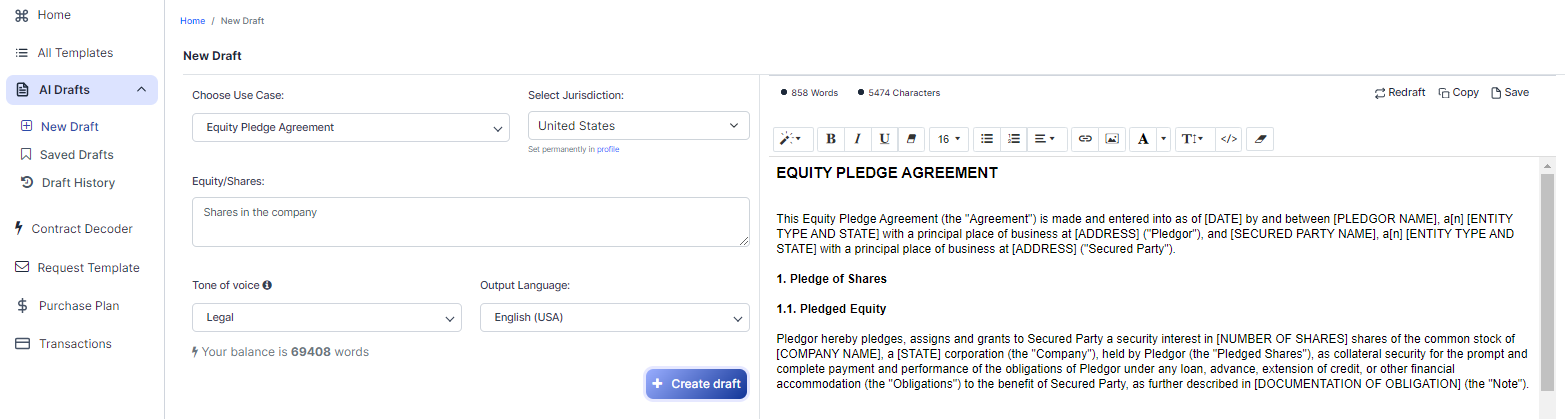

Free Equity Pledge Agreement (Template & Builder)

What is Equity Pledge Agreement?

Equity Pledge Agreement An agreement pledging equity or shares as collateral, specifying pledged equity, conditions, and remedies in case of default.

Sample template (2026):

EQUITY PLEDGE AGREEMENT

This Equity Pledge Agreement (the "Agreement") is made and entered into as of [DATE] by and between [PLEDGOR NAME], a[n] [ENTITY TYPE AND STATE] with a principal place of business at [ADDRESS] ("Pledgor"), and [SECURED PARTY NAME], a[n] [ENTITY TYPE AND STATE] with a principal place of business at [ADDRESS] ("Secured Party").

1. Pledge of Shares

1.1. Pledged Equity

Pledgor hereby pledges, assigns and grants to Secured Party a security interest in [NUMBER OF SHARES] shares of the common stock of [COMPANY NAME], a [STATE] corporation (the "Company"), held by Pledgor (the "Pledged Shares"), as collateral security for the prompt and complete payment and performance of the obligations of Pledgor under any loan, advance, extension of credit, or other financial accommodation (the "Obligations") to the benefit of Secured Party, as further described in [DOCUMENTATION OF OBLIGATION] (the "Note").

2. Representations and Warranties

2.1. Pledgor's Ownership

Pledgor represents and warrants that Pledgor is the sole legal and beneficial owner, free and clear of any liens, encumbrances, or adverse claims, of the Pledged Shares and has the unconditional and unrestricted right to pledge the Pledged Shares

2.2. Company Authorization

Pledgor represents and warrants that the pledge and assignment of the Pledged Shares is allowed by the Company and any applicable agreements, and that Pledgor is not subject to any restrictions or prohibitions regarding the transfer or pledge of the Pledged Shares.

3. Covenants

3.1. Preservation of Rights

Pledgor shall take all necessary actions, at Pledgor's expense, to preserve and protect the Pledged Shares, including maintaining its ownership and voting rights in the Company.

