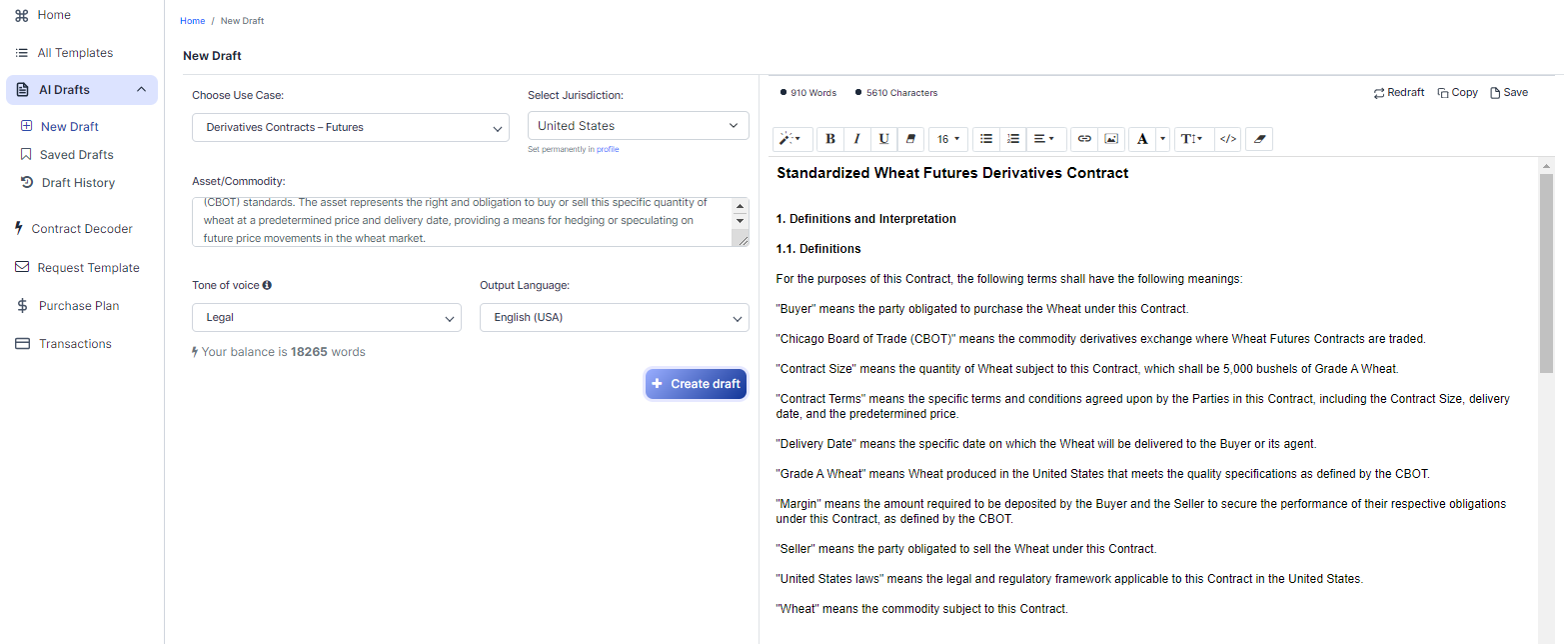

Free Derivatives Contracts – Futures (Template & Builder)

What is Derivatives Contracts – Futures?

Derivatives Contracts – Futures Derivatives Contracts for Futures are agreements to buy or sell assets at a future date at a predetermined price, often used in commodities and financial markets for hedging and speculation.

Sample template (2026):

Standardized Wheat Futures Derivatives Contract

1. Definitions and Interpretation

1.1. Definitions

For the purposes of this Contract, the following terms shall have the following meanings:

"Buyer" means the party obligated to purchase the Wheat under this Contract.

"Chicago Board of Trade (CBOT)" means the commodity derivatives exchange where Wheat Futures Contracts are traded.

"Contract Size" means the quantity of Wheat subject to this Contract, which shall be 5,000 bushels of Grade A Wheat.

"Contract Terms" means the specific terms and conditions agreed upon by the Parties in this Contract, including the Contract Size, delivery date, and the predetermined price.

"Delivery Date" means the specific date on which the Wheat will be delivered to the Buyer or its agent.

"Grade A Wheat" means Wheat produced in the United States that meets the quality specifications as defined by the CBOT.

"Margin" means the amount required to be deposited by the Buyer and the Seller to secure the performance of their respective obligations under this Contract, as defined by the CBOT.

"Seller" means the party obligated to sell the Wheat under this Contract.

"United States laws" means the legal and regulatory framework applicable to this Contract in the United States.

"Wheat" means the commodity subject to this Contract.

2. Contract Terms

The Buyer agrees to purchase, and the Seller agrees to sell, 5,000 bushels of Grade A Wheat at a predetermined price and on the Delivery Date, subject to the terms and conditions of this Contract and in accordance with United States laws and CBOT regulations.

