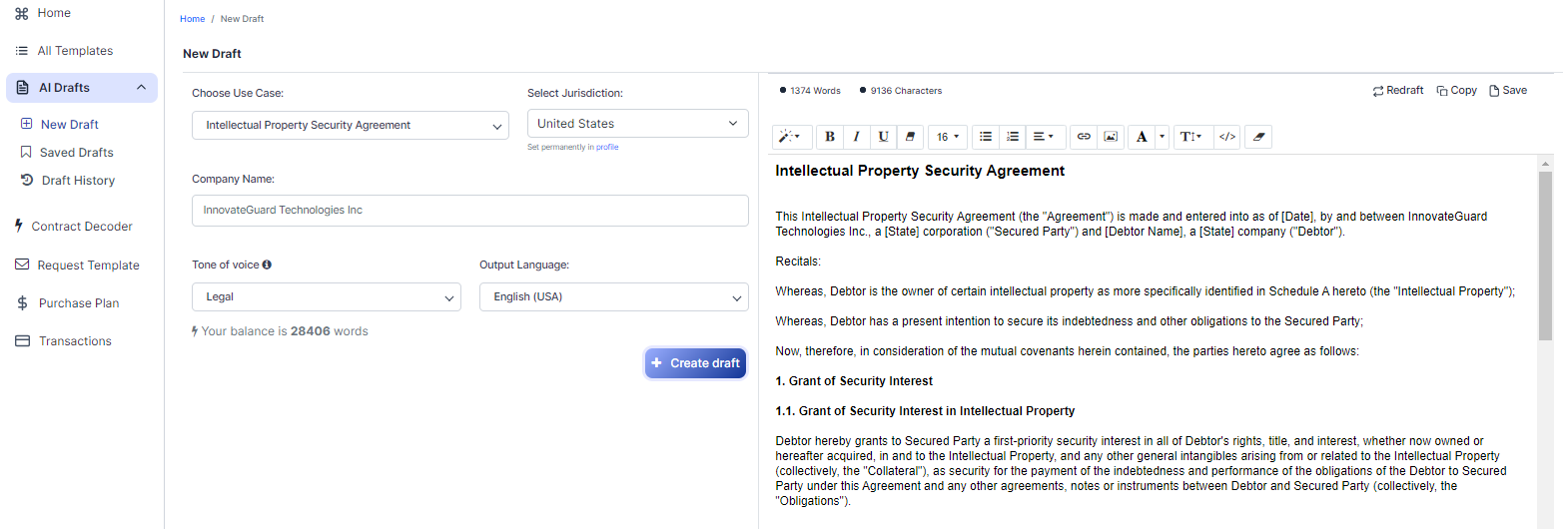

Free Intellectual Property Security Agreement (Template & Builder)

What is Intellectual Property Security Agreement?

Intellectual Property Security Agreement An Intellectual Property Security Agreement secures intellectual property rights, specifying security measures, confidentiality provisions, and dispute resolution mechanisms to protect intellectual property assets.

Sample template (2026):

Intellectual Property Security Agreement

This Intellectual Property Security Agreement (the "Agreement") is made and entered into as of [Date], by and between InnovateGuard Technologies Inc., a [State] corporation ("Secured Party") and [Debtor Name], a [State] company ("Debtor").

Recitals:

Whereas, Debtor is the owner of certain intellectual property as more specifically identified in Schedule A hereto (the "Intellectual Property");

Whereas, Debtor has a present intention to secure its indebtedness and other obligations to the Secured Party;

Now, therefore, in consideration of the mutual covenants herein contained, the parties hereto agree as follows:

1. Grant of Security Interest

1.1. Grant of Security Interest in Intellectual Property

Debtor hereby grants to Secured Party a first-priority security interest in all of Debtor's rights, title, and interest, whether now owned or hereafter acquired, in and to the Intellectual Property, and any other general intangibles arising from or related to the Intellectual Property (collectively, the "Collateral"), as security for the payment of the indebtedness and performance of the obligations of the Debtor to Secured Party under this Agreement and any other agreements, notes or instruments between Debtor and Secured Party (collectively, the "Obligations").

