Free Investment Syndication Agreement (Template & Builder)

What is Investment Syndication Agreement?

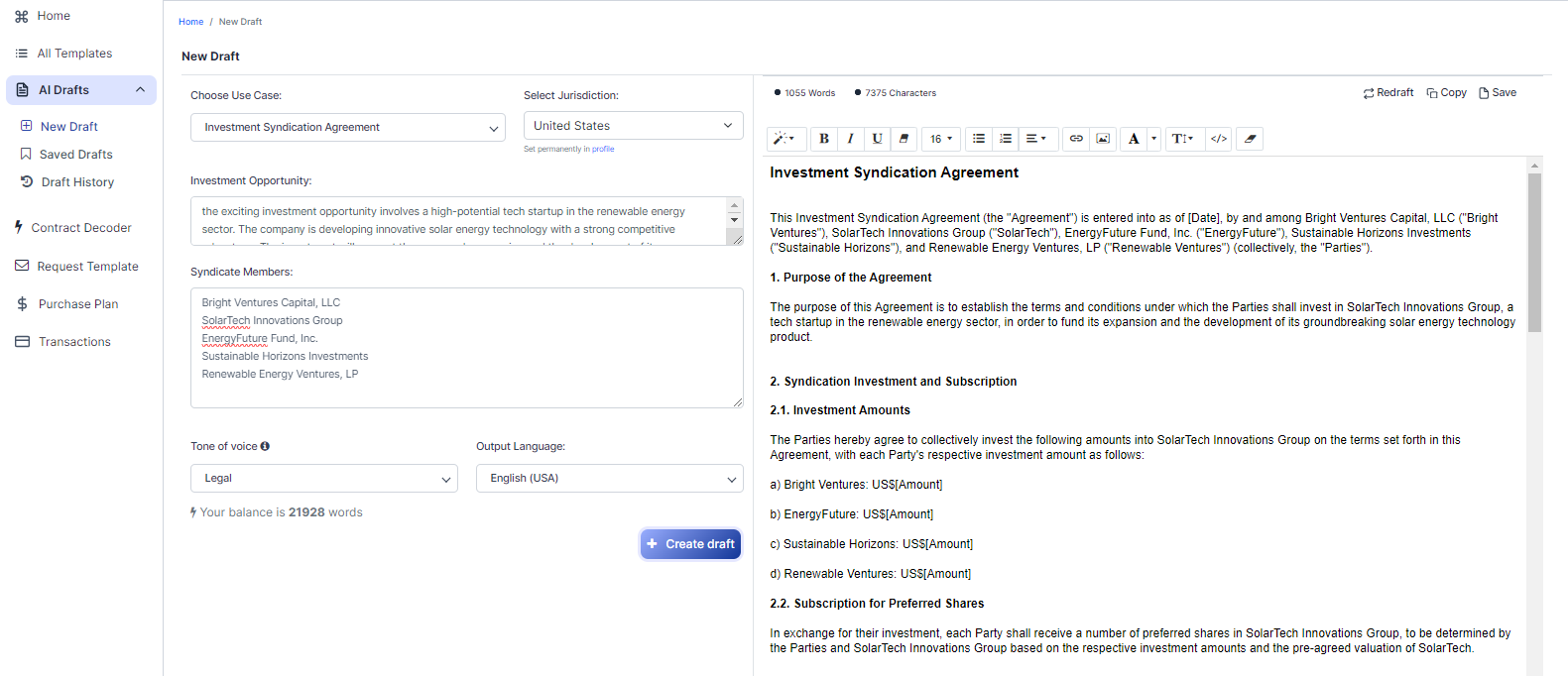

Investment Syndication Agreement An agreement for syndicating investments among multiple investors, specifying syndication terms, investment amounts, profit-sharing arrangements, and management responsibilities.

