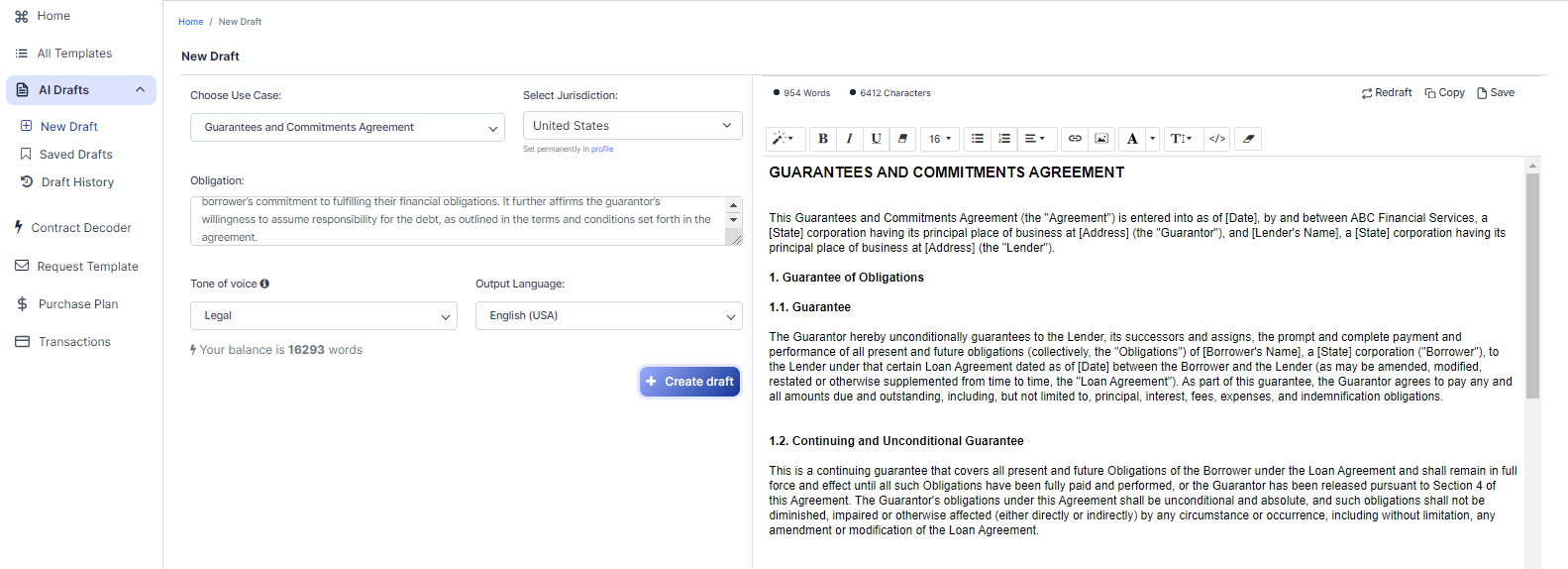

Free Guarantees and Commitments Agreement (Template & Builder)

What is Guarantees and Commitments Agreement?

Guarantees and Commitments Agreement Guarantees and Commitments Agreements outline financial guarantees or commitments to fulfill obligations, often used in financial and lending transactions.

Sample template (2026):

GUARANTEES AND COMMITMENTS AGREEMENT

This Guarantees and Commitments Agreement (the "Agreement") is entered into as of [Date], by and between ABC Financial Services, a [State] corporation having its principal place of business at [Address] (the "Guarantor"), and [Lender's Name], a [State] corporation having its principal place of business at [Address] (the "Lender").

1. Guarantee of Obligations

1.1. Guarantee

The Guarantor hereby unconditionally guarantees to the Lender, its successors and assigns, the prompt and complete payment and performance of all present and future obligations (collectively, the "Obligations") of [Borrower's Name], a [State] corporation ("Borrower"), to the Lender under that certain Loan Agreement dated as of [Date] between the Borrower and the Lender (as may be amended, modified, restated or otherwise supplemented from time to time, the "Loan Agreement"). As part of this guarantee, the Guarantor agrees to pay any and all amounts due and outstanding, including, but not limited to, principal, interest, fees, expenses, and indemnification obligations.

1.2. Continuing and Unconditional Guarantee

This is a continuing guarantee that covers all present and future Obligations of the Borrower under the Loan Agreement and shall remain in full force and effect until all such Obligations have been fully paid and performed, or the Guarantor has been released pursuant to Section 4 of this Agreement. The Guarantor's obligations under this Agreement shall be unconditional and absolute, and such obligations shall not be diminished, impaired or otherwise affected (either directly or indirectly) by any circumstance or occurrence, including without limitation, any amendment or modification of the Loan Agreement.

2. Collateral

2.1. Security Interest

To secure the Guarantor's obligations under this Agreement, the Guarantor hereby grants to the Lender a first priority security interest in the assets and property described in Exhibit A hereto (the "Collateral"), and all cash, accounts, inventory, equipment, and other tangible and intangible property now or hereafter owned or acquired by the Guarantor, wherever located and whether now existing or hereafter arising or acquired. This security interest constitutes a continuously effective security agreement, and the Lender shall have the rights and remedies of a secured party under the applicable Uniform Commercial Code, as well as any additional rights and remedies as may be available to the Lender under the United States law or any relevant state law.

