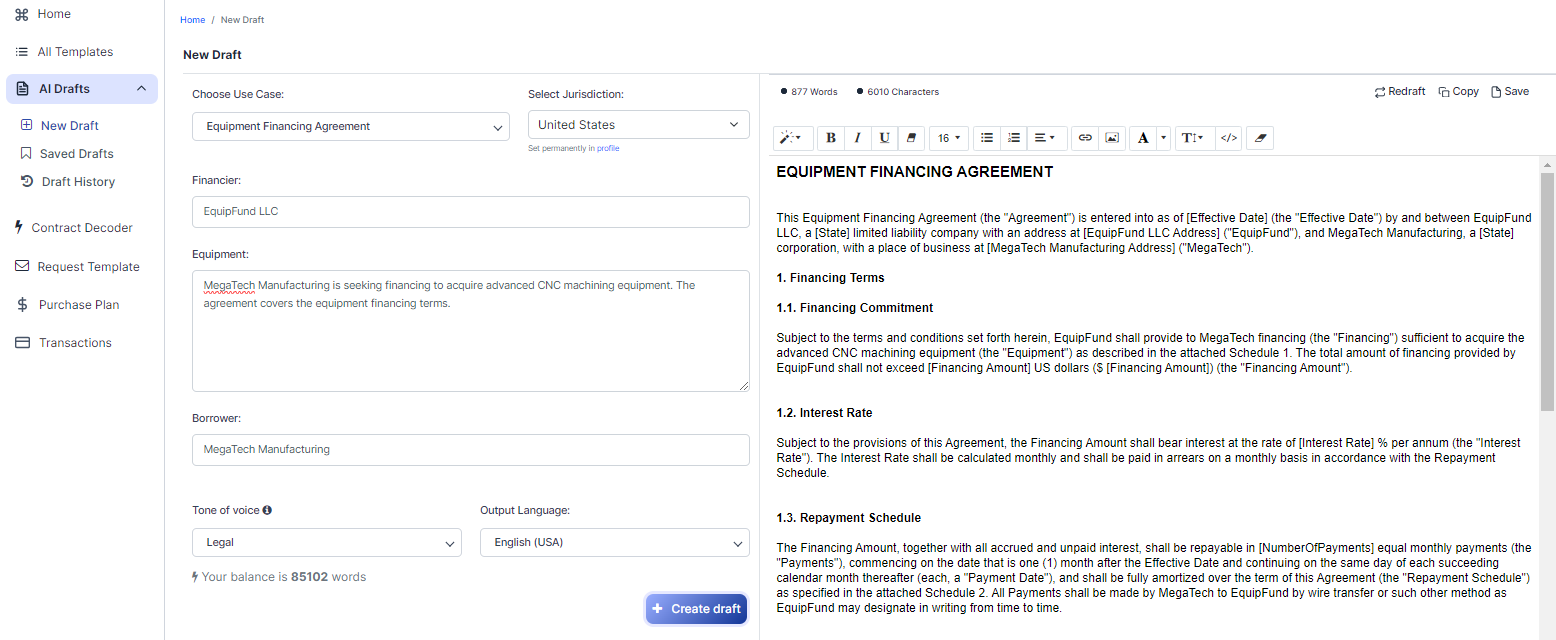

Free Equipment Financing Agreement (Template & Builder)

What is Equipment Financing Agreement?

Equipment Financing Agreement An agreement for financing equipment acquisition, outlining terms, interest rates, repayment schedules, and equipment-related details.

Sample template (2026):

EQUIPMENT FINANCING AGREEMENT

This Equipment Financing Agreement (the "Agreement") is entered into as of [Effective Date] (the "Effective Date") by and between EquipFund LLC, a [State] limited liability company with an address at [EquipFund LLC Address] ("EquipFund"), and MegaTech Manufacturing, a [State] corporation, with a place of business at [MegaTech Manufacturing Address] ("MegaTech").

1. Financing Terms

1.1. Financing Commitment

Subject to the terms and conditions set forth herein, EquipFund shall provide to MegaTech financing (the "Financing") sufficient to acquire the advanced CNC machining equipment (the "Equipment") as described in the attached Schedule 1. The total amount of financing provided by EquipFund shall not exceed [Financing Amount] US dollars ($ [Financing Amount]) (the "Financing Amount").

1.2. Interest Rate

Subject to the provisions of this Agreement, the Financing Amount shall bear interest at the rate of [Interest Rate] % per annum (the "Interest Rate"). The Interest Rate shall be calculated monthly and shall be paid in arrears on a monthly basis in accordance with the Repayment Schedule.

1.3. Repayment Schedule

The Financing Amount, together with all accrued and unpaid interest, shall be repayable in [NumberOfPayments] equal monthly payments (the "Payments"), commencing on the date that is one (1) month after the Effective Date and continuing on the same day of each succeeding calendar month thereafter (each, a "Payment Date"), and shall be fully amortized over the term of this Agreement (the "Repayment Schedule") as specified in the attached Schedule 2. All Payments shall be made by MegaTech to EquipFund by wire transfer or such other method as EquipFund may designate in writing from time to time.

