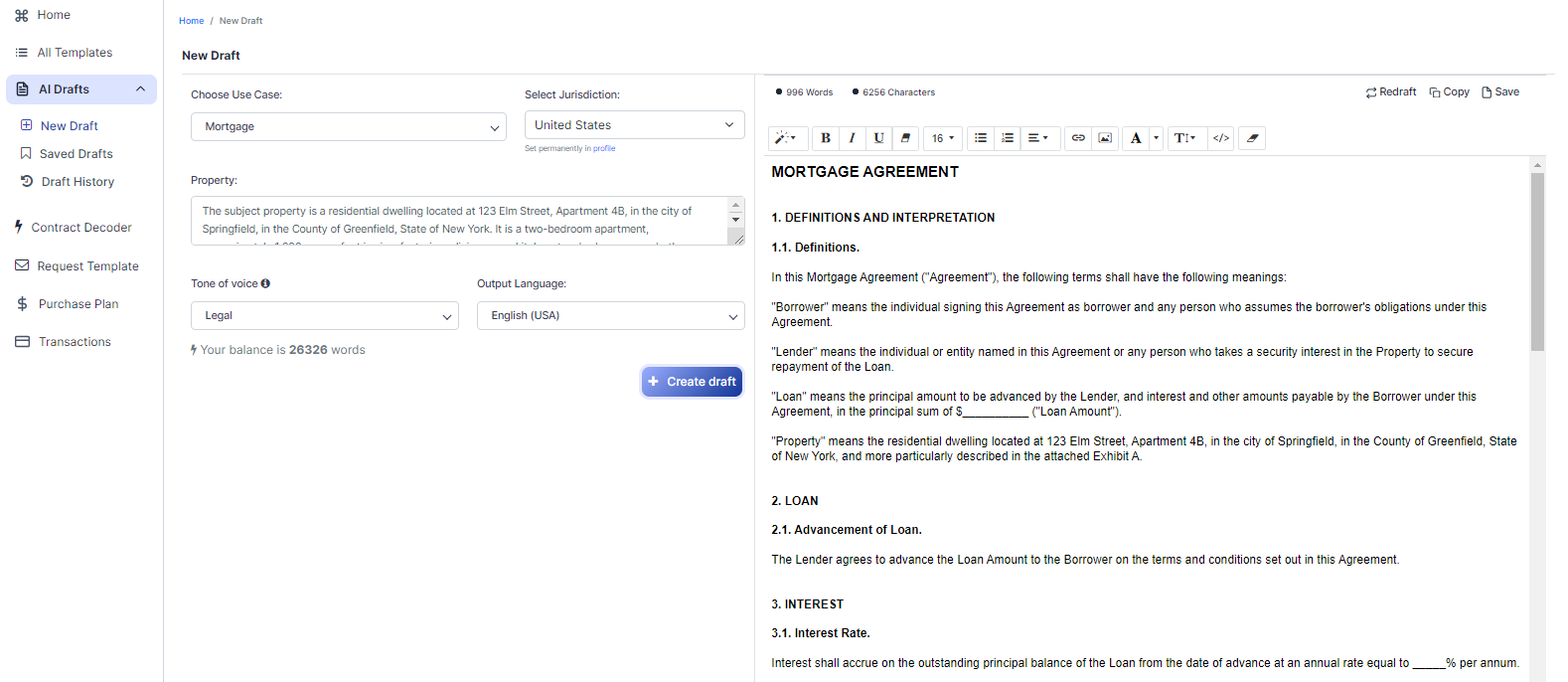

Free Mortgage (Template & Builder)

What is Mortgage?

Mortgage A Mortgage Agreement is a contract for borrowing money to purchase real estate, with the property serving as collateral for the loan.

Sample template (2026):

MORTGAGE AGREEMENT

1. DEFINITIONS AND INTERPRETATION

1.1. Definitions.

In this Mortgage Agreement ("Agreement"), the following terms shall have the following meanings:

"Borrower" means the individual signing this Agreement as borrower and any person who assumes the borrower's obligations under this Agreement.

"Lender" means the individual or entity named in this Agreement or any person who takes a security interest in the Property to secure repayment of the Loan.

"Loan" means the principal amount to be advanced by the Lender, and interest and other amounts payable by the Borrower under this Agreement, in the principal sum of $__________ ("Loan Amount").

"Property" means the residential dwelling located at 123 Elm Street, Apartment 4B, in the city of Springfield, in the County of Greenfield, State of New York, and more particularly described in the attached Exhibit A.

2. LOAN

2.1. Advancement of Loan.

The Lender agrees to advance the Loan Amount to the Borrower on the terms and conditions set out in this Agreement.

3. INTEREST

3.1. Interest Rate.

Interest shall accrue on the outstanding principal balance of the Loan from the date of advance at an annual rate equal to _____% per annum.

4. REPAYMENT

4.1. Repayment Terms.

The Borrower shall repay the Loan, together with accrued and unpaid interest, in equal monthly installments of $__________, commencing on the first day of the month following the date of advance.

4.2. Maturity Date.

The Borrower shall repay the Loan in full, together with any accrued but unpaid interest, on or before the maturity date, which shall be no later than _________ years from the date of advance ("Maturity Date").

4.3. Prepayment.

The Borrower may, at any time and from time to time, prepay the Loan, in whole or in part without premium or penalty, provided that the Borrower gives the Lender prior written notice of the prepayment.

