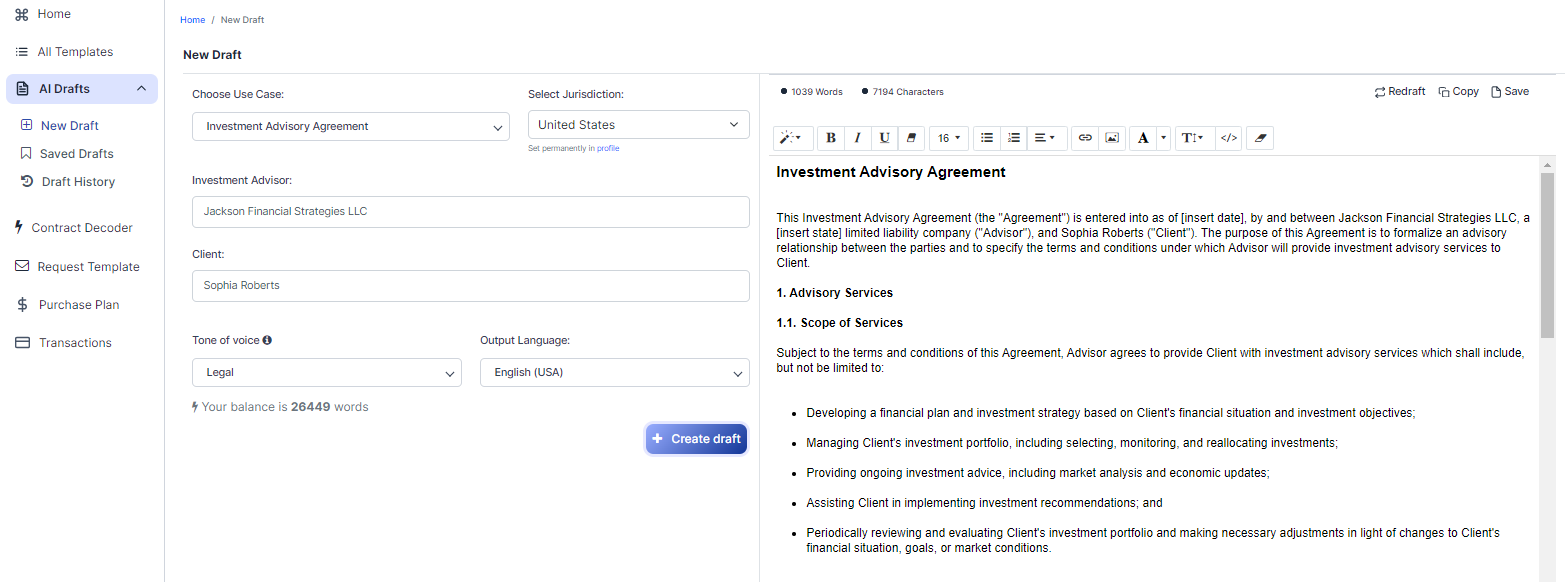

Free Investment Advisory Agreement (Template & Builder)

What is Investment Advisory Agreement?

Investment Advisory Agreement An Investment Advisory Agreement formalizes the relationship between an investment advisor and a client, specifying advisory services, fees, and client objectives.

Sample template (2026):

Investment Advisory Agreement

This Investment Advisory Agreement (the "Agreement") is entered into as of [insert date], by and between Jackson Financial Strategies LLC, a [insert state] limited liability company ("Advisor"), and Sophia Roberts ("Client"). The purpose of this Agreement is to formalize an advisory relationship between the parties and to specify the terms and conditions under which Advisor will provide investment advisory services to Client.

1. Advisory Services

1.1. Scope of Services

Subject to the terms and conditions of this Agreement, Advisor agrees to provide Client with investment advisory services which shall include, but not be limited to:

- Developing a financial plan and investment strategy based on Client's financial situation and investment objectives;

- Managing Client's investment portfolio, including selecting, monitoring, and reallocating investments;

- Providing ongoing investment advice, including market analysis and economic updates;

- Assisting Client in implementing investment recommendations; and

- Periodically reviewing and evaluating Client's investment portfolio and making necessary adjustments in light of changes to Client's financial situation, goals, or market conditions.

2. Client Responsibilities

2.1. Information and Cooperation

Client agrees to provide Advisor with complete, accurate, and up-to-date information regarding Client's financial situation, investment objectives, and any other relevant information necessary for Advisor to render the services. Client agrees to notify Advisor of any material changes in financial circumstances or investment objectives that may require a revision of Client's investment strategy.

3. Fees and Expenses

3.1. Advisory Fees

For the services provided under this Agreement, Client shall pay Advisor an annual advisory fee (the "Advisory Fee"). The Advisory Fee shall be calculated as a percentage of the market value of the assets held in Client's investment portfolio ("Assets Under Management") at the end of each calendar quarter and shall be billed quarterly in arrears at the following rates:

- First $500,000 of Assets Under Management: 1.00% per annum

- Next $500,000 of Assets Under Management: 0.75% per annum

- Assets Under Management over $1,000,000: 0.50% per annum

Payment can be made by check or via direct debit from the Client's custodian account at a bank, savings and loan association, or trust company, as designated by Advisor.