2. Equipment Collateral

2.1. Grant of Security Interest

MegaTech hereby grants to EquipFund a first priority security interest in and to the Equipment (the "Collateral") to secure the prompt payment and performance of all obligations under this Agreement and all other documents, instruments, and agreements executed and delivered in connection herewith (collectively, the "Financing Documents"). The security interest granted to EquipFund shall continue until all amounts owed under this Agreement and the Financing Documents have been fully and indefeasibly paid and satisfied in cash.

2.2. Perfection of Security Interest

MegaTech shall, at its own expense, upon request by EquipFund, execute and deliver to EquipFund such other documents, including, without limitation, Uniform Commercial Code financing statements, and take such other actions as EquipFund may reasonably require to perfect, maintain, and protect the priority of the security interest granted to EquipFund in the Collateral.

3. Representations and Warranties

3.1. MegaTech's Representations and Warranties

MegaTech represents and warrants to EquipFund that (a) MegaTech has the right, power, and authority to enter into and perform under this Agreement, (b) the execution, delivery, and performance of this Agreement will not violate any agreement, law, rule, regulation, order, or other obligation to which MegaTech is subject, and (c) the information provided by MegaTech to EquipFund is true, complete, and correct in all material respects.

3.2. EquipFund's Representations and Warranties

EquipFund represents and warrants to MegaTech that (a) EquipFund has the right, power, and authority to enter into and perform under this Agreement, (b) the execution, delivery, and performance of this Agreement will not violate any agreement, law, rule, regulation, order, or other obligation to which EquipFund is subject, and (c) the Financing hereunder has been duly authorized and all necessary corporate and regulatory action have been taken by EquipFund in connection therewith.

4. Events of Default; Remedies

4.1. Events of Default

An "Event of Default" shall occur if (a) MegaTech fails to make any Payment when due, (b) MegaTech breaches any representation, warranty, covenant, or other provision of this Agreement, (c) MegaTech becomes insolvent or bankrupt, or (d) the Collateral is subject to any lien or encumbrance other than the security interest granted to EquipFund hereunder.

4.2. Remedies

Upon the occurrence of an Event of Default, EquipFund may, at its option and without notice to MegaTech, (a) declare the entire unpaid balance of the Financing Amount, together with all accrued and unpaid interest thereon, to be immediately due and payable, (b) exercise all the rights and remedies of a secured party under applicable law, including, without limitation, the Uniform Commercial Code, and (c) pursue any other remedy available to EquipFund at law or in equity.

5. Miscellaneous

5.1. Governing Law

This Agreement shall be governed by, and construed in accordance with, the laws of the United States and the laws of the State of [State], without regard to its conflicts of law principles.

5.2. Entire Agreement

This Agreement constitutes the entire agreement between the parties with respect to the subject matter hereof and supersedes all prior and contemporaneous agreements, understandings, negotiations, and discussions, whether oral or written, of the parties relating to the subject matter hereof.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the Effective Date.

EquipFund LLC MegaTech Manufacturing By: __________________________________ By: __________________________________ (Name) (Name) (Title) (Title)

Ready to Create your own Equipment Financing Agreement?

Main Sections of an Equipment Financing Agreement

In this Equipment Financing Agreement, you will see the following sections:

- Financing Terms

- Equipment Collateral

- Representations and Warranties

- Events of Default; Remedies

- Miscellaneous

About each Section - Analysis and Summary:

- Financing Terms : This section outlines the details of the financing provided by EquipFund to MegaTech for purchasing the equipment. It includes the total financing amount, the interest rate, and the repayment schedule. Think of it as the blueprint for how the loan will work, including how much money is being borrowed, the cost of borrowing (interest rate), and the timeline for paying it back.

- Equipment Collateral : This section explains that MegaTech is giving EquipFund a security interest in the equipment being purchased as collateral for the loan. This means that if MegaTech fails to repay the loan, EquipFund has the right to take possession of the equipment to recover their losses. It also covers the steps MegaTech must take to ensure EquipFund's security interest is properly documented and maintained.

- Representations and Warranties : In this section, both EquipFund and MegaTech make certain promises to each other. For example, they both promise that they have the authority to enter into the agreement and that doing so won't violate any other agreements or laws. These promises help build trust between the parties and provide a basis for legal action if one party doesn't live up to their promises.

- Events of Default; Remedies : This section defines what constitutes a default on the loan (e.g., missed payments, breach of agreement terms) and the actions EquipFund can take if a default occurs. This could include demanding immediate repayment of the entire loan balance, seizing the equipment, or pursuing other legal remedies. It's like a list of rules and consequences for not following those rules.

- Miscellaneous : This section covers various additional terms, such as the governing law (which state's laws will be used to interpret the agreement) and the fact that this agreement is the entire understanding between the parties (meaning no other verbal or written agreements will be considered). It's like a catch-all for important details that don't fit neatly into the other sections.

Ready to get started?

Create your Equipment Financing Agreement now