continue to secure the Debt as restructured pursuant to this Agreement, unless otherwise expressly agreed in writing by the Creditor.

5. Representations and Warranties

Each Party hereby represents and warrants to the other Party that:

5.1. Authority and Capacity

Such Party has the legal capacity, the full right, and unrestricted power and authority to enter into, execute, and deliver this Agreement, and to perform and carry out all provisions hereof without any further authorization or approval.

5.2. Binding Obligation

This Agreement, when executed and delivered by each Party, will constitute the legal, valid, and binding obligation of such Party, enforceable against such Party in accordance with its terms, subject to applicable bankruptcy, insolvency, reorganization, moratorium, and similar laws affecting creditors' rights.

6. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the United States and the State of [State] without regard to conflict of laws principles.

7. Entire Agreement

This Agreement, together with its schedules and any other documents referenced herein, constitutes the entire agreement between the Parties with respect to the subject matter hereof and supersedes any and all prior or contemporaneous agreements, whether written or oral. This Agreement may not be amended or modified in any respect, except by a written agreement signed by the Parties hereto.

8. Counterparts

This Agreement may be executed in any number of counterparts, each of which shall be an original, but all of which taken together shall constitute one and the same instrument. Facsimile or electronic signatures shall be treated as original signatures for all purposes.

IN WITNESS WHEREOF, the Parties have duly executed this Debt Restructuring Agreement as of the date first written above.

______________________________ ______________________________

John Anderson (Debtor) [Creditor's Name] (Creditor)

______________________________

Date Date

Schedule A - Debt

The outstanding principal balance of the Debt as of the date of this Agreement is [Amount], plus any accrued and unpaid interest at the rate of [Old Interest Rate] per annum from [Date of Last Payment] to the date of this Agreement.

Ready to Create your own Debt Restructuring Agreement?

Main Sections of a Debt Restructuring Agreement

In this Debt Restructuring Agreement, you will see the following sections:

- Recitals

- Debt Restructuring

- Prepayment

- Security and Guarantees

- Representations and Warranties

- Governing Law

- Entire Agreement

- Counterparts

- Schedule A - Debt

About each Section - Analysis and Summary:

- Recitals : This section provides the background information and context for the agreement. It explains that the debtor owes the creditor money and that both parties want to restructure the debt.

- Debt Restructuring : This section outlines the new terms of the debt, including the new repayment term, new interest rate, and new monthly payment schedule. It's like refinancing a mortgage to get better terms and make it more manageable for the debtor.

- Prepayment : This section allows the debtor to pay off the debt early without any penalties. It's like paying off a car loan early to save on interest.

- Security and Guarantees : This section states that any existing security interests, guarantees, and collateral will continue to secure the restructured debt. It's like keeping the same collateral for a loan even after refinancing it.

- Representations and Warranties : This section contains promises made by both parties, such as having the authority to enter into the agreement and that the agreement is legally binding. It's like both parties promising they have the power to make this deal and will follow through on their commitments.

- Governing Law : This section specifies which state's laws will be used to interpret and enforce the agreement. It's like choosing the "rules of the game" for any disputes that may arise.

- Entire Agreement : This section states that the agreement, along with any referenced documents, is the complete agreement between the parties and supersedes any previous agreements. It's like saying this is the final and complete version of the agreement, and any previous discussions or agreements don't matter anymore.

- Counterparts : This section allows the agreement to be signed in multiple copies, with each copy considered an original. It also allows for electronic signatures. It's like allowing both parties to sign separate copies of the agreement and still have it be legally binding.

- Schedule A - Debt : This section provides specific details about the outstanding debt, including the principal balance, accrued interest, and the old interest rate. It's like a snapshot of the debt before the restructuring takes place.

Ready to get started?

Create your Debt Restructuring Agreement now