Free Letters of Credit (Template & Builder)

What is Letters of Credit?

Letters of Credit Letters of Credit are financial instruments used in international trade to ensure payment to a seller, often issued by a bank, guaranteeing payment upon fulfillment of certain conditions.

Sample template (2026):

LETTER OF CREDIT AGREEMENT

THIS LETTER OF CREDIT AGREEMENT (the "Agreement") is entered into as of [DATE], by and between ABC CORPORATION, a [STATE OF INCORPORATION] corporation ("Buyer"), XYZ IMPORTERS, a [STATE OF INCORPORATION] corporation ("Seller"), and [ISSUING BANK NAME], a [STATE OF INCORPORATION] bank ("Issuing Bank").

1. DEFINITIONS

1.1. Letter of Credit

As used herein, "Letter of Credit" shall mean an irrevocable letter of credit issued by Issuing Bank for the account of Buyer in favor of Seller, in accordance with the terms and conditions set forth in this Agreement, the Sales Contract (as defined below), and any other relevant document, and in compliance with United States laws and regulations.

2. ISSUANCE OF LETTER OF CREDIT

2.1. Request for Issuance

Upon execution of a sales contract for the purchase of goods (the "Sales Contract") by Buyer and Seller, Buyer shall promptly request Issuing Bank to issue a Letter of Credit in favor of Seller in an amount equal to the purchase price of the goods as specified in the Sales Contract.

2.2. Issuing Bank's Obligations

Issuing Bank shall issue the Letter of Credit in favor of Seller within [NUMBER] business days of receiving a request for issuance from Buyer, provided that such request complies with the terms and conditions of this Agreement and the Sales Contract. Upon issuance, the Letter of Credit shall be delivered to Seller's designated bank (the "Advising Bank") via courier or electronic means.

2.3. Terms and Conditions of the Letter of Credit

The terms and conditions of the Letter of Credit shall include, without limitation, the following:

(a) Expiration Date: The Letter of Credit shall expire on [DATE] (the "Expiration Date");

(b) Presentation Period: Seller shall have the right to present documents for payment under the Letter of Credit from the date of issuance until the Expiration Date;

(c) Currency: The Letter of Credit shall be issued and payable in US dollars;

(d) Drafts: Drafts for payment drawn under the Letter of Credit shall be payable at sight;

(e) Partial Shipments: Partial shipments shall be allowed;

(f) Governing Law and Jurisdiction: The Letter of Credit shall be subject to and governed by the laws of the United States and the rules of the Issuing Bank, as applicable;

(g) Amendments and Extensions: The terms of the Letter of Credit may be amended or extended only by the agreement of Buyer, Seller, and Issuing Bank;

(h) Additional Terms and Conditions: Any additional terms and conditions set forth in the Sales Contract or agreed upon by the parties in writing.

3. DOCUMENTS REQUIRED FOR PAYMENT

Buyer and Seller agree that the following documents shall be required for Seller to receive payment under the Letter of Credit:

(a) Commercial Invoice: One (1) original and [NUMBER] copies of Seller's commercial invoice, identifying the goods and the purchase price, and other information required under the Sales Contract;

(b) Bill of Lading: One (1) full set of clean, negotiable, and properly endorsed ocean bills of lading or air waybills, evidencing shipment of goods from the country of origin to the destination specified in the Sales Contract;

(c) Certificate of Origin: One (1) original and [NUMBER] copies of the certificate of origin for the goods, issued by a competent authority in the country of origin;

(d) Inspection Certificate: One (1) original and one (1) copy of the inspection certificate, issued by an independent inspection agency acceptable to Buyer and Seller, certifying the quality and quantity of the goods;

(e) Insurance Documents: One (1) original and [NUMBER] copies of insurance documents or certificates covering the goods during transit, as required under the Sales Contract;

(f) Any other documents specified in the Sales Contract or required by United States laws or regulations.

4. PRESENTATION AND PAYMENT

4.1. Presentation of Documents

Seller shall present the documents required under Section 3 above to the Advising Bank within the Presentation Period. The Advising Bank shall examine the documents and forward them to the Issuing Bank for payment, provided that the documents are in compliance with the terms and conditions of the Letter of Credit.

4.2. Payment

Upon receipt and verification of the documents by Issuing Bank, and provided that such documents are in compliance with the terms and conditions of the Letter of Credit, Issuing Bank shall promptly make payment to Seller or Seller's designated account.

5. MISCELLANEOUS

5.1. Entire Agreement

This Agreement, together with the Sales Contract and any other relevant document, constitutes the entire agreement and understanding of the parties with respect to the subject matter hereof and supersedes all prior negotiations, agreements, and understandings, whether written or oral, relating to such subject matter.

5.2. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the United States, excluding its conflict of laws principles.

5.3. Counterparts

This Agreement may be executed in any number of counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same agreement.

