Free Investment Agreement (Template & Builder)

What is Investment Agreement?

Investment Agreement Outlines terms for investments in businesses, specifying investment amounts, equity stakes, and investor rights.

Sample template (2026):

INVESTMENT AGREEMENT

This Investment Agreement (the "Agreement") is entered into as of [Date], by and between John Doe (the "Investor") and Homenick Inc., a corporation duly organized and existing under the laws of the United States of America (the "Company").

1. INVESTMENT

1.1. Amount and Equity

The Investor shall invest the total amount of Five Hundred Million United States Dollars (USD 500,000,000.00) (the "Investment") into the Company in exchange for a [#]% equity stake in the Company (the "Equity Stake"). The Company will issue the equivalent number of shares of common stock, par value per share (the "Shares") necessary to grant the Investor the Equity Stake. The investment shall be made in a single payment by wire transfer to a bank account specified by the Company within thirty (30) days from the Effective Date of this Agreement.

2. REPRESENTATIONS AND WARRANTIES

2.1. Company Representations and Warranties

The Company represents and warrants to the Investor that as of the date of this Agreement:

(a) The Company is duly organized, validly existing, and in good standing under the laws of its jurisdiction of incorporation, and has the requisite power to carry on its business as presently conducted.

(b) The Company has all requisite corporate power and authority to enter into this Agreement, to issue the Shares, and to perform its obligations under this Agreement.

(c) The Shares, when issued and fully paid, will constitute validly issued, fully paid and non-assessable shares of the Company.

2.2. Investor Representations and Warranties

The Investor represents and warrants to the Company that as of the date of this Agreement:

(a) The Investor has the requisite legal capacity to enter into this Agreement and to perform its obligations under this Agreement.

(b) The Investor has sufficient knowledge and experience in financial, business, and investment matters to evaluate the risks and merits of its Investment into the Company, and the Investor is able to bear the economic risk of the Investment, including a total loss of the Investment amount.

(c) The Investor understands that the Shares have not been registered under the Securities Act of 1933, as amended (the "Securities Act") and that the Shares are being offered and sold pursuant to an exemption from registration under the Securities Act based on the Investor's status as an accredited investor as defined in Rule 501 of Regulation D promulgated under the Securities Act.

3. INVESTOR RIGHTS

3.1. Right of First Refusal

Subject to applicable law, in the event the Company proposes to offer and sell any new securities, the Company shall first offer the Investor the opportunity to purchase, on the same terms and conditions as offered to third parties, its pro rata portion of such new securities in an amount that would allow the Investor to maintain its Equity Stake in the Company.

3.2. Board Representation

The Company shall take all necessary actions to appoint a representative designated by the Investor (the "Investor Director") to the Company's board of directors (the "Board") immediately following the execution of this Agreement.

4. CONFIDENTIALITY

During the term of this Agreement and for a period of the five (5) years following its termination, each party (the "Receiving Party") shall maintain in confidence, and shall not use or disclose, any confidential or proprietary information of the other party (the "Disclosing Party") without the prior written consent of the Disclosing Party, except as required by law or court order. Notwithstanding the foregoing, the Receiving Party may disclose such information to its directors, officers, employees, and professional advisors who need to know such information for purposes of performing its obligations under this Agreement.

5. TERM AND TERMINATION

5.1. Term

This Agreement shall be effective from the date hereof and shall continue in effect until terminated in accordance with this Section 5.

5.2. Termination

Either party may terminate this Agreement upon the breach of any material term, representation, or warranty by the other party that is not cured within thirty (30) days after the breaching party's receipt of written notice of such breach. Upon termination of this Agreement, the Investor shall have no further rights or obligations under this Agreement, except for rights and obligations that expressly survive termination.

6. MISCELLANEOUS

6.1. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the United States and the State of [Insert State], without regard to conflicts of law principles.

6.2. Assignment

Neither party may assign its rights, duties or obligations under this Agreement without the prior written consent of the other party, except that the Investor may assign its rights and obligations under this Agreement to an affiliate or to a successor in interest resulting from a merger, acquisition or other change of control transaction.

6.3. Entire Agreement

This Agreement constitutes the entire understanding and agreement between the parties with respect to its subject matter and supersedes all prior and contemporaneous agreements, representations and understandings, whether oral or written, between the parties relating to its subject matter.

6.4. Amendments and Waivers

Any term of this Agreement may be amended, modified, or waived only by a written instrument executed by the parties hereto. The waiver by any party of any breach of any term or condition of this Agreement shall not be deemed to constitute the waiver of any other breach of the same or any other term or condition.

6.5. Execution in Counterparts

This Agreement may be executed in counterparts, each of which shall be deemed an original, but all such counterparts when taken together shall constitute but one and the same Agreement. Signatures delivered by facsimile or in electronic format (e.g., PDF) shall be deemed to have the same legal effect as originals.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

INVESTOR:

________________________

John Doe

COMPANY:

Homenick Inc.

