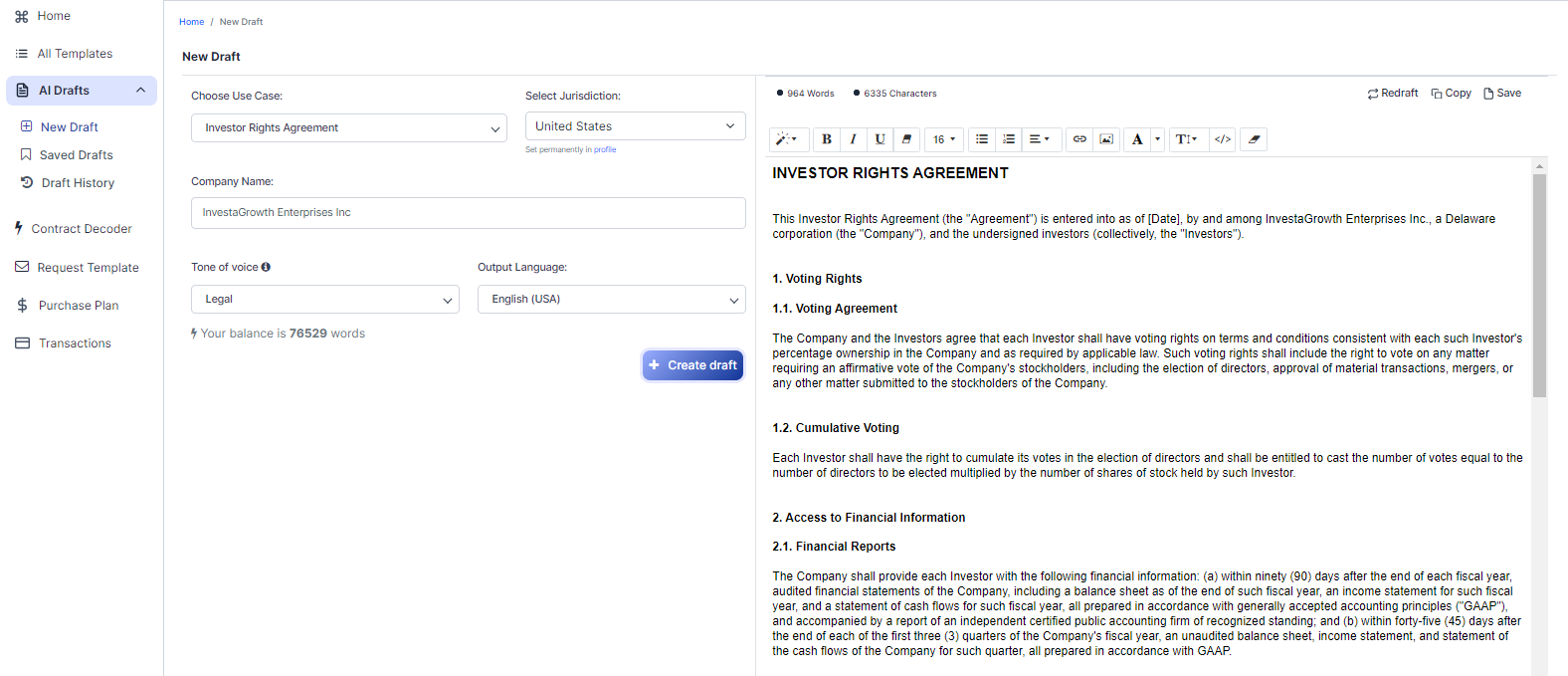

Free Investor Rights Agreement (Template & Builder)

What is Investor Rights Agreement?

Investor Rights Agreement This agreement outlines the rights and obligations of investors in a company, including voting rights, information access, and exit provisions.

Sample template (2026):

INVESTOR RIGHTS AGREEMENT

This Investor Rights Agreement (the "Agreement") is entered into as of [Date], by and among InvestaGrowth Enterprises Inc., a Delaware corporation (the "Company"), and the undersigned investors (collectively, the "Investors").

1. Voting Rights

1.1. Voting Agreement

The Company and the Investors agree that each Investor shall have voting rights on terms and conditions consistent with each such Investor's percentage ownership in the Company and as required by applicable law. Such voting rights shall include the right to vote on any matter requiring an affirmative vote of the Company's stockholders, including the election of directors, approval of material transactions, mergers, or any other matter submitted to the stockholders of the Company.

1.2. Cumulative Voting

Each Investor shall have the right to cumulate its votes in the election of directors and shall be entitled to cast the number of votes equal to the number of directors to be elected multiplied by the number of shares of stock held by such Investor.

2. Access to Financial Information

2.1. Financial Reports

The Company shall provide each Investor with the following financial information: (a) within ninety (90) days after the end of each fiscal year, audited financial statements of the Company, including a balance sheet as of the end of such fiscal year, an income statement for such fiscal year, and a statement of cash flows for such fiscal year, all prepared in accordance with generally accepted accounting principles ("GAAP"), and accompanied by a report of an independent certified public accounting firm of recognized standing; and (b) within forty-five (45) days after the end of each of the first three (3) quarters of the Company's fiscal year, an unaudited balance sheet, income statement, and statement of the cash flows of the Company for such quarter, all prepared in accordance with GAAP.

