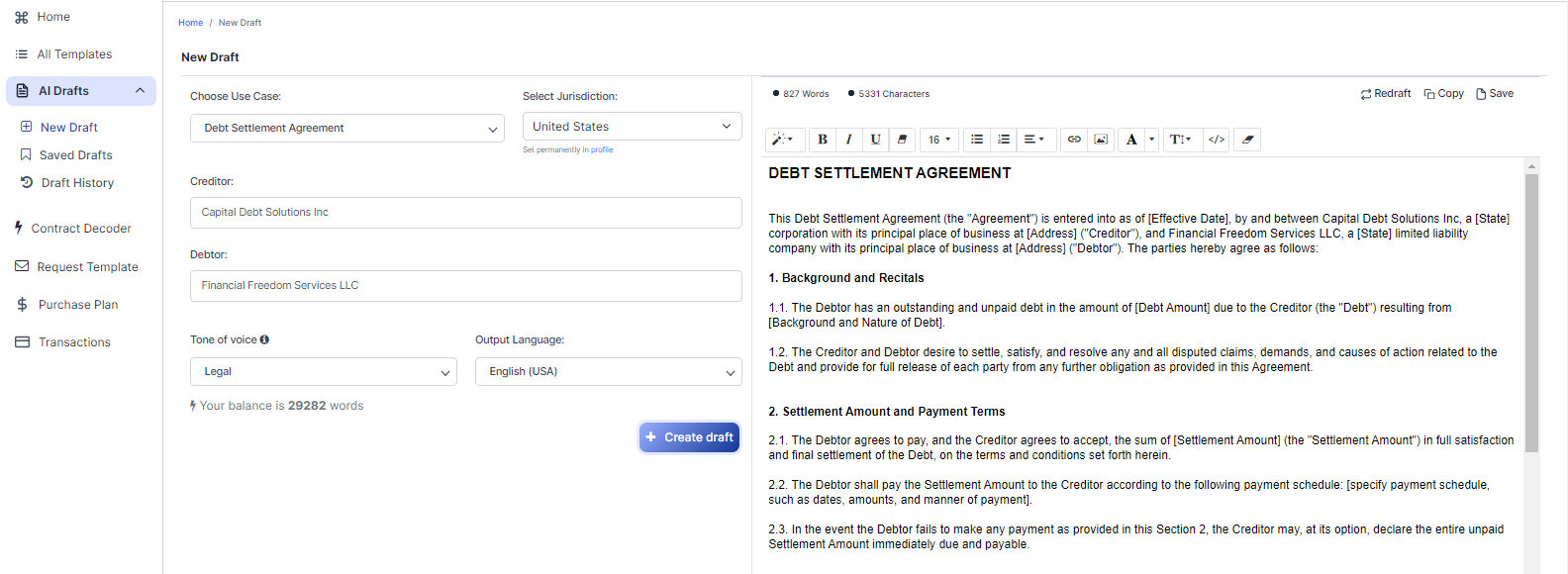

Free Debt Settlement Agreement (Template & Builder)

What is Debt Settlement Agreement?

Debt Settlement Agreement Resolves debt-related disputes, specifying terms of debt repayment, settlement amounts, payment schedules, and debt release conditions.

Sample template (2026):

DEBT SETTLEMENT AGREEMENT

This Debt Settlement Agreement (the "Agreement") is entered into as of [Effective Date], by and between Capital Debt Solutions Inc, a [State] corporation with its principal place of business at [Address] ("Creditor"), and Financial Freedom Services LLC, a [State] limited liability company with its principal place of business at [Address] ("Debtor"). The parties hereby agree as follows:

1. Background and Recitals

1.1. The Debtor has an outstanding and unpaid debt in the amount of [Debt Amount] due to the Creditor (the "Debt") resulting from [Background and Nature of Debt].

1.2. The Creditor and Debtor desire to settle, satisfy, and resolve any and all disputed claims, demands, and causes of action related to the Debt and provide for full release of each party from any further obligation as provided in this Agreement.

2. Settlement Amount and Payment Terms

2.1. The Debtor agrees to pay, and the Creditor agrees to accept, the sum of [Settlement Amount] (the "Settlement Amount") in full satisfaction and final settlement of the Debt, on the terms and conditions set forth herein.

2.2. The Debtor shall pay the Settlement Amount to the Creditor according to the following payment schedule: [specify payment schedule, such as dates, amounts, and manner of payment].

2.3. In the event the Debtor fails to make any payment as provided in this Section 2, the Creditor may, at its option, declare the entire unpaid Settlement Amount immediately due and payable.