By: _______________________

Name: _____________________

Title: ______________________

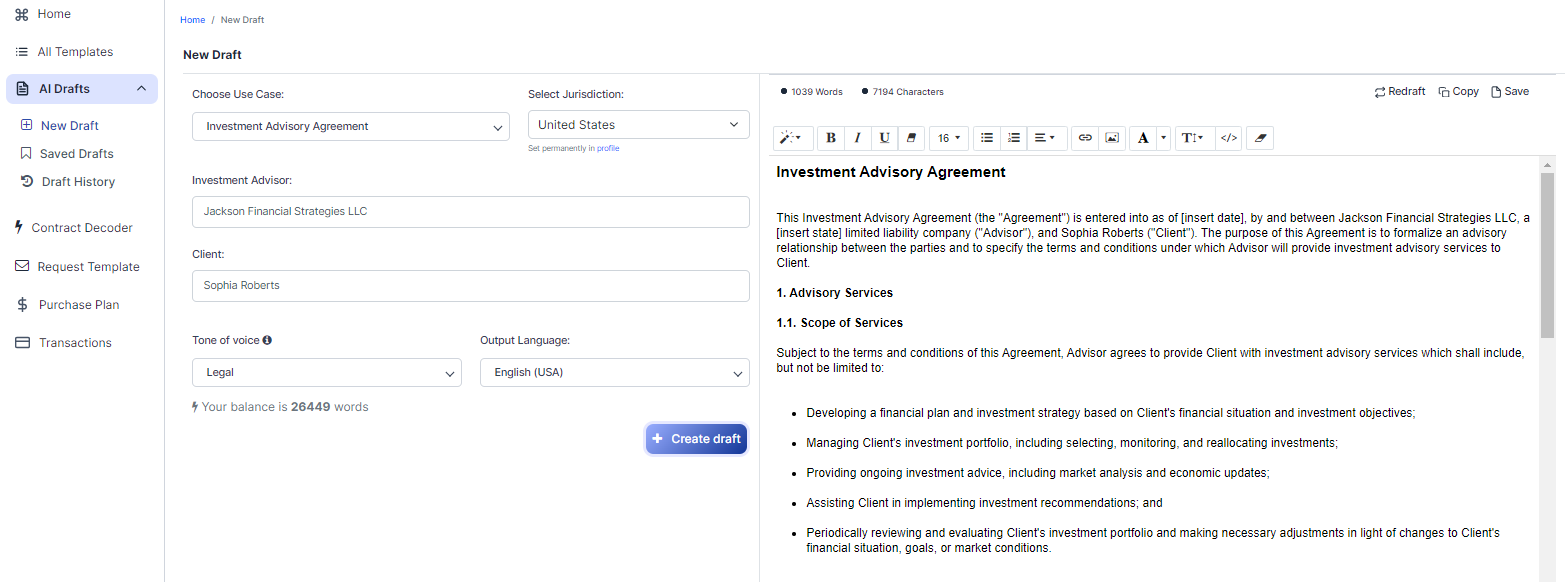

Ready to Create your own Investment Agreement?

Common Sections of an Investment Agreement

In this Investment Agreement, you will see the following sections:

- Investment

- Representations and Warranties

- Investor Rights

- Confidentiality

- Term and Termination

- Miscellaneous

Analysis/Summary of each section

- Investment : In this section, the agreement states that the Investor will invest USD 500,000,000 into the Company in exchange for a certain percentage of equity. The investment will be made in a single payment within 30 days from the agreement's effective date.

- Representations and Warranties : This section contains statements made by both the Company and the Investor to assure each other of certain facts. The Company assures the Investor that it is legally established and has the authority to enter into the agreement. The Investor assures the Company that they have the legal capacity to enter into the agreement and have the knowledge and experience to evaluate the investment's risks and merits.

- Investor Rights : This section outlines the rights granted to the Investor, such as the right of first refusal (the opportunity to maintain their equity stake if the Company offers new securities) and the right to appoint a representative to the Company's board of directors.

- Confidentiality : This section requires both parties to keep each other's confidential information secret for five years after the agreement's termination. They can only disclose such information to specific individuals who need to know it for performing their obligations under the agreement.

- Term and Termination : This section states that the agreement will be effective from the date it is signed and will continue until it is terminated according to the terms outlined. Either party can terminate the agreement if the other party breaches any material term and does not fix the breach within 30 days of receiving written notice.

- Miscellaneous : This section covers various additional terms, such as governing law, assignment, entire agreement, amendments and waivers, and execution in counterparts. It states that the agreement is governed by the laws of the United States and a specific state, and neither party can assign their rights or obligations without the other's consent. The agreement can only be amended in writing, and it can be executed in counterparts, with electronic signatures having the same legal effect as originals.

Ready to get started?

Create your Investment Agreement now