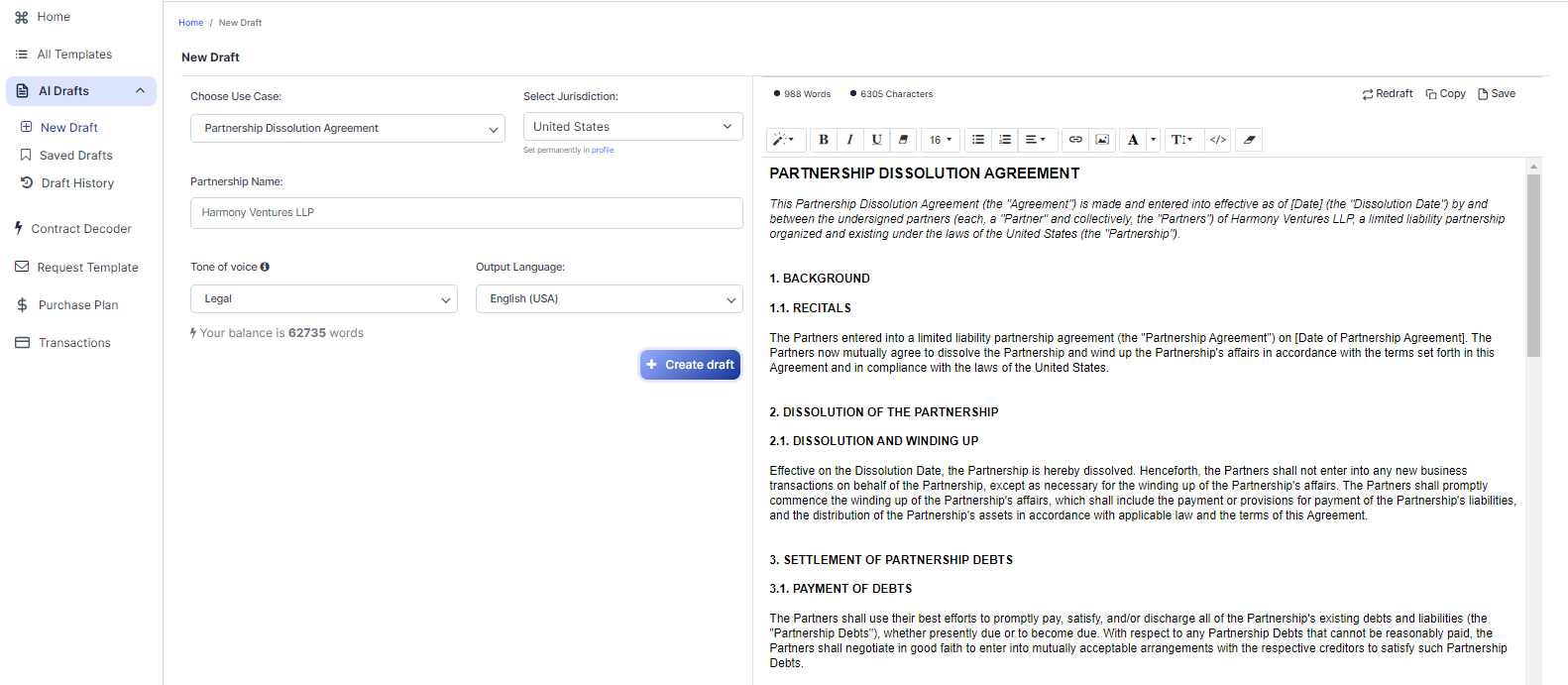

Free Partnership Dissolution Agreement (Template & Builder)

What is Partnership Dissolution Agreement?

Partnership Dissolution Agreement Specifies the terms for dissolving a business partnership, including asset distribution, liability settlement, and dissolution process.

Sample template (2026):

Partnership Dissolution Agreement

This Partnership Dissolution Agreement (the "Agreement") is made and entered into as of [Effective Date] (hereinafter, the "Effective Date") by and between the partners of Sterling Capital Advisors LLP, a limited liability partnership registered under the laws of the United States, having its principal place of business at [Address] (collectively, the "Partners").

1. Recitals

1.1. Consideration and Background

WHEREAS, the Partners have been conducting business as a limited liability partnership under the firm name Sterling Capital Advisors LLP (the "Partnership");

AND WHEREAS, the Partners wish to dissolve and terminate the Partnership upon the terms and conditions set forth in this Agreement;

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

2. Dissolution

2.1. Effective Date of Dissolution

Subject to the terms and conditions of this Agreement, the Partners acknowledge and agree that the Partnership shall be dissolved as of the Effective Date.

