Free Loan Agreement (Template & Builder)

What is Loan Agreement?

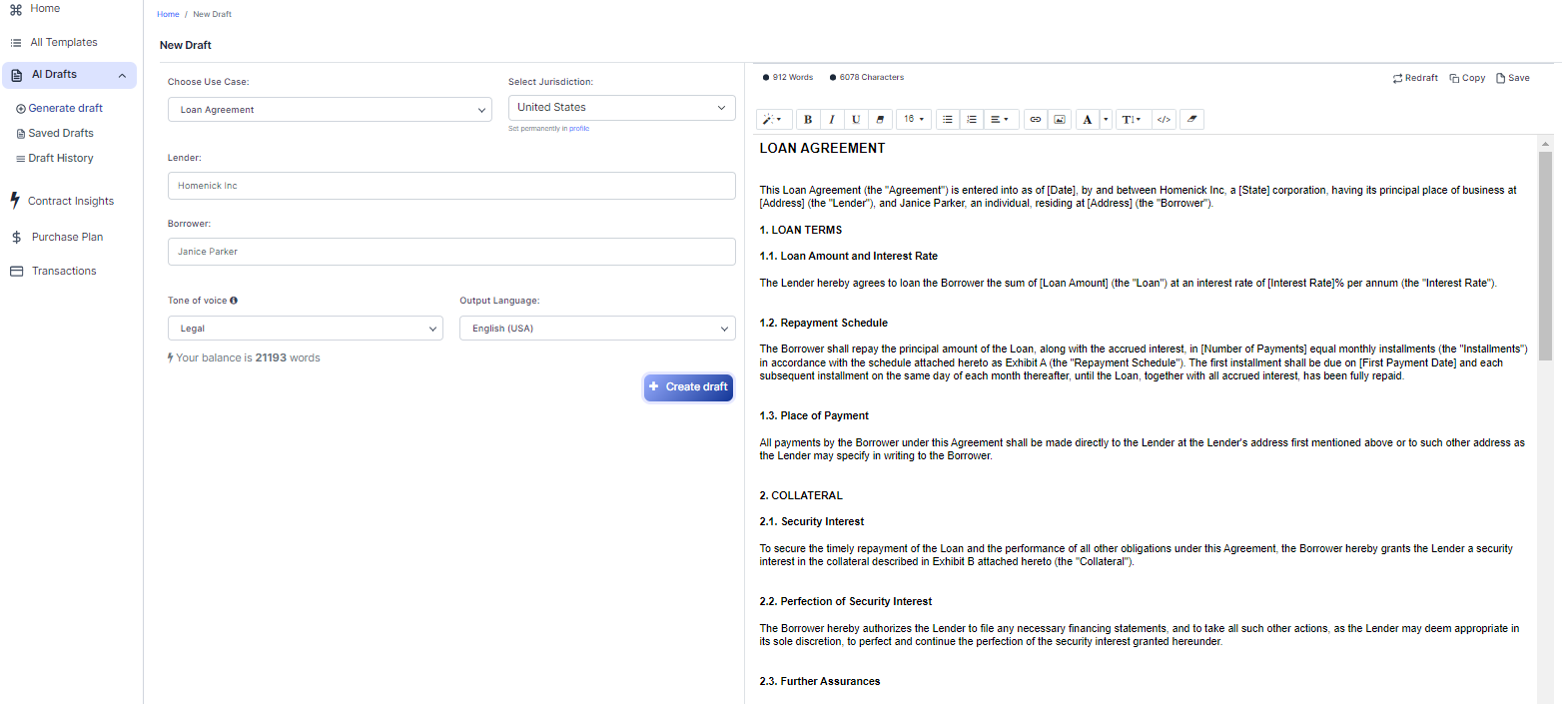

Loan Agreement Specifies terms for lending or borrowing money, such as interest rates and repayment schedules.

Sample template (2026):

LOAN AGREEMENT

This Loan Agreement (the "Agreement") is entered into as of [Date], by and between Homenick Inc, a [State] corporation, having its principal place of business at [Address] (the "Lender"), and Janice Parker, an individual, residing at [Address] (the "Borrower").

1. LOAN TERMS

1.1. Loan Amount and Interest Rate

The Lender hereby agrees to loan the Borrower the sum of [Loan Amount] (the "Loan") at an interest rate of [Interest Rate]% per annum (the "Interest Rate").

1.2. Repayment Schedule

The Borrower shall repay the principal amount of the Loan, along with the accrued interest, in [Number of Payments] equal monthly installments (the "Installments") in accordance with the schedule attached hereto as Exhibit A (the "Repayment Schedule"). The first installment shall be due on [First Payment Date] and each subsequent installment on the same day of each month thereafter, until the Loan, together with all accrued interest, has been fully repaid.

