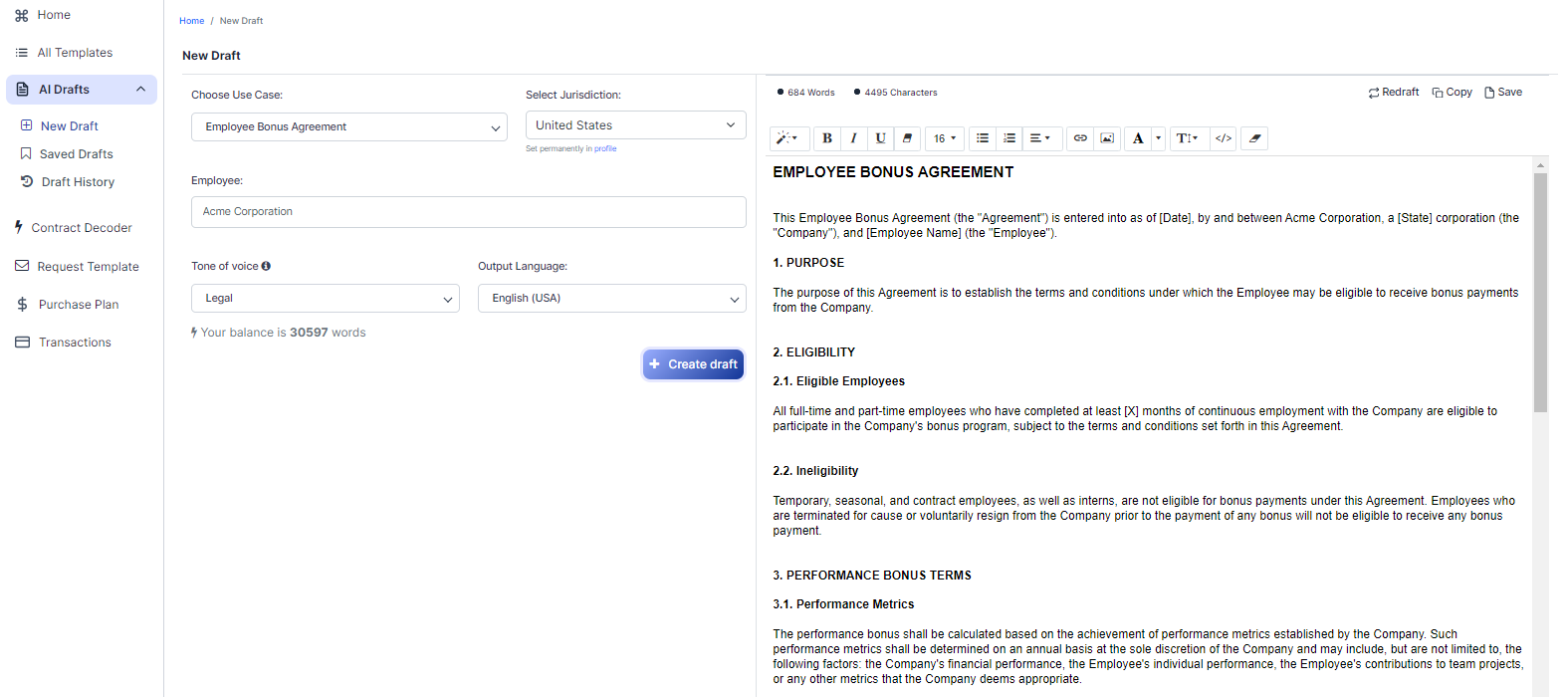

Free Employee Bonus Agreement (Template & Builder)

What is Employee Bonus Agreement?

Employee Bonus Agreement An agreement outlining bonuses or incentives for employees, specifying bonus criteria, payment terms, and any performance metrics required for eligibility.

Sample template (2026):

EMPLOYEE BONUS AGREEMENT

This Employee Bonus Agreement (the "Agreement") is entered into as of [Date], by and between Acme Corporation, a [State] corporation (the "Company"), and [Employee Name] (the "Employee").

1. PURPOSE

The purpose of this Agreement is to establish the terms and conditions under which the Employee may be eligible to receive bonus payments from the Company.

2. ELIGIBILITY

2.1. Eligible Employees

All full-time and part-time employees who have completed at least [X] months of continuous employment with the Company are eligible to participate in the Company's bonus program, subject to the terms and conditions set forth in this Agreement.

2.2. Ineligibility

Temporary, seasonal, and contract employees, as well as interns, are not eligible for bonus payments under this Agreement. Employees who are terminated for cause or voluntarily resign from the Company prior to the payment of any bonus will not be eligible to receive any bonus payment.

