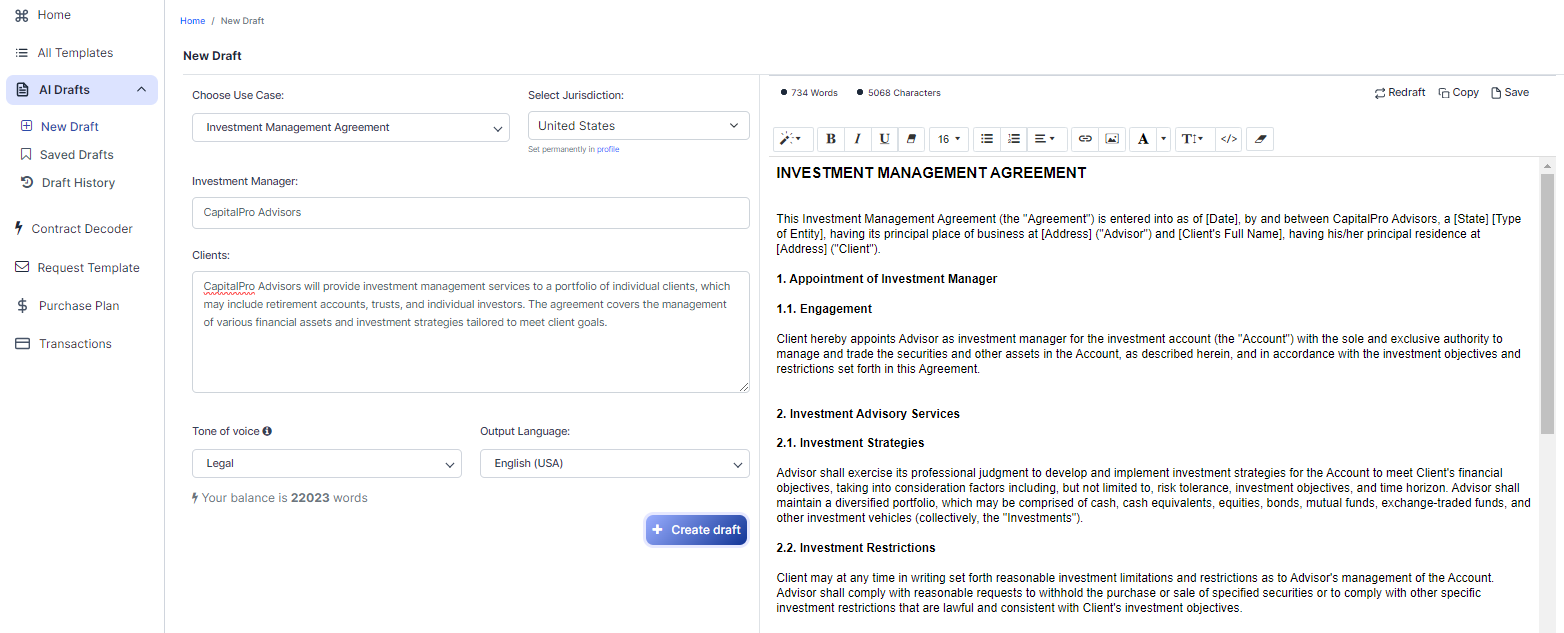

Free Investment Management Agreement (Template & Builder)

What is Investment Management Agreement?

Investment Management Agreement An Investment Management Agreement defines terms for managing investments on behalf of clients, specifying investment strategies, fees, and reporting requirements.

Sample template (2026):

INVESTMENT MANAGEMENT AGREEMENT

This Investment Management Agreement (the "Agreement") is entered into as of [Date], by and between CapitalPro Advisors, a [State] [Type of Entity], having its principal place of business at [Address] ("Advisor") and [Client's Full Name], having his/her principal residence at [Address] ("Client").

1. Appointment of Investment Manager

1.1. Engagement

Client hereby appoints Advisor as investment manager for the investment account (the "Account") with the sole and exclusive authority to manage and trade the securities and other assets in the Account, as described herein, and in accordance with the investment objectives and restrictions set forth in this Agreement.

2. Investment Advisory Services

2.1. Investment Strategies

Advisor shall exercise its professional judgment to develop and implement investment strategies for the Account to meet Client's financial objectives, taking into consideration factors including, but not limited to, risk tolerance, investment objectives, and time horizon. Advisor shall maintain a diversified portfolio, which may be comprised of cash, cash equivalents, equities, bonds, mutual funds, exchange-traded funds, and other investment vehicles (collectively, the "Investments").