1.3. Place of Payment

All payments by the Borrower under this Agreement shall be made directly to the Lender at the Lender's address first mentioned above or to such other address as the Lender may specify in writing to the Borrower.

2. COLLATERAL

2.1. Security Interest

To secure the timely repayment of the Loan and the performance of all other obligations under this Agreement, the Borrower hereby grants the Lender a security interest in the collateral described in Exhibit B attached hereto (the "Collateral").

2.2. Perfection of Security Interest

The Borrower hereby authorizes the Lender to file any necessary financing statements, and to take all such other actions, as the Lender may deem appropriate in its sole discretion, to perfect and continue the perfection of the security interest granted hereunder.

2.3. Further Assurances

The Borrower shall execute and deliver, and shall cause to be executed and delivered, such other documents and instruments and to take such other actions as the Lender may reasonably require to perfect and continue the perfection of the security interest granted hereunder, or to carry out the intent and purposes of this Agreement.

3. PREPAYMENT

The Borrower may prepay the Loan, in whole or in part, at any time without penalty, provided that any partial payment shall first be applied to accrued but unpaid interest and the remainder to the outstanding principal balance of the Loan.

4. DEFAULT

4.1. Events of Default

An event of default (an "Event of Default") under this Agreement shall include any of the following occurrences:

- Failure by the Borrower to pay when due any Installment;

- Material breach by the Borrower of any covenant, representation, or warranty contained in this Agreement;

- Attachment, garnishment, or levy upon any asset of the Borrower, or the Collateral;

- Bankruptcy, insolvency, reorganization, winding up, or liquidation of the Borrower;

- Dissolution, termination, or suspension of the Borrower's business;

- Default by the Borrower under any other material agreement;

- Any representation or warranty made by the Borrower in this Agreement shall prove to have been materially false or misleading on the date when made; or

- The occurrence of any other event specified as an Event of Default in this Agreement.

4.2. Remedies upon Default

Upon the occurrence of an Event of Default, the Lender may, in its sole discretion and without notice or demand, declare the entire outstanding balance of the Loan, together with all accrued but unpaid interest and all other amounts owed under this Agreement, to be immediately due and payable, and the Lender shall have all rights and remedies provided by the United States laws, including, without limitation, the right to proceed against the Collateral as provided herein.

5. MISCELLANEOUS

5.1. Governing Law

This Agreement shall be governed by, and construed in accordance with, the laws of the United States, without giving effect to any conflict of laws rules.

5.2. Amendment

No amendment, modification, or waiver of any provision of this Agreement shall be effective unless the same shall be in writing and signed by both parties hereto. No waiver of a breach of any provision of this Agreement shall constitute a waiver of any other breach or any other provision of this Agreement.

5.3. Counterparts

This Agreement may be executed in multiple counterparts, each of which shall be deemed to be an original, but all of which together shall constitute one and the same instrument.

5.4. Severability

If any term, condition, or provision of this Agreement is held to be invalid or unenforceable for any reason, the remainder of the Agreement shall continue in full force and effect.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

LENDER: BORROWER:

Homenick Inc Janice Parker

By: _________________________ By: _________________________

[Authorized Signature] [Signature]

Name: _______________________ Name: Janice Parker

Title: ______________________

CONSENT AND AGREEMENT OF SPOUSE:

I, ___________________________, the spouse of Janice Parker, the Borrower, hereby consent and agree to the terms of this Loan Agreement and confirm that I have read and understand the same.

By: _________________________

[Signature]

Name: _______________________

Date: _______________________

Ready to Create your own Loan Agreement?

Common Sections of a Loan Agreement

In this Loan Agreement, you will see the following sections:

- Loan Terms

- Collateral

- Prepayment

- Default

- Miscellaneous

Analysis/Summary of each section

- Loan Terms : This section outlines the specifics of the loan, such as the amount being borrowed, the interest rate, and the repayment schedule. Think of it like the recipe for a cake, with all the ingredients and instructions needed to make it.

- Collateral : This section explains that the borrower is providing something of value (the collateral) as a guarantee that they will repay the loan. If the borrower fails to repay the loan, the lender can take the collateral as compensation. It's like leaving your watch with a friend as a guarantee that you'll return their borrowed book.

- Prepayment : This section allows the borrower to repay the loan early, either in full or partially, without any penalties. It's like being able to return a borrowed item before the agreed-upon date without any consequences.

- Default : This section lists the events that would be considered a default on the loan, such as missed payments or bankruptcy. It also explains the lender's rights and remedies in case of default, like taking the collateral or demanding immediate repayment. Think of it as the rules of a game, with consequences for breaking them.

- Miscellaneous : This section covers various legal and administrative aspects of the agreement, such as governing law, amendments, and severability. It's like the fine print on a contract that ensures everything runs smoothly and fairly.

Ready to get started?

Create your Loan Agreement now