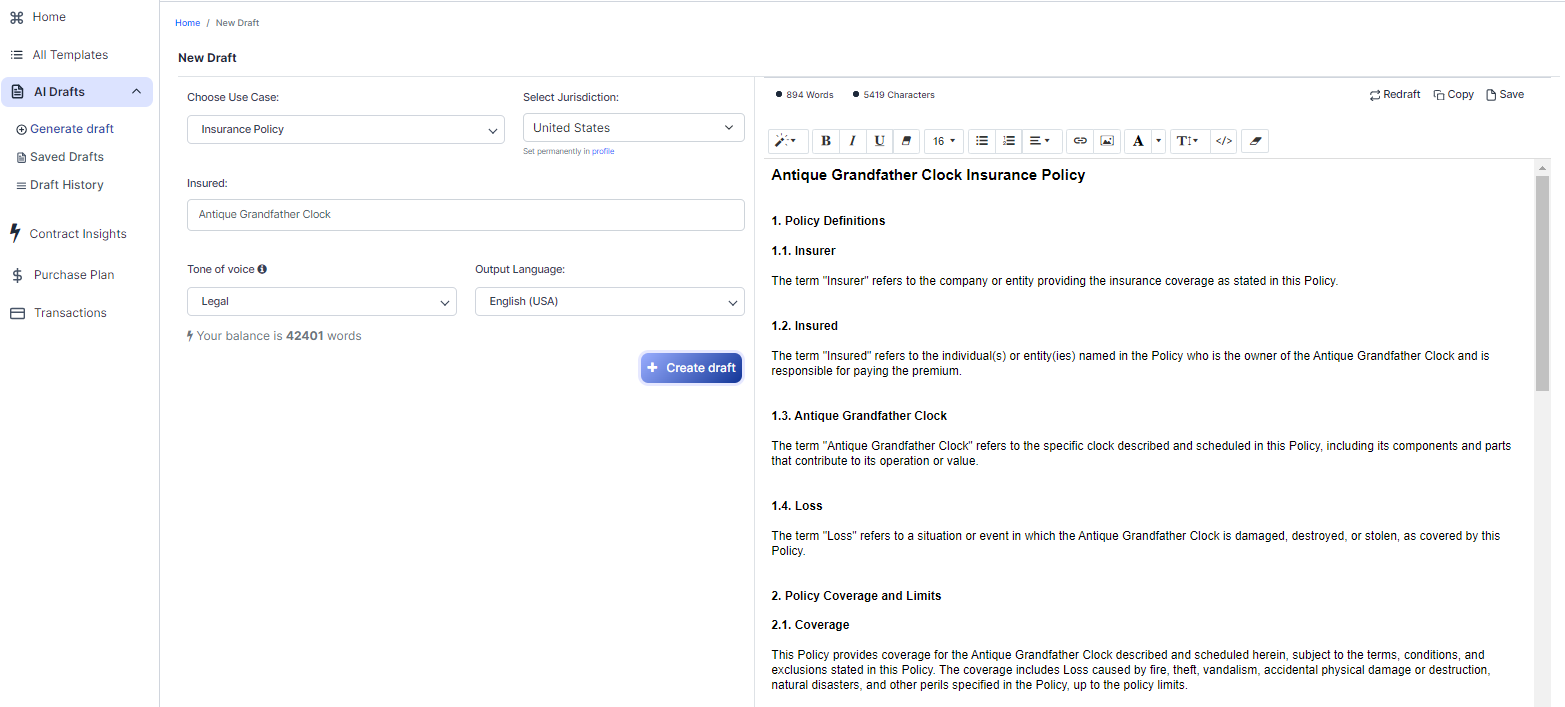

Free Insurance Policy (Template & Builder)

What is Insurance Policy?

Insurance Policy Outlines coverage and terms of insurance, specifying premiums, coverage limits, and deductibles.

Sample template (2026):

Antique Grandfather Clock Insurance Policy

1. Policy Definitions

1.1. Insurer

The term "Insurer" refers to the company or entity providing the insurance coverage as stated in this Policy.

1.2. Insured

The term "Insured" refers to the individual(s) or entity(ies) named in the Policy who is the owner of the Antique Grandfather Clock and is responsible for paying the premium.

1.3. Antique Grandfather Clock

The term "Antique Grandfather Clock" refers to the specific clock described and scheduled in this Policy, including its components and parts that contribute to its operation or value.

1.4. Loss

The term "Loss" refers to a situation or event in which the Antique Grandfather Clock is damaged, destroyed, or stolen, as covered by this Policy.

2. Policy Coverage and Limits

2.1. Coverage

This Policy provides coverage for the Antique Grandfather Clock described and scheduled herein, subject to the terms, conditions, and exclusions stated in this Policy. The coverage includes Loss caused by fire, theft, vandalism, accidental physical damage or destruction, natural disasters, and other perils specified in the Policy, up to the policy limits.

