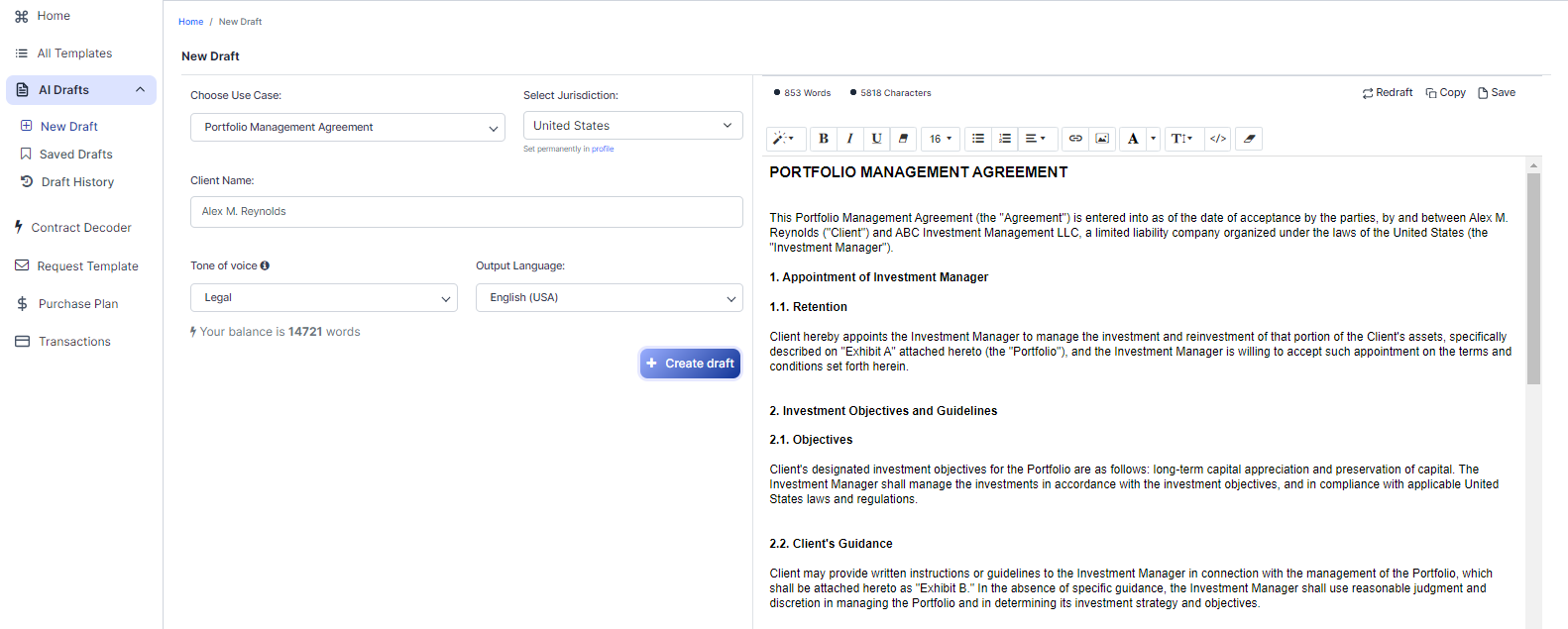

Free Portfolio Management Agreement (Template & Builder)

What is Portfolio Management Agreement?

Portfolio Management Agreement A Portfolio Management Agreement defines the terms for managing investment portfolios on behalf of clients, specifying investment strategies, fees, and reporting requirements.

Sample template (2026):

PORTFOLIO MANAGEMENT AGREEMENT

This Portfolio Management Agreement (the "Agreement") is entered into as of the date of acceptance by the parties, by and between Alex M. Reynolds ("Client") and ABC Investment Management LLC, a limited liability company organized under the laws of the United States (the "Investment Manager").

1. Appointment of Investment Manager

1.1. Retention

Client hereby appoints the Investment Manager to manage the investment and reinvestment of that portion of the Client's assets, specifically described on "Exhibit A" attached hereto (the "Portfolio"), and the Investment Manager is willing to accept such appointment on the terms and conditions set forth herein.

2. Investment Objectives and Guidelines

2.1. Objectives

Client's designated investment objectives for the Portfolio are as follows: long-term capital appreciation and preservation of capital. The Investment Manager shall manage the investments in accordance with the investment objectives, and in compliance with applicable United States laws and regulations.

2.2. Client's Guidance

Client may provide written instructions or guidelines to the Investment Manager in connection with the management of the Portfolio, which shall be attached hereto as "Exhibit B." In the absence of specific guidance, the Investment Manager shall use reasonable judgment and discretion in managing the Portfolio and in determining its investment strategy and objectives.