Sample template (2026):

Investment Syndication Agreement

This Investment Syndication Agreement (the "Agreement") is entered into as of [Date], by and among Bright Ventures Capital, LLC ("Bright Ventures"), SolarTech Innovations Group ("SolarTech"), EnergyFuture Fund, Inc. ("EnergyFuture"), Sustainable Horizons Investments ("Sustainable Horizons"), and Renewable Energy Ventures, LP ("Renewable Ventures") (collectively, the "Parties").

1. Purpose of the Agreement

The purpose of this Agreement is to establish the terms and conditions under which the Parties shall invest in SolarTech Innovations Group, a tech startup in the renewable energy sector, in order to fund its expansion and the development of its groundbreaking solar energy technology product.

2. Syndication Investment and Subscription

2.1. Investment Amounts

The Parties hereby agree to collectively invest the following amounts into SolarTech Innovations Group on the terms set forth in this Agreement, with each Party's respective investment amount as follows:

a) Bright Ventures: US$[Amount]

b) EnergyFuture: US$[Amount]

c) Sustainable Horizons: US$[Amount]

d) Renewable Ventures: US$[Amount]

2.2. Subscription for Preferred Shares

In exchange for their investment, each Party shall receive a number of preferred shares in SolarTech Innovations Group, to be determined by the Parties and SolarTech Innovations Group based on the respective investment amounts and the pre-agreed valuation of SolarTech.

3. Profit Sharing and Distribution of Returns

3.1. Dividends and Exit Proceeds

Each Party shall be entitled to receive dividends and other distributions from SolarTech in proportion to the number of preferred shares held by such Party. Upon any liquidation event or exit transaction, the Parties shall receive their pro rata share of proceeds, based on their respective preferred share ownership, subject to any rights to receive a preference on recoupment of their investment.

4. Management and Roles

4.1. Designation of a Syndicate Lead

Bright Ventures is hereby designated as the Syndicate Lead for the purpose of coordinating activities and communications among the Parties and with SolarTech. Specifically, Bright Ventures shall, acting reasonably and in good faith, oversee and facilitate the execution of this Agreement and any related agreements, monitor and report on the performance of SolarTech, and coordinate decisions and communications to SolarTech, as required.

4.2. Syndicate Advisory Committee

An advisory committee, consisting of one representative from each Party, shall be formed (the "Syndicate Advisory Committee"). The Syndicate Advisory Committee shall meet periodically to discuss and provide oversight for the investment, share information about SolarTech's performance, and address any material issues or matters requiring the input or decision of the Parties.

5. Representations and Warranties

The Parties hereby represent and warrant to each other that they have full power and authority to enter into and perform their respective obligations under this Agreement, and that this Agreement constitutes a legally valid and binding obligation of each Party, enforceable against such Party in accordance with its terms.

6. Confidentiality

Each Party shall treat all information provided by any other Party in connection with this Agreement, or obtained as a result of the Party's participation in the investment in SolarTech, as confidential and shall not disclose such information to any third party, except as required by law or as otherwise agreed in writing by the Parties.

7. Termination

This Agreement may be terminated by mutual written agreement of the Parties or upon the occurrence of a material breach that is not cured within thirty (30) days after written notice thereof has been given to the breaching Party.

8. Governing Law and Dispute Resolution

8.1. Governing Law

This Agreement shall be governed by, and construed in accordance with, the laws of the United States and the state of [State], without regard to its conflicts-of-laws principles.

8.2. Dispute Resolution

Any disputes arising out of or in connection with this Agreement shall be resolved through good faith negotiations between the Parties. If such negotiations do not result in a resolution, the dispute shall be submitted to binding arbitration in accordance with the rules of the American Arbitration Association, and judgment on the award rendered by the arbitrator(s) may be entered in any court having jurisdiction thereof.

9. Notices

All notices, requests, consents, and other communications under this Agreement shall be in writing and shall be deemed duly given (a) when delivered personally, (b) three (3) days after being sent by registered or certified mail, postage prepaid and return receipt requested, or (c) one (1) business day following dispatch by a nationally recognized overnight courier service (e.g., Federal Express), to the intended recipient at the address specified below, or at such other address as the recipient shall have specified by written notice to the sender.

