Free Event Insurance Agreement (Template & Builder)

What is Event Insurance Agreement?

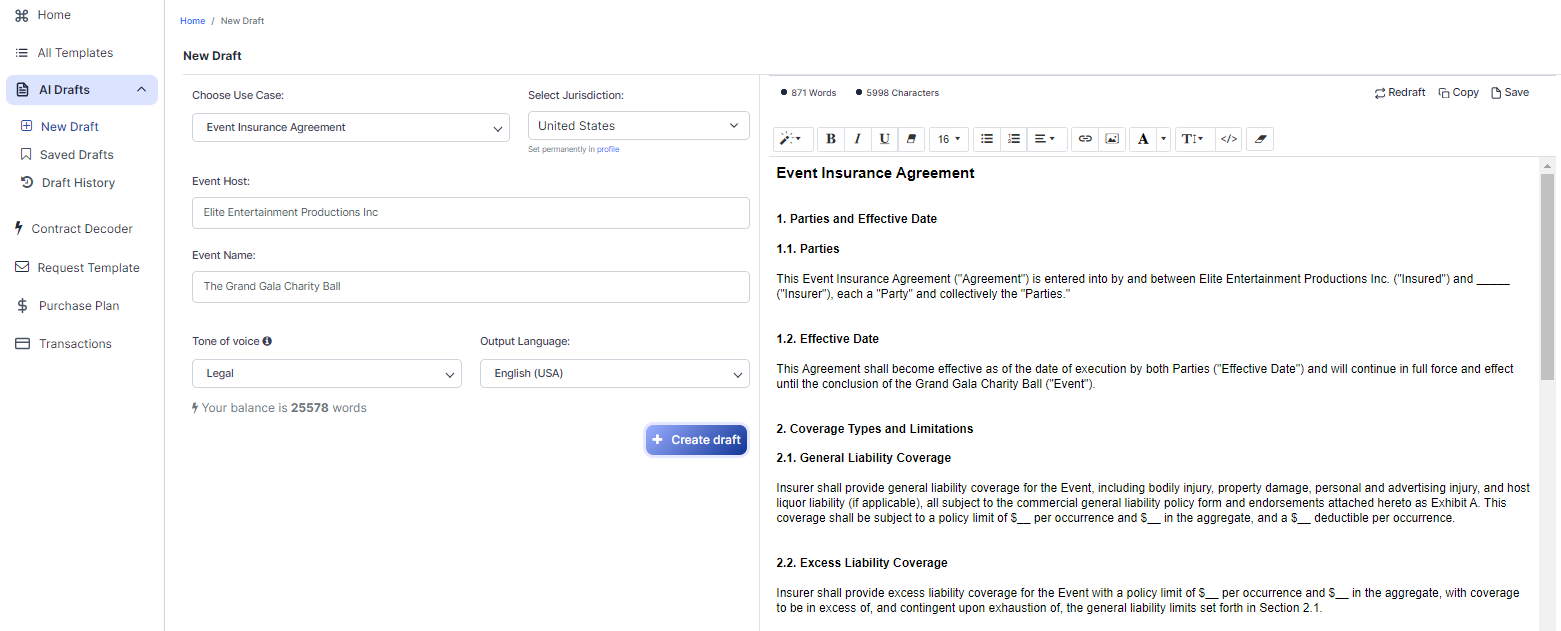

Event Insurance Agreement An Event Insurance Agreement secures insurance coverage for events, specifying coverage types, policy limits, and terms related to event liability and potential risks.

Sample template (2026):

Event Insurance Agreement

1. Parties and Effective Date

1.1. Parties

This Event Insurance Agreement ("Agreement") is entered into by and between Elite Entertainment Productions Inc. ("Insured") and _____ ("Insurer"), each a "Party" and collectively the "Parties."

1.2. Effective Date

This Agreement shall become effective as of the date of execution by both Parties ("Effective Date") and will continue in full force and effect until the conclusion of the Grand Gala Charity Ball ("Event").

2. Coverage Types and Limitations

2.1. General Liability Coverage

Insurer shall provide general liability coverage for the Event, including bodily injury, property damage, personal and advertising injury, and host liquor liability (if applicable), all subject to the commercial general liability policy form and endorsements attached hereto as Exhibit A. This coverage shall be subject to a policy limit of $__ per occurrence and $__ in the aggregate, and a $__ deductible per occurrence.

2.2. Excess Liability Coverage

Insurer shall provide excess liability coverage for the Event with a policy limit of $__ per occurrence and $__ in the aggregate, with coverage to be in excess of, and contingent upon exhaustion of, the general liability limits set forth in Section 2.1.

2.3. Event Cancellation Coverage

Insurer shall provide event cancellation insurance coverage for the Event to compensate the Insured for its financial losses and legal liabilities sustained as a direct result of the necessary cancellation, abandonment, curtailment, postponement, rescheduling, or interruption of the Event, subject to the event cancellation policy form and endorsements attached hereto as Exhibit B.