3. PERFORMANCE BONUS TERMS

3.1. Performance Metrics

The performance bonus shall be calculated based on the achievement of performance metrics established by the Company. Such performance metrics shall be determined on an annual basis at the sole discretion of the Company and may include, but are not limited to, the following factors: the Company's financial performance, the Employee's individual performance, the Employee's contributions to team projects, or any other metrics that the Company deems appropriate.

3.2. Discretionary Determination of Bonus Amount

The actual amount of the performance bonus shall be determined at the Company's sole discretion, based on the Employee's achievement of the performance metrics and other factors deemed appropriate by the Company. The Company reserves the right to adjust the bonus amount or withhold a bonus payment in its sole discretion.

3.3. Payment Schedule

Performance bonuses shall be paid annually, following the close of the Company's fiscal year. Payments shall be made no later than the last day of the first quarter of the subsequent fiscal year, subject to the Employee's continued employment with the Company at the time of payment.

4. ADDITIONAL BONUS PLANS

The Company reserves the right to implement additional bonus or incentive plans at its sole discretion. Participation in such additional plans, if any, shall be subject to the terms and conditions of those plans and any applicable agreements.

5. TAXES AND OTHER WITHHOLDING

The Employee is responsible for all applicable taxes and other withholding deductions required by law relating to bonus payments made by the Company, and the Company shall be entitled to withhold such amounts from any bonus payments to the Employee.

6. AMENDMENT AND TERMINATION

6.1. Amendment

The Company reserves the right to amend, modify, or terminate this Agreement at any time, with or without notice, in its sole discretion. The Employee's continued employment with the Company, following any such amendment or modification, shall constitute acceptance of the amended or modified terms.

6.2. Termination

The Company may terminate the Employee's participation in this Agreement at any time, with or without cause, upon written notice to the Employee. Termination of the Employee's participation in the Agreement does not constitute a termination of the Employee's employment with the Company.

7. GOVERNING LAW

This Agreement shall be construed and enforced in accordance with the laws of the State of [State], without giving effect to its principles or rules of conflict of laws.

8. ENTIRE AGREEMENT

This Agreement constitutes the entire understanding between the Employee and the Company with respect to the bonus program and supersedes all prior or contemporaneous negotiations, representations, and agreements, oral or written, relating to the bonus program.

IN WITNESS WHEREOF, the Employee has executed this Employee Bonus Agreement as of the date first above written.

___________________________________

[Employee Name]

___________________________________

[Company Representative]

Title: ____________________________

Ready to Create your own Employee Bonus Agreement?

Main Sections of an Employee Bonus Agreement

In this Employee Bonus Agreement, you will see the following sections:

- Purpose

- Eligibility

- Performance Bonus Terms

- Additional Bonus Plans

- Taxes and Other Withholding

- Amendment and Termination

- Governing Law

- Entire Agreement

About each Section - Analysis and Summary:

- Purpose : This section explains the reason for the agreement, which is to set the terms and conditions for the employee to receive bonus payments from the company.

- Eligibility : This section outlines who is eligible for the bonus program (full-time and part-time employees who have completed a certain number of months with the company) and who is not (temporary, seasonal, and contract employees, as well as interns). It also states that employees who are terminated for cause or voluntarily resign before the bonus payment will not be eligible for the bonus.

- Performance Bonus Terms : This section describes how the performance bonus will be calculated based on performance metrics determined by the company. It also states that the company has the discretion to determine the actual bonus amount and can adjust or withhold the bonus payment. Lastly, it provides information on the payment schedule for the bonus.

- Additional Bonus Plans : This section states that the company has the right to implement additional bonus or incentive plans at its discretion. Participation in these additional plans will be subject to their specific terms and conditions.

- Taxes and Other Withholding : This section explains that the employee is responsible for all applicable taxes and other withholding deductions related to the bonus payments, and the company has the right to withhold these amounts from the bonus payments.

- Amendment and Termination : This section states that the company can amend, modify, or terminate the agreement at any time, with or without notice. The employee's continued employment after any changes to the agreement will be considered acceptance of the new terms. The company can also terminate the employee's participation in the agreement at any time, with or without cause, but this does not mean the employee's employment is terminated.

- Governing Law : This section specifies that the agreement will be governed by the laws of a particular state, without considering its conflict of law principles.

- Entire Agreement : This section states that the agreement is the complete understanding between the employee and the company regarding the bonus program and supersedes any previous negotiations, representations, or agreements related to the bonus program.

Ready to get started?

Create your Employee Bonus Agreement now