2.2. Perfection of Security Interest

The Guarantor shall execute and deliver to the Lender any documents, financing statements, or other instruments that the Lender deems necessary or desirable to perfect or protect the security interest granted herein, or to vest or confirm in the Lender the rights, interests, and priorities created or intended to be created hereby, and the Guarantor shall take all other actions as the Lender may reasonably require or request for such purposes. The Guarantor hereby authorizes the Lender to file financing statements or other similar documents in any jurisdiction without its signature, to the extent permitted by applicable law.

3. Representations and Warranties

3.1. Corporate Existence, Authority, and Compliance with Law

The Guarantor represents and warrants that it is duly organized, validly existing, and in good standing under the laws of its state of incorporation; that it has all requisite corporate power, authority, and legal right to execute, deliver, and perform its obligations under this Agreement; and that the execution, delivery, and performance of this Agreement have been duly authorized, and do not and will not violate any applicable provision of law or any order, judgment, or decree binding upon the Guarantor.

4. Release of Guarantor

4.1. Conditions for Release

The Guarantor shall be released from its obligations under this Agreement upon the occurrence of any one or more of the following conditions: (i) full and final payment and performance of all Obligations under the Loan Agreement, (ii) the written consent of the Lender, or (iii) any other condition as may be specified in writing by the Lender in its sole discretion. Any such release shall be effective without need for the execution and delivery of any document, instrument or agreement.

5. Governing Law and Jurisdiction

This Agreement shall be governed by, and construed in accordance with, the laws of the United States and the laws of the State of [State], without giving effect to any choice or conflict of law provisions that would cause the application of the laws of any jurisdiction other than the United States and the State of [State]. The parties hereby submit to the exclusive jurisdiction of the federal and state courts located in the [County], in the State of [State] in any action or proceeding arising out of or relating to this Agreement.

6. Miscellaneous

6.1. Entire Agreement; Amendments

This Agreement, together with the Loan Agreement, constitutes the entire agreement between the parties with respect to the subject matter hereof and supersedes all prior understandings, negotiations and agreements, whether written or oral, relating to the subject matter hereof. This Agreement may not be amended, modified, or supplemented except by a written instrument signed by both parties hereto.

6.2. Counterparts

This Agreement may be executed in any number of counterparts, each of which shall be an original, and all of which together shall constitute one and the same agreement.

IN WITNESS WHEREOF, the Guarantor has executed this Guarantees and Commitments Agreement as of the date first above written.

---------------------------------

[GUARANTOR'S FULL LEGAL NAME]

By: ______________________________

Name: ____________________________

Title: _____________________________

Accepted and agreed:

---------------------------------

[LENDER'S FULL LEGAL NAME]

By: ______________________________

Name: ____________________________

Title: _____________________________

Ready to Create your own Guarantees and Commitments Agreement?

Sections of a Guarantees and Commitments Agreement

In this Guarantees and Commitments Agreement, you will see the following sections:

- Guarantee of Obligations

- Collateral

- Representations and Warranties

- Release of Guarantor

- Governing Law and Jurisdiction

- Miscellaneous

Going indepth - Analysis of each section:

- Guarantee of Obligations : This section explains that the Guarantor (ABC Financial Services) promises to pay the Lender (Lender's Name) if the Borrower (Borrower's Name) fails to fulfill their obligations under the Loan Agreement. It's like a friend vouching to pay your rent if you can't. The guarantee is ongoing and unconditional, meaning it covers all current and future obligations and won't be affected by any changes to the Loan Agreement.

- Collateral : To secure the Guarantor's promise, they're giving the Lender a first priority claim on certain assets and property (the "Collateral"). This is like putting your car up as collateral for a loan. The Guarantor also agrees to help the Lender perfect (legally establish) their claim on the Collateral and allows the Lender to file necessary documents without the Guarantor's signature, if allowed by law.

- Representations and Warranties : The Guarantor makes certain promises about their legal status, authority, and compliance with laws. It's like saying, "I'm a real company, I have the power to make this agreement, and I'm not breaking any laws by doing so."

- Release of Guarantor : This section outlines the conditions under which the Guarantor can be released from their obligations under the Agreement, such as full payment of the Borrower's obligations, written consent from the Lender, or any other condition the Lender specifies. It's like saying, "Once the Borrower pays off the loan or the Lender agrees, I'm off the hook."

- Governing Law and Jurisdiction : This part states that the Agreement is governed by the laws of the United States and a specific state, and any disputes will be handled in courts located in a specific county and state. It's like saying, "If we have a disagreement, we'll follow these rules and go to this court to resolve it."

- Miscellaneous : This section covers various additional terms, such as the Agreement being the entire understanding between the parties, how it can be amended, and that it can be signed in multiple copies. It's like saying, "This is our complete agreement, and we can only change it in writing. We can also sign separate copies, and they'll all count as the real deal."

Ready to get started?

Create your Guarantees and Commitments Agreement now