2.2. Investment Restrictions

Client may at any time in writing set forth reasonable investment limitations and restrictions as to Advisor's management of the Account. Advisor shall comply with reasonable requests to withhold the purchase or sale of specified securities or to comply with other specific investment restrictions that are lawful and consistent with Client's investment objectives.

3. Fees

3.1. Management Fee

For Advisor's services under this Agreement, Client shall pay a management fee (the "Management Fee") equal to [Percentage] % per annum of the market value of the Account, payable quarterly in arrears. The Management Fee shall be calculated on the last business day of each calendar quarter based on the average daily balance of the Account during the quarter. Client authorizes the custodian of the Account to deduct the Management Fee from the Account and pay the Management Fee directly to Advisor.

3.2. Additional Expenses

Client shall be responsible for all expenses incurred in connection with the Account, including, without limitation, transaction costs, custodian fees, and other charges related to the purchase, sale, and holding of Investments in the Account. Advisor shall not be responsible for any such expenses.

4. Reporting

4.1. Quarterly Reports

Advisor shall furnish Client with quarterly reports within 30 days after the end of each calendar quarter. These reports shall include a statement of the Account's holdings, a summary of transactions during the quarter, performance results, and any other relevant information. Client shall review the reports and promptly notify Advisor in writing of any incorrect information or other issue.

4.2. Annual Review

Advisor shall provide Client with an annual review on or before March 1st of each year, including an assessment of the Account's performance, a review of Client's financial goals, and any recommendations for changes in the Account's investment strategy.

5. Custody of Account Assets

Client shall appoint a qualified custodian (the "Custodian") to hold and maintain the Investments and other assets in the Account. Client hereby authorizes and directs the Custodian to execute transactions, settle trades, and act upon the instructions of Advisor in accordance with this Agreement.

6. Termination

This Agreement may be terminated by either party upon thirty (30) days written notice to the other party. Upon termination, any prepaid, unearned Management Fee shall be refunded to Client on a prorated basis.

7. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the United States and the State of [State], without giving effect to any principles of conflicts of law.

8. Entire Agreement

This Agreement, including any exhibits and schedules hereto, constitutes the entire agreement between the parties with respect to the subject matter hereof and supersedes all prior and contemporaneous agreements, understandings, negotiations, and discussions of the parties, whether oral or written.

IN WITNESS WHEREOF, the parties hereto have executed this Investment Management Agreement as of the date first above written.

___________________________ ____________________________

CapitalPro Advisors [Client's Full Name]

By: [Advisor's Authorized Signature] [Client's Signature]

[Advisor's Printed Name] [Client's Printed Name]

Ready to Create your own Investment Management Agreement?

Sections of an Investment Management Agreement

In this Investment Management Agreement, you will see the following sections:

- Appointment of Investment Manager

- Investment Advisory Services

- Fees

- Reporting

- Custody of Account Assets

- Termination

- Governing Law

- Entire Agreement

Summary of the sections:

- Appointment of Investment Manager: This section explains that the client is hiring the advisor to manage their investment account. The advisor will have the authority to make decisions about buying and selling assets in the account, based on the client's investment goals and restrictions.

- Investment Advisory Services: This part outlines the advisor's responsibilities in managing the account. They will develop and implement investment strategies to meet the client's financial objectives, considering factors like risk tolerance and time horizon. The client can set restrictions on the advisor's actions, and the advisor must follow these rules.

- Fees: This section details the fees the client will pay for the advisor's services. The client will pay a management fee based on a percentage of the account's market value, as well as any additional expenses related to the account, such as transaction costs and custodian fees.

- Reporting: The advisor must provide the client with regular reports on the account's performance, including quarterly reports and an annual review. The client should review these reports and notify the advisor of any issues or inaccuracies.

- Custody of Account Assets: The client will appoint a custodian to hold and maintain the investments and other assets in the account. The custodian will follow the advisor's instructions for executing transactions and settling trades.

- Termination: Either party can end the agreement by giving 30 days written notice to the other party. If the agreement is terminated, any prepaid, unearned management fees will be refunded to the client on a prorated basis.

- Governing Law: This section states that the agreement will be governed by the laws of the United States and the specific state where the agreement is made, without considering any conflicting legal principles.

- Entire Agreement: This part clarifies that the agreement, along with any exhibits and schedules, represents the entire understanding between the client and the advisor. It supersedes any previous agreements, discussions, or negotiations between the parties, whether written or verbal.

Ready to get started?

Create your Investment Management Agreement now