2.4. Coverage Limitations

Each of the coverage types described in this Section 2 shall be subject to all terms, conditions, limitations, exclusions, and endorsements set forth in the applicable policy and endorsement forms, and nothing in this Agreement shall be construed to provide coverage broader than that set forth in such forms.

3. Policy Premiums

3.1. Payment of Premiums

Upon execution of this Agreement, the Insured shall pay the Insurer a non-refundable premium in the total amount of $__ (the "Premium"), which shall cover all of the coverage types described in Section 2, subject to the terms, conditions, limitations, and exclusions set forth therein.

3.2. Adjustment and Audit

If any part of the Premium is subject to adjustment based on audit or retrospective rating, such adjustment(s) shall be made by the Insurer as soon as reasonably practicable following the Event.

4. Insured's Duties in the Event of a Loss or Claim

In the event of a loss, occurrence, or claim that may potentially be covered under any of the coverage types described in Section 2, the Insured shall provide the Insurer with prompt notice in writing, which shall include a detailed description of the circumstances surrounding the loss, occurrence, or claim and any other information required by the applicable policy or endorsement form.

5. Indemnification and Hold Harmless

The Insured agrees to defend, indemnify, and hold harmless the Insurer, its directors, officers, employees, and agents from and against any and all claims, actions, damages, losses, liabilities, fines, penalties, costs, and expenses, including reasonable attorney fees, arising out of or in any way connected with the Insured’s breach of this Agreement, violation of any law or regulation, or any allegation not subject to the coverage provided under this Agreement.

6. Governing Law and Dispute Resolution

6.1. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the United States and the state laws of ________, without regard to any conflicts of law principles that would require the application of the laws of any other jurisdiction.

6.2. Arbitration

Any disputes arising out of or in connection with this Agreement shall be resolved by professional arbitration. The arbitration shall be conducted by a single arbitrator according to the expedited commercial arbitration rules and regulations of the American Arbitration Association. The arbitration shall take place in ________. The award rendered by the arbitrator shall be final and binding on the Parties, and judgment upon the award may be entered in any court having jurisdiction thereof.

7. Miscellaneous

7.1. Entire Agreement

This Agreement, together with Exhibits A and B attached hereto, constitutes the entire agreement between the Parties with respect to the subject matter hereof and supersedes all prior negotiations, understandings, and agreements between the Parties.

7.2. Amendment

This Agreement may be amended only by a written document executed by both Parties.

7.3. Counterparts

This Agreement may be executed in one or more counterparts, each of which shall be deemed an original, but all of which shall constitute one and the same instrument.

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the Effective Date.

________________________________ __________________________________

[Insured Signature] [Insurer Signature]

[Insured Printed Name] [Insurer Printed Name]

[Insured Title, if applicable] [Insurer Title, if applicable]

Date: ______________________ Date: ______________________

Ready to Create your own Event Insurance Agreement?

Sections of an Event Insurance Agreement

In this Event Insurance Agreement, you will see the following sections:

- Parties and Effective Date

- Coverage Types and Limitations

- Policy Premiums

- Insured's Duties in the Event of a Loss or Claim

- Indemnification and Hold Harmless

- Governing Law and Dispute Resolution

- Miscellaneous

Summary of the sections:

- Parties and Effective Date: This section introduces the two parties involved in the agreement, the Insured (Elite Entertainment Productions Inc.) and the Insurer. It also states when the agreement becomes effective and how long it lasts (until the conclusion of the Grand Gala Charity Ball).

- Coverage Types and Limitations: This section outlines the different types of insurance coverage provided for the event, including general liability, excess liability, and event cancellation coverage. It also explains the limitations and exclusions of each coverage type.

- Policy Premiums: This section details the payment of insurance premiums by the Insured to the Insurer. It also mentions the possibility of adjustments based on audit or retrospective rating.

- Insured's Duties in the Event of a Loss or Claim: This section explains the Insured's responsibilities in case of a loss, occurrence, or claim that may be covered under the insurance policy. The Insured must provide prompt written notice to the Insurer with a detailed description of the circumstances.

- Indemnification and Hold Harmless: This section states that the Insured agrees to defend, indemnify, and hold harmless the Insurer from any claims, damages, losses, or expenses arising from the Insured's breach of the agreement, violation of any law, or any allegation not covered by the insurance policy.

- Governing Law and Dispute Resolution: This section specifies that the agreement is governed by the laws of the United States and the state laws of a particular state. It also states that any disputes arising from the agreement will be resolved through professional arbitration, following the rules of the American Arbitration Association.

- Miscellaneous: This section covers various miscellaneous provisions, such as the entire agreement clause, amendment process, and the execution of the agreement in counterparts.

Ready to get started?

Create your Event Insurance Agreement now