3. Release and Satisfaction of Debt

3.1. Upon receipt of the full Settlement Amount, the Creditor shall release and fully discharge the Debtor from any and all liability and obligation to pay the Debt, and the Debt shall be deemed satisfied in full.

3.2. The Creditor shall provide the Debtor with a written acknowledgment of full satisfaction of the Debt within [Number of Days] days after receipt of the final payment of the Settlement Amount.

3.3. The parties agree that this Agreement constitutes the entire understanding and agreement between them with respect to the Debt and supersedes any prior agreements, understandings, or representations, whether written or oral, relating to the Debt.

4. Representations and Warranties

4.1. Each party represents and warrants to the other that: (a) it has the full right, power, and authority to enter into and perform its obligations under this Agreement; (b) the execution, delivery, and performance of this Agreement have been duly authorized; and (c) this Agreement constitutes a legal, valid, and binding obligation, enforceable against it in accordance with its terms.

4.2. The Debtor represents and warrants that it has not assigned, transferred, or otherwise disposed of any interest in the Debt and has not filed or had filed against it a petition for bankruptcy relief under any federal or state bankruptcy or insolvency law.

5. Governing Law and Dispute Resolution

5.1. This Agreement shall be governed by and construed in accordance with the laws of the United States and the laws of the State of [State], without regard to its conflicts of laws principles.

5.2. Any dispute arising out of or relating to this Agreement, or the breach thereof, shall be finally settled by arbitration in accordance with the commercial arbitration rules of the American Arbitration Association then in effect, and judgment upon the award rendered by the arbitrator(s) may be entered in any court having jurisdiction thereof.

6. Miscellaneous

6.1. This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

6.2. If any provision of this Agreement is held invalid, illegal, or unenforceable, the remaining provisions shall remain in full force and effect.

6.3. Any amendment or modification to this Agreement must be in writing and signed by both parties.

6.4. No waiver of any provision of this Agreement shall be deemed or shall constitute a waiver of any other provision, nor shall any waiver constitute a continuing waiver.

6.5. This Agreement and any rights or obligations hereunder may not be assigned by either party without the prior written consent of the other party.

6.6. All notices, requests, and other communications under this Agreement must be in writing and shall be deemed to have been duly given when personally delivered or sent by certified mail, return receipt requested, or by email (if receipt is confirmed) to the respective addresses or email addresses of the parties as set forth in the preamble of this Agreement or to such other address or email address as either party may designate by notice to the other party.

IN WITNESS WHEREOF, the parties have executed this Debt Settlement Agreement as of the date first above written.

CAPITAL DEBT SOLUTIONS INC FINANCIAL FREEDOM SERVICES LLC

By: ______________________ By: _________________________

Name: ____________________ Name: _______________________

Title: _____________________ Title: ________________________

Ready to Create your own Debt Settlement Agreement?

Sections of a Debt Settlement Agreement

In this Debt Settlement Agreement, you will see the following sections:

- Background and Recitals

- Settlement Amount and Payment Terms

- Release and Satisfaction of Debt

- Representations and Warranties

- Governing Law and Dispute Resolution

- Miscellaneous

Going indepth - Analysis of each section:

- Background and Recitals : This section provides the context of the agreement, including the outstanding debt amount and the reason for the debt. It also states that both parties want to settle the debt and release each other from further obligations.

- Settlement Amount and Payment Terms : This section outlines the agreed-upon settlement amount and the payment schedule. It also states that if the debtor fails to make a payment, the creditor can demand the entire unpaid settlement amount immediately.

- Release and Satisfaction of Debt : This section explains that once the full settlement amount is paid, the creditor will release the debtor from any further liability and the debt will be considered satisfied. The creditor must also provide written acknowledgment of the debt satisfaction within a specified number of days.

- Representations and Warranties : This section contains assurances from both parties that they have the authority to enter into the agreement and that it is legally binding. The debtor also confirms that they have not assigned or transferred the debt or filed for bankruptcy.

- Governing Law and Dispute Resolution : This section states that the agreement is governed by the laws of a specific state and any disputes will be settled through arbitration under the rules of the American Arbitration Association.

- Miscellaneous : This section covers various additional provisions, such as the agreement being executed in counterparts, the requirement for written amendments, and the process for giving notices. It also states that the agreement cannot be assigned without the other party's consent and that any invalid provisions do not affect the remaining provisions.

Ready to get started?

Create your Debt Settlement Agreement now