2. Security Measures

2.1. Protection of Intellectual Property Rights

Debtor covenants to maintain, protect, and defend the Intellectual Property against infringement, misappropriation, or violation by any person or entity. Debtor shall promptly notify Secured Party of any actual or suspected infringement, misappropriation, or violation and shall take all necessary actions, at Debtor's expense, to protect and enforce its rights in the Intellectual Property.

2.2. Registration and Recordation

Debtor shall execute any and all documents, and take all actions necessary to perfect and maintain the first-priority security interest of Secured Party in the Intellectual Property under applicable federal and state laws, including registering and recording this Agreement with the United States Patent and Trademark Office (USPTO) and the United States Copyright Office, as applicable.

3. Confidentiality Provisions

3.1. Confidentiality Obligations of the Parties

Both Secured Party and Debtor shall hold in strict confidence and not disclose to any third party any Confidential Information (as defined below) that they receive from the other party or gain access to during the course of this Agreement, except as required by law or as otherwise authorized in writing by the disclosing party. "Confidential Information" means non-public information related to the Intellectual Property and the business activities of the disclosing party, including but not limited to trade secrets, financial data, customer lists, and other proprietary information.

3.2. Exceptions to Confidentiality

Notwithstanding the foregoing, the receiving party's obligations under Section 3.1 shall not apply to information that: (a) is or becomes generally available to the public other than as a result of the receiving party's breach of this Agreement; (b) is independently developed by the receiving party without the use of any Confidential Information; or (c) is required to be disclosed by law or court order, provided that the receiving party provides the disclosing party with prompt written notice of such requirement and gives the disclosing party a reasonable opportunity to oppose the disclosure or seek a protective order.

4. Events of Default

Any one or more of the following events shall constitute an event of default under this Agreement (an "Event of Default"): (a) Debtor fails to pay any of the Obligations when due; (b) Debtor breaches any of its covenants or representations in this Agreement or the other agreements, notes or instruments evidencing or relating to the Obligations; (c) any representation or warranty made by Debtor in this Agreement or the other agreements, notes or instruments evidencing or relating to the Obligations is materially false or misleading when made; or (d) Debtor becomes insolvent, commences or has commenced against it a case under the United States Bankruptcy Code or any similar insolvency or debtor relief law, or makes an assignment for the benefit of creditors.

5. Remedies Upon Default

5.1. Remedies

Upon the occurrence of any Event of Default, Secured Party may, without notice or demand, exercise any and all rights and remedies available to it under applicable law and pursuant to the terms of this Agreement, including without limitation: (a) the right to take possession of the Collateral, (b) the right to sell, assign, or otherwise dispose of the Collateral, and (c) the right to enforce Debtor's Intellectual Property rights and retain the proceeds thereof to satisfy the Obligations.

5.2. Waiver; Cumulative Remedies

Debtor hereby waives any right to notice of default or demand for performance, except as expressly provided in this Agreement. No delay or omission by Secured Party in exercising any right or remedy hereunder shall impair such right or remedy or be construed as a waiver of any default or Event of Default. The rights and remedies of Secured Party under this Agreement, and any other agreements, notes, or instruments evidencing or relating to the Obligations are cumulative and not exclusive, and may be exercised by Secured Party in whole or in part, in any order, and from time to time, until all of the Obligations are paid in full and performed.

6. Dispute Resolution

6.1. Governing Law

This Agreement and any disputes arising out of or in connection with this Agreement shall be governed by and construed in accordance with the laws of [State], without regard to its conflict of law principles.