10. Miscellaneous

10.1. Assignment

No Party may assign or transfer any of its rights or obligations under this Agreement without the prior written consent of the other Parties.

10.2. Counterparts

This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

10.3. Entire Agreement

This Agreement constitutes the entire agreement between the Parties pertaining to the subject matter hereof, and supersedes all prior agreements, understandings, negotiations, and discussions, whether oral or written.

10.4. Amendments

This Agreement may be amended only by a writing executed by all Parties.

10.5. No Waiver

The failure of any Party to enforce any provision of this Agreement shall not be construed as a waiver of that provision or the right of such Party to enforce that provision or any other provisions of this Agreement.

IN WITNESS WHEREOF, the Parties have executed this Investment Syndication Agreement as of the date first above written.

Bright Ventures Capital, LLC

By: ______________________________

Name: ____________________________

Title: _____________________________

SolarTech Innovations Group

By: ______________________________

Name: ____________________________

Title: _____________________________

EnergyFuture Fund, Inc.

By: ______________________________

Name: ____________________________

Title: _____________________________

Sustainable Horizons Investments

By: ______________________________

Name: ____________________________

Title: _____________________________

Renewable Energy Ventures, LP

By: ______________________________

Name: ____________________________

Title: _____________________________

Ready to Create your own Investment Syndication Agreement?

Main Sections of an Investment Syndication Agreement

In this Investment Syndication Agreement, you will see the following sections:

- Purpose of the Agreement

- Syndication Investment and Subscription

- Profit Sharing and Distribution of Returns

- Management and Roles

- Representations and Warranties

- Confidentiality

- Termination

- Governing Law and Dispute Resolution

- Notices

- Miscellaneous

About each Section - Analysis and Summary:

- Purpose of the Agreement : This section explains that the agreement is meant to establish the terms for the parties to invest in SolarTech Innovations Group, a renewable energy tech startup. The investment will help fund the company's expansion and development of its solar energy technology product.

- Syndication Investment and Subscription : This section outlines the investment amounts each party will contribute to SolarTech and the preferred shares they will receive in return. The number of shares will be determined based on the investment amounts and the pre-agreed valuation of SolarTech.

- Profit Sharing and Distribution of Returns : This section describes how each party will receive dividends and other distributions from SolarTech based on their preferred share ownership. In the event of a liquidation or exit transaction, parties will receive their share of proceeds according to their preferred share ownership, subject to any preference rights.

- Management and Roles : This section designates Bright Ventures as the Syndicate Lead to coordinate activities and communications among the parties and with SolarTech. It also establishes a Syndicate Advisory Committee, consisting of one representative from each party, to provide oversight and discuss SolarTech's performance and any material issues.

- Representations and Warranties : This section states that each party has the authority to enter into the agreement and that the agreement is legally binding for all parties involved.

- Confidentiality : This section requires each party to treat all information related to the agreement and investment as confidential and not to disclose it to any third party, except as required by law or agreed upon in writing by the parties.

- Termination : This section explains that the agreement can be terminated by mutual written agreement of the parties or if there is a material breach that is not cured within 30 days after written notice has been given to the breaching party.

- Governing Law and Dispute Resolution : This section states that the agreement is governed by the laws of the United States and the state specified in the agreement. Any disputes will be resolved through good faith negotiations between the parties, and if necessary, binding arbitration in accordance with the rules of the American Arbitration Association.

- Notices : This section outlines the methods for delivering notices, requests, consents, and other communications under the agreement, including personal delivery, registered or certified mail, and overnight courier service.

- Miscellaneous : This section covers various additional provisions, such as assignment, counterparts, entire agreement, amendments, and no waiver. It clarifies that no party can assign or transfer their rights or obligations without prior written consent, and that the agreement can only be amended in writing by all parties.

Ready to get started?

Create your Investment Syndication Agreement now