3. Asset Distribution

3.1. Distribution of Assets

As soon as reasonably practicable following the Effective Date, and subject to the provisions of this Agreement, the Partners shall distribute the Partnership's tangible and intangible assets (the "Assets"), net of any liabilities (the "Liabilities") associated with such Assets, in accordance with their respective ownership interests in the Partnership.

3.2. Valuation of Assets

All Assets of the Partnership shall be valued at their fair market value on the Effective Date or as close to the Effective Date as is reasonably possible. Such valuations shall be performed by an independent appraiser mutually agreed upon by the Partners.

3.3. Disposal of Assets

Returns from the sale or disposal of Assets, if any, shall be distributed amongst the Partners in proportion to their respective ownership interests.

4. Liability Settlement

4.1. Settlement of Liabilities

All Liabilities of the Partnership, whether accrued, vested, or contingent, shall be promptly settled, discharged, or fully provided for as of the Effective Date. The Partners shall be individually and jointly responsible for meeting their respective obligations in relation to the Liabilities, proportionate to their respective ownership interests in the Partnership, to the extent required by applicable law.

4.2. Indemnification

Each Partner agrees to indemnify and hold harmless the other Partner(s) from and against any loss, liability, claim, damages, or expenses, including without limitation, reasonable attorney's fees and disbursements, arising out of or in connection with a breach or alleged breach by the indemnifying Partner of its obligations in relation to the Liabilities under this Agreement or under the laws applicable to the Partnership.

5. Winding-down Procedures

5.1. Notice to Creditors

As soon as reasonably practicable after the Effective Date, the Partners shall give written notice to all creditors of the Partnership, informing them of the dissolution of the Partnership, and the intention to settle all outstanding Liabilities in accordance with this Agreement and applicable law.

5.2. Tax Filings

The Partners shall promptly file or cause to be filed all final federal, state, and local income tax returns for the Partnership, and shall make any and all required payments of taxes, penalties, and interest in respect of such returns.

5.3. Notice of Dissolution to Government Authorities

Within a reasonable period following the Effective Date, the Partners shall provide written notice to the relevant government authorities in accordance with applicable law, of the dissolution and winding down of the Partnership.

5.4. Record Retention

The Partners shall retain and maintain copies of the Partnership's records for a period of not less than six (6) years following the Effective Date as required by applicable law.

6. Miscellaneous

6.1. Governing Law and Jurisdiction

This Agreement shall be governed by and construed in accordance with the laws of the United States.

6.2. Entire Agreement

This Agreement constitutes the sole and entire agreement between the Partners with respect to the subject matter herein, and supersedes all prior or contemporaneous understandings, negotiations, and agreements, whether written or oral, relating to the subject matter herein.

6.3. Severability

In the event that any provision of this Agreement is determined by a court of competent jurisdiction to be unenforceable or invalid, such unenforceability or invalidity shall not affect the enforceability or validity of other provisions of this Agreement, and the unenforceable or invalid provision shall be deemed severed from the remainder of this Agreement.

6.4. Binding Effect

This Agreement shall inure to the benefit of and shall be binding upon the Partners and their respective heirs, executors, administrators, successors, and permitted assigns.

6.5. Amendments

This Agreement may be amended or modified only by a written instrument executed by all of the Partners.

6.6. Counterparts

This Agreement may be executed in multiple counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

IN WITNESS WHEREOF, the parties have duly executed this Partnership Dissolution Agreement as of the Effective Date.

______________________________ ______________________________

[Partner 1 Name] [Partner 2 Name]

______________________________ ______________________________

[Partner 3 Name] [Partner 4 Name]

Ready to Create your own Partnership Dissolution Agreement?

Common Sections of a Partnership Dissolution Agreement

In this Partnership Dissolution Agreement, you will see the following sections:

- Recitals

- Dissolution

- Asset Distribution

- Liability Settlement

- Winding-down Procedures

- Miscellaneous

Summary of each section:

- Recitals : This section provides the background and reasons for the dissolution of the partnership. It's like the introduction to a story, setting the stage for the rest of the agreement.

- Dissolution : This section states that the partnership will be dissolved as of the Effective Date. Think of it as the official "break-up" date of the partnership.

- Asset Distribution : This section explains how the partnership's assets will be divided among the partners. It's like dividing up the belongings after a break-up, making sure everyone gets their fair share.

- Liability Settlement : This section outlines how the partnership's liabilities will be settled and how the partners will be responsible for them. It's like figuring out who will pay the bills after a break-up.

- Winding-down Procedures : This section describes the steps the partners will take to close down the partnership, such as notifying creditors and filing tax returns. It's like the "clean-up" process after a party is over.

- Miscellaneous : This section covers various legal provisions, such as governing law, amendments, and severability. It's like the "fine print" at the end of a contract, tying up any loose ends and making sure everything is legally sound.

Ready to get started?

Create your Partnership Dissolution Agreement now