3.2. No Sale or Transfer of Pledged Shares

Pledgor shall not, without the prior written consent of the Secured Party, sell, encumber, assign, or otherwise transfer any of the Pledged Shares.

4. Voting and Dividends

4.1. Voting Rights

So long as no Event of Default (as defined below) has occurred and is continuing, Pledgor shall retain the right to vote the Pledged Shares on any matter presented to the shareholders of the Company.

4.2. Dividends

Any and all dividends, distributions, or other income from the Pledged Shares shall be paid directly to Pledgor, subject to the rights of Secured Party as set forth in this Agreement.

5. Remedies upon Default

5.1. Events of Default

An "Event of Default" shall occur if any of the following occurs:

(a) Pledgor fails to perform any of its obligations under this Agreement, including payment of the Obligations;

(b) Any representation or warranty made by Pledgor in this Agreement or any other document or instrument in connection with this Agreement is or becomes materially false or misleading; or

(c) Pledgor becomes insolvent, makes a general assignment for the benefit of creditors, seeks relief under any bankruptcy or similar laws, or takes any action indicating its insolvency or inability to pay its debts as they become due.

5.2. Secured Party Remedies

Upon the occurrence and continuation of an Event of Default, Secured Party may, at its option and without further notice or demand:

(a) Declare the outstanding Obligations immediately due and payable;

(b) Exercise any and all remedies available under the terms of the Note and applicable law;

(c) Exercise any and all voting, consent, and other rights and powers associated with the Pledged Shares, and apply any dividends, distributions, or income from the Pledged Shares to the outstanding Obligations;

(d) Sell, at a public or private sale, or otherwise dispose of the Pledged Shares in accordance with applicable law, and apply the proceeds thereof to the outstanding Obligations.

6. Miscellaneous

6.1. Binding Effect

This Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective heirs, successors, and assigns.

6.2. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the United States and the State of [GOVERNING STATE], without regard to conflict of law principles.

6.3. Entire Agreement; Amendment

This Agreement constitutes the entire agreement between the parties with respect to the subject matter hereof and supersedes all prior and contemporaneous negotiations, understandings, and agreements, oral or written. This Agreement may only be amended or supplemented in writing executed by both parties.

6.4. Counterparts

This Agreement may be executed in one or more counterparts, each of which shall be deemed an original and all of which shall be considered one and the same agreement.

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be duly executed as of the date first above written.

__________________________ _________________________

[PLEDGOR NAME] [SECURED PARTY NAME]

Pledgor Secured Party

Ready to Create your own Equity Pledge Agreement?

Main Sections of an Equity Pledge Agreement

In this Equity Pledge Agreement, you will see the following sections:

- Pledge of Shares

- Representations and Warranties

- Covenants

- Voting and Dividends

- Remedies upon Default

- Miscellaneous

About each Section - Analysis and Summary:

- Pledge of Shares : This section explains that the Pledgor (the person pledging the shares) is giving the Secured Party (the person receiving the pledge) a security interest in a specific number of shares in a company. This is done as collateral for a loan or other financial obligation. The details of the loan or financial obligation are described in a separate document called the "Note."

- Representations and Warranties : In this section, the Pledgor makes certain promises to the Secured Party. These promises include that the Pledgor is the sole owner of the pledged shares, free of any other claims or encumbrances, and that the company allows the pledge of these shares without any restrictions or prohibitions.

- Covenants : This section outlines the Pledgor's responsibilities, such as preserving and protecting the pledged shares and not selling or transferring them without the Secured Party's consent.

- Voting and Dividends : This section explains that the Pledgor retains the right to vote the pledged shares and receive any dividends or income from them, as long as there is no default on the loan or financial obligation. If a default occurs, the Secured Party may have rights to the dividends or income.

- Remedies upon Default : This section describes what happens if the Pledgor fails to meet their obligations under the agreement (an "Event of Default"). If an Event of Default occurs, the Secured Party has various options, such as declaring the loan due and payable, exercising voting rights, or selling the pledged shares to satisfy the outstanding debt.

- Miscellaneous : This section contains various standard legal provisions, such as the agreement being binding on both parties and their successors, the governing law, and the requirement that any amendments to the agreement must be in writing and signed by both parties.

Ready to get started?

Create your Equity Pledge Agreement now