3. Contract Size

The Contract Size for this Wheat Futures Derivatives Contract shall be 5,000 bushels of Grade A Wheat. The Contract Size shall be the same for both the Buyer and Seller.

4. Delivery Date

The Delivery Date shall be mutually agreed upon by the Buyer and the Seller and shall be specified in this Contract. Upon the Delivery Date, the Buyer shall take delivery of the Wheat at the delivery point specified by the CBOT and in accordance with the applicable terms and conditions set out in this Contract and by the CBOT.

5. Margin and Settlement Requirements

5.1. Margin

Both the Buyer and Seller shall deposit with a licensed and registered futures commission merchant an initial Margin to cover their respective potential obligations under this Contract. The amount of Margin required shall be determined by the CBOT and shall be subject to change in accordance with CBOT rules and regulations.

5.2. Settlement

Settlement of this Contract shall be made as follows:

(a) If the Buyer and Seller agree to offset their respective positions prior to the Delivery Date, they shall provide written notice to each other and their futures commission merchant, specifying the date and terms of the offsetting transaction.

(b) If the Buyer and the Seller proceed with delivery, the final settlement price shall be the predetermined price of Wheat as specified in this Contract. The Buyer shall pay the Seller such final settlement price in accordance with CBOT regulations and United States laws, and the Seller shall deliver the Wheat in accordance with the terms of this Contract and the applicable CBOT regulations.

6. Governing Law and Dispute Resolution

6.1. Governing Law

This Contract shall be governed by and construed in accordance with United States laws, including the Commodity Exchange Act and rules and regulations promulgated thereunder, as well as CBOT rules and regulations.

6.2. Dispute Resolution

Any dispute, claim, or controversy arising out of or relating to this Contract or the breach, termination, enforcement, interpretation, or validity thereof, shall be resolved in accordance with the dispute resolution procedures specified by the CBOT and under United States laws.

7. Representation and Warranties

Each party represents and warrants that it has the legal capacity and authority to enter into and perform its obligations under this Contract, and that all necessary consents and approvals have been obtained.

8. Miscellaneous

8.1. Amendments

This Contract may only be amended by a written agreement signed by both Parties.

8.2. Notices

All notices given under this Contract shall be in writing and shall be deemed to have been properly given if delivered personally or sent by e-mail, registered mail, or recognized courier service to the address of the other party as specified in this Contract or such other address as may be specified in writing by such party.

8.3. Counterparts

This Contract may be executed in any number of counterparts, each of which shall be an original, but all of which together shall constitute one and the same instrument.

8.4. Binding Effect

This Contract shall be binding upon and inure to the benefit of the parties hereto and their respective permitted successors and assigns.

IN WITNESS WHEREOF, Buyer and Seller have executed this Contract under seal as of the date first above written.

BUYER:

_________________________

SELLER:

_________________________-

Ready to Create your own Derivatives Contracts – Futures?

Sections of a Standardized Wheat Futures Derivatives Contract

In this Standardized Wheat Futures Derivatives Contract, you will see the following sections:

- Definitions and Interpretation

- Contract Terms

- Contract Size

- Delivery Date

- Margin and Settlement Requirements

- Governing Law and Dispute Resolution

- Representation and Warranties

- Miscellaneous

Going indepth - Analysis of each section:

- Definitions and Interpretation: This section explains the meaning of specific terms used throughout the contract, such as "Buyer," "Seller," "Contract Size," and "Delivery Date." It helps to clarify the language and avoid misunderstandings between the parties.

- Contract Terms: This section outlines the main agreement between the Buyer and Seller, which is to buy and sell a specific amount of wheat at a predetermined price and on a specific delivery date. It also states that the contract must follow United States laws and CBOT regulations.

- Contract Size: This section specifies the amount of wheat being traded in the contract, which is 5,000 bushels of Grade A Wheat. Both the Buyer and Seller must agree on this amount.

- Delivery Date: This section establishes the date when the wheat will be delivered to the Buyer. Both parties must agree on this date, and the delivery must follow CBOT regulations and the terms of the contract.

- Margin and Settlement Requirements: This section explains the financial requirements for both parties, including the initial deposit (Margin) and the final payment (Settlement). The Margin amount is determined by the CBOT and can change according to their rules. The Settlement process is also described, including the possibility of offsetting positions or proceeding with delivery.

- Governing Law and Dispute Resolution: This section states that the contract is governed by United States laws and CBOT regulations. It also explains the process for resolving any disputes that may arise between the parties, which must follow CBOT procedures and United States laws.

- Representation and Warranties: This section contains assurances from both parties that they have the legal capacity and authority to enter into the contract and fulfill their obligations. It also confirms that all necessary approvals have been obtained.

- Miscellaneous: This section covers various additional topics, such as how to amend the contract, how to give notices, the possibility of executing the contract in multiple counterparts, and the binding effect of the contract on the parties and their successors.

Ready to get started?

Create your Derivatives Contracts – Futures now