5.4. Amendments and Waivers

No amendment, supplement, or modification of this Agreement or any provision hereof shall be binding upon the parties unless executed in writing by the party to be bound. No waiver of any provision of this Agreement shall be binding upon the waiving party unless executed in writing by such party.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

ABC CORPORATION XYZ IMPORTERS

By:_______________ By:_______________

[NAME] [NAME]

Title: [TITLE] Title: [TITLE]

[ISSUING BANK NAME]

By:_______________

[NAME]

Title: [TITLE]

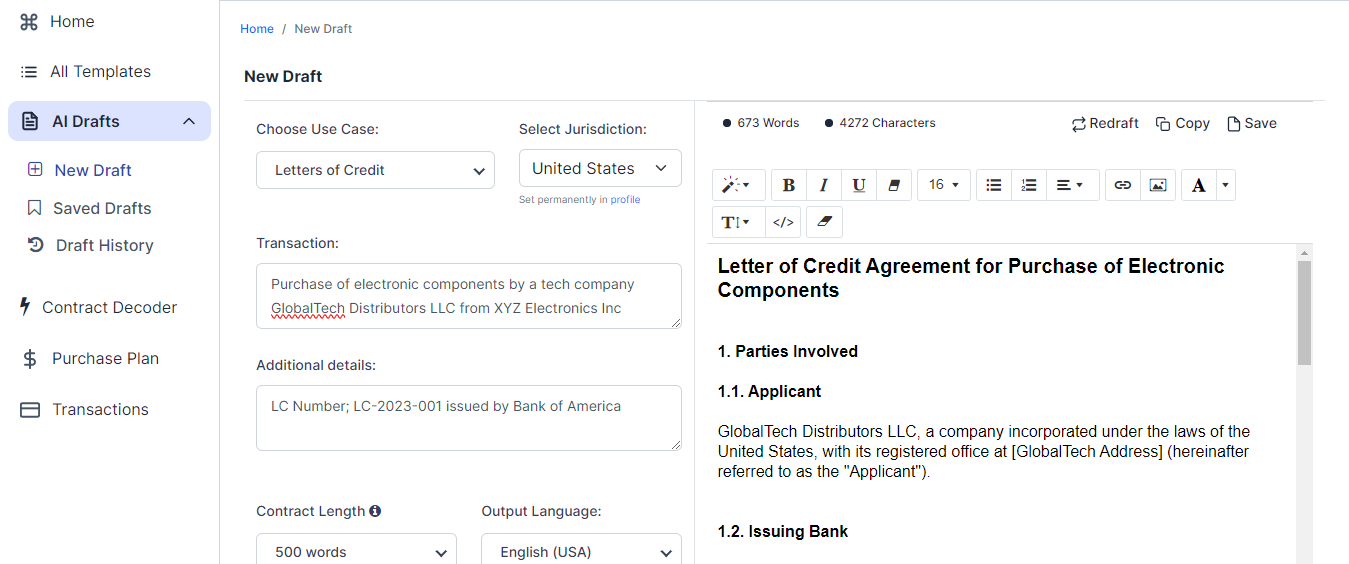

Ready to Create your own Letters of Credit?

Sections of a Letter of Credit Agreement

In this Letter of Credit Agreement, you will see the following sections:

- Definitions

- Issuance of Letter of Credit

- Documents Required for Payment

- Presentation and Payment

- Miscellaneous

Going in-depth - Analysis of each section:

- Definitions : This section explains the meaning of the term "Letter of Credit" used in the agreement. It is an irrevocable letter of credit issued by the Issuing Bank for the account of the Buyer in favor of the Seller, following the terms and conditions of the agreement, the Sales Contract, and any other relevant document, and in compliance with United States laws and regulations.

- Issuance of Letter of Credit : This section outlines the process of issuing a Letter of Credit. The Buyer requests the Issuing Bank to issue a Letter of Credit in favor of the Seller after executing a Sales Contract. The Issuing Bank must issue the Letter of Credit within a specified number of business days and deliver it to the Seller's designated bank. The terms and conditions of the Letter of Credit are also detailed in this section, including the expiration date, presentation period, currency, drafts, partial shipments, governing law and jurisdiction, amendments and extensions, and additional terms and conditions.

- Documents Required for Payment : This section lists the documents that the Seller must provide to receive payment under the Letter of Credit. These documents include a commercial invoice, bill of lading, certificate of origin, inspection certificate, insurance documents, and any other documents specified in the Sales Contract or required by United States laws or regulations.

- Presentation and Payment : This section explains the process of presenting documents and receiving payment. The Seller presents the required documents to the Advising Bank within the Presentation Period. The Advising Bank examines the documents and forwards them to the Issuing Bank for payment, provided that the documents comply with the terms and conditions of the Letter of Credit. The Issuing Bank then verifies the documents and makes payment to the Seller or the Seller's designated account.

- Miscellaneous : This section covers various additional provisions, such as the entire agreement clause, governing law, counterparts, and amendments and waivers. It states that the agreement, along with the Sales Contract and any other relevant document, constitutes the entire agreement between the parties and supersedes any prior negotiations or agreements. The agreement is governed by United States law, and any amendments or waivers must be executed in writing by the party to be bound.

Ready to get started?

Create your Letters of Credit now