6.2. Arbitration

Any dispute, controversy or claim arising out of or relating to this Agreement, or the breach, termination or invalidity thereof, shall be settled by arbitration administered by the American Arbitration Association in accordance with its Commercial Arbitration Rules, and judgment on the award rendered by the arbitrator(s) may be entered in any court having jurisdiction thereof.

6.3. Attorneys' Fees and Costs

In the event of any arbitration or legal proceeding arising out of or relating to this Agreement, the prevailing party shall be entitled to recover its reasonable attorneys' fees and costs, in addition to any other relief to which it may be entitled.

7. Miscellaneous Provisions

7.1. Entire Agreement; Amendments

This Agreement, including any Schedules hereto, constitutes the entire understanding of the parties in respect of the subject matter hereof and supersedes all prior or contemporaneous agreements, representations, and negotiations, oral or written. This Agreement may not be amended or modified except in writing, signed by both parties.

7.2. Severability

If any provision of this Agreement is held to be invalid, illegal or unenforceable for any reason, such provision shall be deemed severed from this Agreement, and the remaining provisions of this Agreement shall be unaffected and continue in full force and effect.

7.3. Binding Effect; Assignment

This Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns. Debtor may not assign its rights or obligations under this Agreement without the prior written consent of Secured Party, which consent may be withheld in Secured Party's sole discretion.

7.4. Notices

All notices, requests, and other communications under this Agreement shall be in writing and shall be deemed to have been given: (a) on the date of receipt if delivered personally or by email with confirmation of receipt, (b) on the next business day after dispatch by a nationally recognized overnight courier service, or (c) on the third business day following mailing by registered or certified mail, postage prepaid, return receipt requested. The parties' respective addresses for notices shall be as set forth below, or to such other address as either party may designate by written notice to the other party in accordance with this Section 7.4.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

InnovateGuard Technologies Inc. [Debtor Name]

By: ___________________________ By: _____________________________

[Print Name] [Print Name]

Title: ___________________________ Title: ____________________________

[Address] [Address]

Ready to Create your own Intellectual Property Security Agreement?

Sections of an Intellectual Property Security Agreement

In this Intellectual Property Security Agreement, you will see the following sections:

- Grant of Security Interest

- Security Measures

- Confidentiality Provisions

- Events of Default

- Remedies Upon Default

- Dispute Resolution

- Miscellaneous Provisions

Summary of the sections:

- Grant of Security Interest : This section explains that the Debtor is granting the Secured Party a first-priority security interest in the Intellectual Property and related assets as collateral for the Debtor's obligations. Think of it as the Debtor putting up their Intellectual Property as collateral for a loan.

- Security Measures : This section outlines the Debtor's responsibility to protect and defend the Intellectual Property from infringement and to register the security interest with the appropriate government offices. It's like the Debtor promising to take care of the collateral and make sure it's properly documented.

- Confidentiality Provisions : Both parties agree to keep each other's confidential information secret and not disclose it to third parties, with some exceptions. This is like a mutual promise to keep each other's secrets safe.

- Events of Default : This section lists the events that would constitute a default under the agreement, such as failure to pay or breach of the agreement. It's like a list of "deal breakers" that would allow the Secured Party to take action if the Debtor doesn't fulfill their obligations.

- Remedies Upon Default : If an Event of Default occurs, this section outlines the rights and remedies available to the Secured Party, such as taking possession of the collateral or enforcing the Debtor's Intellectual Property rights. It's like a list of actions the Secured Party can take if the Debtor doesn't hold up their end of the bargain.

- Dispute Resolution : This section explains how disputes between the parties will be resolved, including the governing law, arbitration, and the recovery of attorneys' fees and costs. It's like a roadmap for resolving disagreements that may arise during the agreement.

- Miscellaneous Provisions : This section contains various additional terms, such as the entire agreement clause, severability, binding effect, assignment, and notice requirements. These are like the "fine print" details that help clarify and support the overall agreement.

Ready to get started?

Create your Intellectual Property Security Agreement now