5. SECURITY

5.1. Mortgage Liens.

The Borrower shall grant, convey, and pledge to the Lender, as security for the payment and performance of all the Borrower's obligations under this Agreement, a valid and subsisting first mortgage lien upon the Property, in the form and substance satisfactory to the Lender ("Mortgage").

5.2. Recording.

The Borrower shall cause the Mortgage to be duly recorded in the appropriate office for the recording of land title documents in the County of Greenfield, State of New York, and shall pay all fees and expenses related to such recording.

6. COVENANTS

6.1. Use and Maintenance of Property.

The Borrower shall, at all times, (a) use the Property only for residential purposes; and (b) maintain and repair the Property in a good and workmanlike manner, in accordance with all applicable laws, regulations, and building requirements.

6.2. Insurance.

The Borrower shall maintain, at its expense, insurance on the Property acceptable to the Lender, in amounts and with insurers as the Lender may require from time to time.

7. EVENTS OF DEFAULT

7.1. Events of Default.

An event of default ("Event of Default") shall occur if (a) the Borrower fails to pay any amount due under this Agreement when due; (b) the Borrower fails to perform or observe any material covenant or obligation contained in this Agreement or the Mortgage; or (c) any event or circumstance occurs that the Lender reasonably believes could materially and adversely affect the Borrower's ability to pay or perform its obligations under this Agreement or the Mortgage.

8. REMEDIES UPON DEFAULT

8.1. Acceleration.

Upon the occurrence of an Event of Default, the Lender may, at its option, declare the entire outstanding principal balance of the Loan, together with all accrued but unpaid interest thereon, to be immediately due and payable without presentment, demand, protest, or further notice of any kind, all of which are hereby expressly waived by the Borrower.

8.2. Foreclosure.

Upon the occurrence of an Event of Default, the Lender may, in accordance with applicable law, foreclose on the Mortgage, sell the Property, and apply the proceeds of the sale to satisfy, in whole or in part, the Borrower's obligations under this Agreement and the Mortgage.

9. GOVERNING LAW AND JURISDICTION

9.1. Governing Law.

This Agreement shall be governed by and construed in accordance with the laws of the United States of America and the laws of the State of New York.

9.2. Jurisdiction.

Any legal proceeding arising out of or relating to this Agreement or the enforcement hereof shall be commenced in the courts located in the County of Greenfield, State of New York, and the parties hereto consent to the exclusive jurisdiction of such courts and the service of process therein.

10. MISCELLANEOUS

10.1. Integration; Modification.

This Agreement, together with the Mortgage, constitutes the entire agreement between the Borrower and the Lender with respect to the Loan and supersedes all prior or contemporaneous understandings or agreements, oral or written, relating thereto. No modification, amendment, waiver or consent of any provision of this Agreement shall be effective unless the same is in writing and signed by all the parties hereto.

10.2. Successors and Assigns.

This Agreement shall be binding upon and inure to the benefit of the Borrower and the Lender and their respective successors and assigns.

IN WITNESS WHEREOF, the parties hereto have executed this Mortgage Agreement as of the date first above written.

______________________________ ______________________________

BORROWER'S NAME LENDER'S NAME

Borrower Lender

Ready to Create your own Mortgage?

Sections of a Mortgage

In this Mortgage Agreement, you will see the following sections:

- Definitions and Interpretation

- Loan

- Interest

- Repayment

- Security

- Covenants

- Events of Default

- Remedies Upon Default

- Governing Law and Jurisdiction

- Miscellaneous

Going indepth - Analysis of each section:

- Definitions and Interpretation: This section explains the meaning of important terms used throughout the agreement, such as "Borrower," "Lender," "Loan," and "Property." Think of it as a dictionary for the agreement.

- Loan: This section outlines the Lender's agreement to provide the Borrower with the loan amount and the terms and conditions that apply. It's like the Lender saying, "I'll give you this money, but you have to follow these rules."

- Interest: This section specifies the annual interest rate that will be applied to the outstanding principal balance of the loan. It's like the cost of borrowing the money from the Lender.

- Repayment: This section explains how the Borrower must repay the loan, including the monthly installment amount, when payments begin, and the maturity date (when the loan must be fully repaid). It also covers prepayment, which is when the Borrower can pay off the loan early without penalty.

- Security: This section describes the mortgage lien that the Borrower gives to the Lender as security for the loan. It's like the Borrower saying, "If I don't pay back the loan, you can take my property." It also covers the recording of the mortgage lien with the appropriate government office.

- Covenants: This section lists the promises the Borrower makes to the Lender regarding the use, maintenance, and insurance of the property. It's like the Borrower saying, "I'll take good care of the property and follow the rules while I have this loan."

- Events of Default: This section defines what constitutes a default on the loan, such as missed payments or failure to maintain the property. It's like a list of "don'ts" that the Borrower must avoid to keep the loan in good standing.

- Remedies Upon Default: This section explains what the Lender can do if the Borrower defaults on the loan, such as accelerating the loan (making the entire balance due immediately) or foreclosing on the property. It's like the Lender saying, "If you break the rules, here's what I can do to protect my investment."

- Governing Law and Jurisdiction: This section states that the agreement is governed by the laws of the United States and the State of New York and that any legal disputes will be handled in the courts of Greenfield County, New York. It's like choosing the rulebook and referee for any disagreements that may arise.

- Miscellaneous: This section covers various additional terms, such as the agreement being binding on both parties' successors and assigns, and that any changes to the agreement must be in writing and signed by both parties. It's like a catch-all for important details that don't fit neatly into other sections.

Ready to get started?

Create your Mortgage now