3.2. Other Fees and Expenses

Client may incur additional fees and expenses in connection with the management of their investment portfolio, such as brokerage fees, transaction costs, and taxes. Such fees and expenses are separate from and in addition to the Advisory Fee and shall be borne solely by Client. Advisor will not be liable for any such fees and expenses.

4. Investment Objectives and Restrictions

4.1. Determination of Investment Objectives

Client's investment objectives, as determined through consultation with Advisor and based on the information provided by Client, are as follows: [insert specific investment objectives, e.g., capital preservation, income generation, long-term capital growth].

4.2. Investment Restrictions

Any investment restrictions imposed by Client must be provided to Advisor in writing (the "Investment Restrictions"). Advisor shall not be required to take any action or provide any advice that may, in Advisor's sole opinion, conflict with or jeopardize Client's investment objectives or violate any applicable laws, regulations, or industry best practices.

5. Reporting and Review

5.1. Regular Reporting

Advisor shall provide Client with written reports on a quarterly basis detailing the performance, asset allocation, and other relevant information concerning the Client's investment portfolio. All reports shall be provided to Client by mail, email, or other generally accepted means of delivery.

5.2. Annual Review

Advisor shall conduct an annual review of Client's investment portfolio, including a review of Client's financial situation, investment objectives, risk tolerance, and portfolio performance, as well as any changes in applicable laws, regulations, or market conditions. Client agrees to cooperate in good faith in providing any required information or assistance necessary for the conduct of the annual review.

6. Termination

6.1. Termination Rights

Either party may terminate this Agreement at any time, without cause, upon written notice to the other party. Upon termination, Client shall be entitled to a prorated refund of any prepaid and unearned Advisory Fees, and Advisor shall have no further obligation to perform services or provide advice under this Agreement.

6.2. Survival of Certain Provisions

Sections 3 (Fees and Expenses), 7 (Indemnification and Limitation of Liability), and 8 (Miscellaneous) shall survive the termination of this Agreement.

7. Indemnification and Limitation of Liability

7.1. Indemnification

Each party (the "Indemnifying Party") agrees to indemnify and hold harmless the other party, its affiliates, directors, officers, employees, and agents (the "Indemnified Party") from and against any and all losses, liabilities, damages, claims, and expenses (including reasonable attorney's fees) arising out of the Indemnifying Party's breach of this Agreement.

7.2. Limitation of Liability

Except for cases involving willful misconduct, gross negligence, or violation of applicable laws, Advisor's liability for any losses or damages suffered by Client in connection with this Agreement shall be limited to the amount of Advisory Fees actually paid to Advisor by Client within the 12-month period preceding the event giving rise to such liability.

8. Miscellaneous

8.1. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the United States of America and the State of [insert state], without regard to principles of conflicts of laws.

8.2. Amendment

This Agreement may be amended only by a written instrument signed by both parties.

8.3. Severability

If any provision of this Agreement is held to be invalid or unenforceable, the remaining provisions shall remain in full force and effect.

IN WITNESS WHEREOF, the parties have executed this Investment Advisory Agreement as of the date first above written.

Jackson Financial Strategies LLC

______________________________

By: [Authorized Signature]

Title: [Title]

Sophia Roberts

______________________________

Client Signature

Ready to Create your own Investment Advisory Agreement?

Sections of an Investment Advisory Agreement

In this Investment Advisory Agreement, you will see the following sections:

- Advisory Services

- Client Responsibilities

- Fees and Expenses

- Investment Objectives and Restrictions

- Reporting and Review

- Termination

- Indemnification and Limitation of Liability

- Miscellaneous

Summary of the sections:

- Advisory Services : This section outlines the scope of services the Advisor will provide to the Client, such as developing a financial plan, managing the investment portfolio, providing ongoing advice, assisting in implementing recommendations, and periodically reviewing the portfolio.

- Client Responsibilities : This section explains the Client's obligation to provide accurate and up-to-date information about their financial situation and investment objectives. The Client must also notify the Advisor of any significant changes that may require a revision of their investment strategy.

- Fees and Expenses : This section details the fees the Client will pay the Advisor for their services, calculated as a percentage of the assets under management. It also mentions other fees and expenses the Client may incur, such as brokerage fees and taxes, which are separate from the Advisory Fee.

- Investment Objectives and Restrictions : This section describes the Client's investment objectives and any restrictions they may impose on the Advisor. The Advisor must not take any action or provide advice that conflicts with the Client's objectives or violates any laws, regulations, or industry best practices.

- Reporting and Review : This section explains the Advisor's obligation to provide the Client with regular written reports on their investment portfolio and conduct an annual review of the portfolio, taking into account any changes in the Client's financial situation, objectives, or market conditions.

- Termination : This section outlines the rights of both parties to terminate the Agreement at any time, without cause, upon written notice. Upon termination, the Client is entitled to a prorated refund of any prepaid and unearned Advisory Fees.

- Indemnification and Limitation of Liability : This section states that each party agrees to indemnify and hold the other party harmless from any losses, liabilities, damages, claims, and expenses arising from their breach of the Agreement. The Advisor's liability for any losses or damages suffered by the Client is limited, except in cases of willful misconduct, gross negligence, or violation of applicable laws.

- Miscellaneous : This section covers various miscellaneous provisions, such as governing law, amendment procedures, and severability of the Agreement's provisions.

Ready to get started?

Create your Investment Advisory Agreement now