3. Fees

3.1. Management Fee

For its services provided hereunder, the Investment Manager shall receive an annual management fee equal to 1.00% of the market value of the Portfolio, payable on a quarterly basis, in arrears. This fee shall be calculated based on the average market value of the Portfolio on the last day of each quarter during which the Investment Manager provided services. The first management fee payment shall be prorated for the period from the commencement of this Agreement until the end of the calendar quarter.

3.2. Additional Expenses

Client shall be responsible for the payment of any and all custodial fees, brokerage fees, taxes, and other applicable costs and expenses incurred in the management of the Portfolio. The Investment Manager shall not be responsible for the payment of such fees, taxes, and expenses, unless agreed upon in writing by the parties.

4. Reporting

4.1. Frequency

Not less frequently than quarterly, the Investment Manager shall provide Client with a written statement, which shall include: (i) a summary of the Portfolio's investments and their current market value; (ii) a statement of the Portfolio's investment performance for the period; (iii) a comparison of the Portfolio's performance to its designated investment objectives and benchmarks, if applicable; and (iv) any other information or data reasonably requested by Client.

4.2. Additional Reports

At Client's reasonable request, the Investment Manager shall provide additional reports or analyses with respect to the Portfolio, provided that any significant additional work required to generate such reports or analyses may incur additional fees to be agreed upon in writing by the parties.

5. Term

5.1. Duration

This Agreement shall commence on the date first above written and, unless earlier terminated by Client or Investment Manager, shall continue in full force and effect for an initial term of one (1) year from the date hereof. Following the initial term, this Agreement shall automatically renew for successive one (1) year terms, unless either party provides written notice of its intent to terminate the Agreement at least thirty (30) days prior to the expiration of the then-current term.

6. Governing Law

6.1. Governing Law and Venue

This Agreement shall be governed by, construed and enforced in accordance with the laws of the United States, without regard to its conflict of laws principles. The parties consent to the exclusive jurisdiction of the courts of the United States for the resolution of any disputes arising under or in connection with this Agreement.

7. Miscellaneous

7.1. Entire Agreement

This Agreement, together with any exhibits attached hereto, constitutes the entire agreement and understanding of the parties with respect to the management of the Portfolio, and supersedes all prior agreements, representations and understandings, whether written or oral, with respect thereto.

7.2. Amendments

This Agreement may be amended only by a written instrument executed by both parties that specifically references this Agreement and the provision(s) to be amended.

7.3. Successors and Assigns

This Agreement shall be binding upon and inure to the benefit of the parties and their respective successors and assigns. Neither party may assign its rights or delegate its obligations hereunder without the prior written consent of the other party, which consent may not be unreasonably withheld or delayed.

IN WITNESS WHEREOF, the parties have caused this Portfolio Management Agreement to be executed and delivered as of the date first above written.

CLIENT: __________________________ INVESTMENT MANAGER: __________________________

Alex M. Reynolds

Signature Signature

Name:

Title:

Ready to Create your own Portfolio Management Agreement?

Sections of a Portfolio Management Agreement

In this Portfolio Management Agreement, you will see the following sections:

- Appointment of Investment Manager

- Investment Objectives and Guidelines

- Fees

- Reporting

- Term

- Governing Law

- Miscellaneous

Going indepth - Analysis of each section:

- Appointment of Investment Manager: This section is like hiring a personal trainer for your investments. The client (Alex M. Reynolds) is appointing the Investment Manager (ABC Investment Management LLC) to manage their investment portfolio. The specific assets to be managed are listed in Exhibit A.

- Investment Objectives and Guidelines: This section sets the goals and rules for the Investment Manager. It's like telling your personal trainer what you want to achieve (e.g., lose weight, build muscle) and any specific instructions (e.g., avoid certain exercises). The client's objectives are long-term capital appreciation and preservation of capital. The client can provide additional guidance in Exhibit B.

- Fees: This section outlines the cost of the Investment Manager's services. It's like paying your personal trainer for their expertise. The Investment Manager will receive an annual fee of 1.00% of the portfolio's market value, paid quarterly. The client is also responsible for other expenses like custodial fees, brokerage fees, taxes, and other costs related to managing the portfolio.

- Reporting: This section is about keeping the client informed about their portfolio's progress. It's like getting regular updates from your personal trainer on your fitness progress. The Investment Manager will provide quarterly written statements, including a summary of investments, performance, and comparisons to objectives and benchmarks. Additional reports can be requested by the client, but may incur extra fees.

- Term: This section sets the duration of the agreement, like signing up for a gym membership. The initial term is one year, and it will automatically renew for one-year terms unless either party gives 30 days' written notice to terminate the agreement.

- Governing Law: This section determines which country's laws will be used to interpret and enforce the agreement. In this case, it's the laws of the United States. It also states that any disputes will be resolved in the courts of the United States.

- Miscellaneous: This section covers various additional points, like stating that this agreement is the entire understanding between the parties and can only be amended in writing. It also addresses the assignment of rights and obligations to successors and assigns, which requires the other party's written consent.

Ready to get started?

Create your Portfolio Management Agreement now