2.2. Inspection Rights

Each Investor shall have the right, upon reasonable notice and during normal business hours, to inspect and copy the Company's books and records and to discuss the Company's affairs, financial condition, and business prospects with Company officers, accountants, legal counsel, or other professional advisors, provided that the Investor executes and delivers to the Company a confidential disclosure agreement in the form reasonably acceptable to the Company.

3. Exit Rights

3.1. Right of First Refusal

In the event the Company proposes to enter into a binding agreement relating to a Transformative Transaction (as defined herein), the Company shall give written notice (a "ROFR Notice") to each Investor specifying the material terms and provisions of such proposed Transformative Transaction. For thirty (30) days following receipt of the ROFR Notice, each Investor shall have the initial right to enter into such Transformative Transaction on the material terms and provisions specified in the ROFR Notice by delivering written notice to the Company of such Investor's election to exercise its right of first refusal. If any Investor fails to exercise its right of first refusal within such thirty (30)-day period, the Company may enter into the Transformative Transaction with any third party on substantially the same terms and provisions specified in the ROFR Notice, subject to the investor's tag-along rights set forth in Section 3.2 below. A "Transformative Transaction" means the sale, transfer, or other disposition of all or substantially all of the assets of the Company, a merger, consolidation, or reorganization of the Company, or any other transaction that results in the sale or transfer, in one transaction or a series of related transactions, of more than fifty percent (50%) of the Company's outstanding voting power.

3.2. Tag-Along Rights

Each Investor shall have the right to participate in any Transformative Transaction entered into by the Company on a pro rata basis according to the percentage of shares of each class or series of the Company's capital stock held by such Investor, as reasonably determined by the Company and the Investors (the "Tag-Along Right"). In exercising its Tag-Along Right, each Investor shall be entitled to receive the same consideration on the same terms and conditions as those offered to the other participants in the Transformative Transaction.

4. Governing Law and Miscellaneous

4.1. Governing Law

This Agreement shall be governed by and construed in accordance with the internal laws of the State of Delaware, without giving effect to any choice or conflict of laws provision or rule.

4.2. Counterparts

This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same agreement.

4.3. Amendments and Waivers

Any amendments or waivers of any provision of this Agreement shall be in writing and signed by the Company and a majority-in-interest of the Investors subject to the rights being amended or waived, and no waiver by any party of any breach or default under this Agreement by any other party shall be effective unless in writing and signed by the waiving party. Any failure to exercise any right under this Agreement shall not operate as a waiver of such right.

4.4. Entire Agreement

This Agreement constitutes the entire Agreement and understanding between the parties concerning the subject matter hereof and supersedes all prior understandings, agreements, representations, and warranties, both written and oral, with respect to that subject matter.

IN WITNESS WHEREOF, the parties hereto have caused this Investor Rights Agreement to be executed by their duly authorized representatives as of the date first above written.

InvestaGrowth Enterprises Inc.

By: ______________________________

Name: ____________________________

Title: ___________________________

[Investor]

By: ______________________________

Name: ____________________________

Title: ___________________________

Ready to Create your own Investor Rights Agreement?

Common Sections of an Investor Rights Agreement

In this Investor Rights Agreement, you will see the following sections:

- Voting Rights

- Access to Financial Information

- Exit Rights

- Governing Law and Miscellaneous

Summary of each section:

- Voting Rights : This section outlines the voting rights of the investors. It states that each investor will have voting rights based on their percentage ownership in the company. They can vote on matters such as electing directors, approving transactions, and other matters requiring stockholder approval. Additionally, investors have the right to "cumulative voting," which allows them to cast multiple votes for a single director candidate.

- Access to Financial Information : This section explains that the company must provide financial information to the investors. This includes audited financial statements within 90 days of the fiscal year-end and unaudited financial statements within 45 days of each quarter-end. Investors also have the right to inspect and copy the company's books and records, as well as discuss the company's affairs with its officers and advisors, provided they sign a confidentiality agreement.

- Exit Rights : This section covers the investors' rights when the company undergoes a significant transaction, such as a sale or merger. Investors have the "right of first refusal," which means they have the option to participate in the transaction before any third parties. If an investor doesn't exercise this right, the company can proceed with the transaction, but the investor still has "tag-along rights," allowing them to participate in the transaction on a pro-rata basis and receive the same terms as other participants.

- Governing Law and Miscellaneous : This section specifies that the agreement is governed by the laws of the State of Delaware. It also covers various administrative matters, such as the agreement being executed in counterparts, the process for amending or waiving provisions, and the fact that this agreement represents the entire understanding between the parties on the subject matter.

Ready to get started?

Create your Investor Rights Agreement now