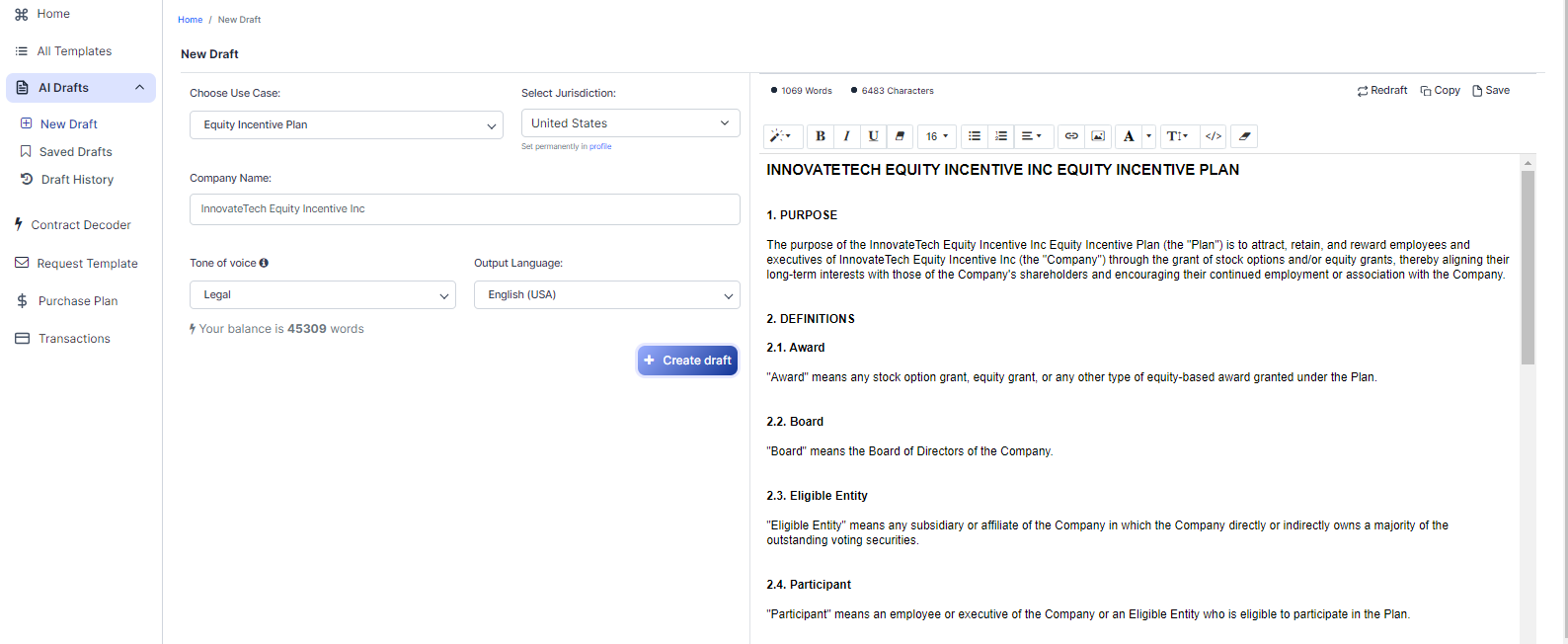

Free Equity Incentive Plan (Template & Builder)

What is Equity Incentive Plan?

Equity Incentive Plan Details the allocation of equity or stock options to employees or executives, specifying vesting schedules and conditions for exercise.

Sample template (2026):

INNOVATETECH EQUITY INCENTIVE INC EQUITY INCENTIVE PLAN

1. PURPOSE

The purpose of the InnovateTech Equity Incentive Inc Equity Incentive Plan (the "Plan") is to attract, retain, and reward employees and executives of InnovateTech Equity Incentive Inc (the "Company") through the grant of stock options and/or equity grants, thereby aligning their long-term interests with those of the Company's shareholders and encouraging their continued employment or association with the Company.

2. DEFINITIONS

2.1. Award

"Award" means any stock option grant, equity grant, or any other type of equity-based award granted under the Plan.

2.2. Board

"Board" means the Board of Directors of the Company.

2.3. Eligible Entity

"Eligible Entity" means any subsidiary or affiliate of the Company in which the Company directly or indirectly owns a majority of the outstanding voting securities.

2.4. Participant

"Participant" means an employee or executive of the Company or an Eligible Entity who is eligible to participate in the Plan.

2.5. Stock

"Stock" means the common stock of the Company, $0.01 par value per share, or any other security into which the Stock may be changed pursuant to the adjustment provisions of Section 9 herein.

3. ELIGIBILITY AND PARTICIPATION

Awards may be granted under the Plan to any employee or executive of the Company or an Eligible Entity, as determined by the Board in its sole discretion. The Board, in its sole discretion, may also determine the types of Awards to be granted to any person eligible under this Plan.

4. STOCK OPTIONS

4.1. Grant of Stock Options

The Board may grant to any Participant one or more Stock Options. Each Stock Option shall provide the holder with the right to purchase a specified number of shares of Stock at a specified exercise price per share, for a specified period, subject to the terms and conditions of the Plan and the applicable Stock Option Award Agreement.

4.2. Exercise Price

The exercise price for each share of Stock purchasable under a Stock Option shall be determined by the Board and set forth in the applicable Stock Option Award Agreement. The exercise price shall not be less than the fair market value of a share of Stock on the date the Stock Option is granted.