2.2. Policy Limits

The limits of the Insurer's liability for Loss of or damage to the Antique Grandfather Clock are as follows:

- The maximum policy limit for any single Loss is equal to the appraised or agreed value of the Antique Grandfather Clock at the time of the Loss, less any applicable deductible.

- The aggregate policy limit for each policy year cannot exceed the total appraised or agreed value of the Antique Grandfather Clock at the commencement of that policy year, less any applicable deductible.

2.3. Deductibles and Coinsurance

The Insured is responsible for payment of a deductible amount specified in the Policy. The deductible shall be applied to each Loss covered under this Policy. Coinsurance, if any, shall be calculated in accordance with the terms of this Policy or by agreement between the Insurer and the Insured at the time the Loss occurs.

3. Premiums and Policy Terms

3.1. Premiums

The Insured shall pay the Insurer a premium for the insurance coverage provided by this Policy. The premium shall be calculated based on the appraised or agreed value of the Antique Grandfather Clock and other factors relating to the risk of Loss. The premium payment is due on or before the effective date of each policy year. The Insurer may adjust the premium rate at the commencement of each policy year based on changes in risk or other factors.

3.2. Policy Term

This Policy is issued for a twelve (12) month policy term and shall become effective upon receipt of the initial premium payment or as otherwise stated in the Policy.

4. Responsibilities of the Insured

4.1. Care of the Antique Grandfather Clock

The Insured shall exercise reasonable care in the maintenance, protection, and storage of the Antique Grandfather Clock to prevent Loss. The Insured shall notify the Insurer of any changes in the location or storage conditions of the Antique Grandfather Clock that may affect the risk of Loss.

4.2. Reporting a Loss

The Insured shall promptly report to the Insurer any Loss or potential Loss that may be covered by this Policy. The Insured shall provide a written description of the Loss, including any evidence or documentation relating to the circumstances and extent of the Loss.

5. Claims and Loss Settlement

5.1. Notice and Proof of Loss

Upon the occurrence of a Loss, the Insured shall provide the Insurer with written notice and proof of Loss within a reasonable time, but not later than ninety (90) days after the Loss, unless prevented by circumstances beyond the Insured's control. The Insurer may, in its discretion, waive the time limit for filing proof of Loss upon a showing of good cause.

5.2. Appraisal and Loss Settlement

The Insurer and the Insured shall cooperate in the appraisal and settlement of any Loss covered by this Policy. The Loss shall be settled based on the appraised or agreed value of the Antique Grandfather Clock at the time of the Loss, less any applicable deductible or coinsurance. The Insurer shall pay the Loss proceeds to the Insured within thirty (30) days after reaching agreement on the Loss settlement.

6. Policy Exclusions

This Policy does not cover Loss arising from fraud, dishonesty, intentional damage by the Insured, war, or nuclear events, or Loss occurring while the Antique Grandfather Clock is being transported or shipped, unless otherwise agreed in writing by the Insurer and the Insured.

7. Governing Law and Jurisdiction

This Policy shall be governed by and construed in accordance with the laws of the United States. The parties agree to submit to the exclusive jurisdiction of the courts located within the United States for the resolution of any disputes arising out of or in connection with this Policy.

Ready to Create your own Insurance Policy?

Common Sections of an Antique Grandfather Clock Insurance Policy

In this Insurance Policy, you will see the following sections:

- Policy Definitions

- Policy Coverage and Limits

- Premiums and Policy Terms

- Responsibilities of the Insured

- Claims and Loss Settlement

- Policy Exclusions

- Governing Law and Jurisdiction

Analysis/Summary of each section

- Policy Definitions : This section explains the key terms used in the policy, such as Insurer, Insured, Antique Grandfather Clock, and Loss. Think of it as a glossary to help you understand the rest of the policy.

- Policy Coverage and Limits : This part outlines what the policy covers (e.g., fire, theft, vandalism, etc.) and the maximum amount the insurer will pay for a single loss or multiple losses in a policy year. It also explains deductibles and coinsurance, which are the portions of a loss you'll need to cover yourself.

- Premiums and Policy Terms : Here, you'll find information about the cost of the policy (the premium) and how it's calculated, as well as the policy's duration (usually 12 months). It also explains when premium payments are due and how the insurer can adjust the premium rate.

- Responsibilities of the Insured : This section outlines your duties as the policyholder, such as taking care of the clock, notifying the insurer of changes in its location or storage, and reporting losses promptly.

- Claims and Loss Settlement : This part explains the process for filing a claim, including the time limit for submitting proof of loss and how the insurer and insured will cooperate in appraising and settling the loss. It also states when the insurer will pay the loss proceeds.

- Policy Exclusions : This section lists situations and events that the policy does not cover, such as fraud, intentional damage, war, nuclear events, and transportation or shipping (unless agreed upon in writing).

- Governing Law and Jurisdiction : This part states that the policy is governed by U.S. law and that any disputes will be resolved in U.S. courts.

Ready to get started?

Create your Insurance Policy now