4.3. Option Period

The term of each Stock Option shall be determined by the Board, in its sole discretion, but in no event shall the term of any Stock Option exceed ten (10) years from the date of grant.

4.4. Vesting and Exercise of Stock Options

Except as otherwise provided in this Plan, Stock Options shall vest and become exercisable in such manner and on such terms and conditions as the Board may determine in its sole discretion, which may include, without limitation, the passage of time, the achievement of performance goals, or other conditions. The Stock Option Award Agreement shall specify the vesting and exercisability conditions applicable to each Stock Option granted thereunder.

5. EQUITY GRANTS

5.1. Grant of Equity Grants

The Board may grant to any Participant one or more Equity Grants. Each Equity Grant shall provide the holder with a specified number of shares of Stock subject to the terms and conditions of the Plan and the applicable Equity Grant Award Agreement.

5.2. Vesting of Equity Grants

Except as otherwise provided in this Plan, Equity Grants shall vest in such manner and on such terms and conditions as the Board may determine in its sole discretion, which may include, without limitation, the passage of time, the achievement of performance goals or other conditions. The Equity Grant Award Agreement shall specify the vesting conditions applicable to each Equity Grant granted thereunder.

6. TERMINATION OF EMPLOYMENT OR SERVICE

Except as otherwise provided in an applicable Award Agreement, upon a Participant's termination of employment or service with the Company or an Eligible Entity, any unvested Awards held by the Participant shall be forfeited and any vested but unexercised Stock Options held by the Participant shall be exercisable for a period specified in the applicable Award Agreement or, if not so specified, for a period of ninety (90) days following termination (but not beyond the original term of the Stock Option).

7. AMENDMENT AND TERMINATION

The Board may at any time amend, modify, suspend, or terminate the Plan, in whole or in part, provided that no such amendment, modification, suspension, or termination shall materially impair the rights of any Participant with respect to any outstanding Award without the Participant's prior written consent. Notwithstanding the foregoing, the Board may, without a Participant's consent, amend the Plan or any outstanding Award to the extent necessary for the Plan or any Award to comply with any applicable law, regulation, or stock exchange rule.

8. GOVERNING LAW

This Plan and all Award Agreements issued hereunder shall be governed by and construed in accordance with the laws of the United States and the State of Delaware, without giving effect to the principles of conflicts of law thereof.

9. ADJUSTMENT UPON CHANGE IN STOCK

In the event of any change in the Stock, such as a stock split, stock dividend, combination or exchange of shares, merger, consolidation, rights offering, reclassification, recapitalization, reorganization, or any other change in the corporate structure of the Company affecting the Stock, the Board shall make such equitable adjustments to the terms of outstanding Awards as it deems appropriate in its sole discretion, including, without limitation, adjustments to the number of shares of Stock subject to such Awards and the exercise price of Stock Options.

10. TAX WITHHOLDING

The Company and any Eligible Entity shall have the right to withhold or require a Participant to pay to the Company or such Eligible Entity, as applicable, an amount sufficient to satisfy any applicable federal, state, and/or local tax withholding requirements upon the exercise, vesting, or other taxable event relating to any Award granted under the Plan.

Ready to Create your own Equity Incentive Plan?

Common Sections of an Equity Incentive Plan

In this Equity Incentive Plan, you will see the following sections:

- Purpose

- Definitions

- Eligibility and Participation

- Stock Options

- Equity Grants

- Termination of Employment or Service

- Amendment and Termination

- Governing Law

- Adjustment Upon Change in Stock

- Tax Withholding

Summary of each section:

- Purpose : This section explains the main goal of the plan, which is to attract, retain, and reward employees and executives by granting them stock options and/or equity grants. This aligns their interests with the company's shareholders and encourages their continued employment or association with the company.

- Definitions : This section provides definitions for key terms used throughout the plan, such as Award, Board, Eligible Entity, Participant, and Stock.

- Eligibility and Participation : This section outlines who is eligible to participate in the plan and receive awards. The Board has the discretion to determine eligibility and the types of awards granted.

- Stock Options : This section describes the process of granting stock options, including setting the exercise price, option period, and vesting and exercise conditions. The Board has the discretion to determine these factors.

- Equity Grants : This section explains the process of granting equity grants, which provide the holder with a specified number of shares of stock. The Board determines the vesting conditions for these grants.

- Termination of Employment or Service : This section outlines what happens to a participant's awards upon termination of employment or service. Unvested awards are forfeited, and vested but unexercised stock options can be exercised within a specified period.

- Amendment and Termination : This section states that the Board can amend, modify, suspend, or terminate the plan at any time, as long as it does not impair the rights of any participant with respect to outstanding awards without their consent.

- Governing Law : This section specifies that the plan and all award agreements are governed by the laws of the United States and the State of Delaware.

- Adjustment Upon Change in Stock : This section explains that if there is any change in the company's stock, such as a stock split or merger, the Board can make equitable adjustments to the terms of outstanding awards as it deems appropriate.

- Tax Withholding : This section states that the company and any eligible entity have the right to withhold or require a participant to pay an amount sufficient to satisfy any applicable tax withholding requirements upon the exercise, vesting, or other taxable event relating to any award granted under the plan.

Ready to get started?

Create your Equity Incentive Plan now