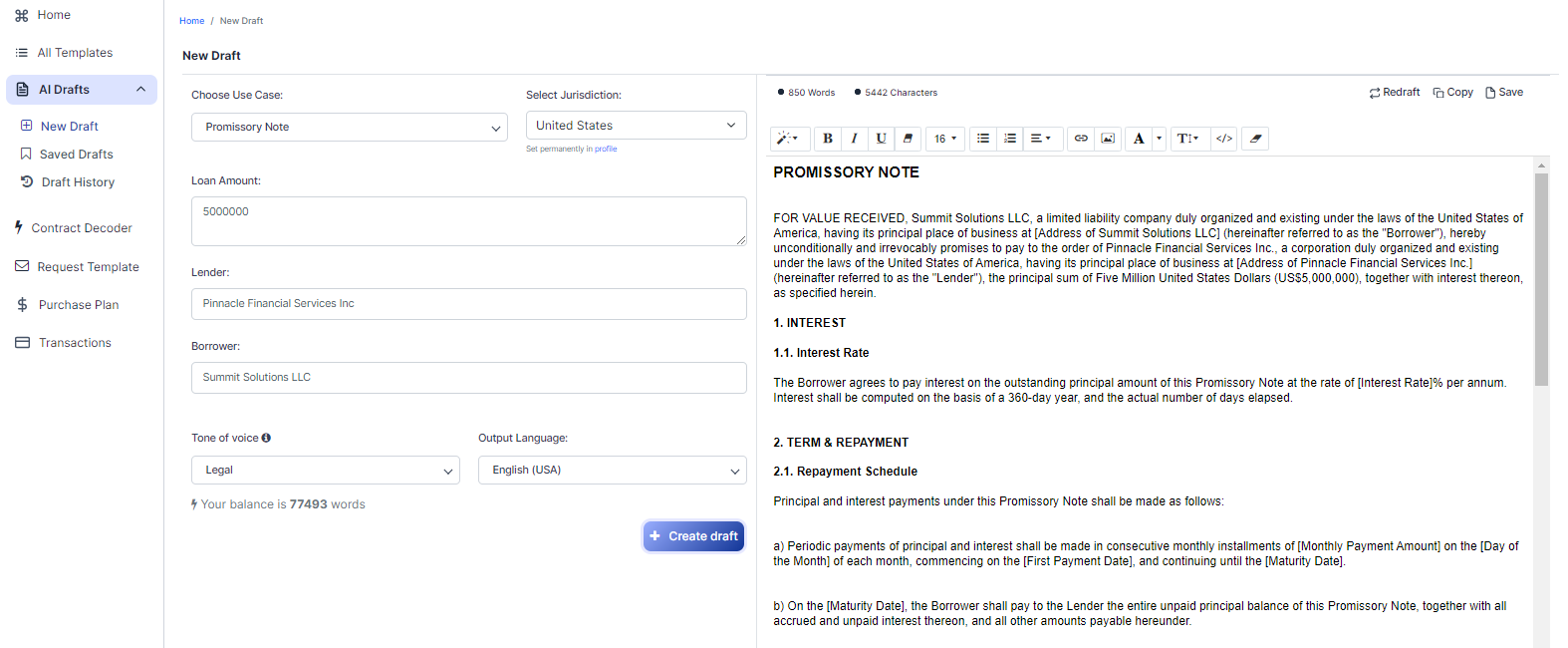

Free Promissory Note (Template & Builder)

What is Promissory Note?

Promissory Note A promissory note is a written promise to repay a loan, specifying the loan amount, interest rate, repayment schedule, and consequences of default.

Sample template (2026):

PROMISSORY NOTE

FOR VALUE RECEIVED, Summit Solutions LLC, a limited liability company duly organized and existing under the laws of the United States of America, having its principal place of business at [Address of Summit Solutions LLC] (hereinafter referred to as the "Borrower"), hereby unconditionally and irrevocably promises to pay to the order of Pinnacle Financial Services Inc., a corporation duly organized and existing under the laws of the United States of America, having its principal place of business at [Address of Pinnacle Financial Services Inc.] (hereinafter referred to as the "Lender"), the principal sum of Five Million United States Dollars (US$5,000,000), together with interest thereon, as specified herein.

1. INTEREST

1.1. Interest Rate

The Borrower agrees to pay interest on the outstanding principal amount of this Promissory Note at the rate of [Interest Rate]% per annum. Interest shall be computed on the basis of a 360-day year, and the actual number of days elapsed.

2. TERM & REPAYMENT

2.1. Repayment Schedule

Principal and interest payments under this Promissory Note shall be made as follows:

a) Periodic payments of principal and interest shall be made in consecutive monthly installments of [Monthly Payment Amount] on the [Day of the Month] of each month, commencing on the [First Payment Date], and continuing until the [Maturity Date].

b) On the [Maturity Date], the Borrower shall pay to the Lender the entire unpaid principal balance of this Promissory Note, together with all accrued and unpaid interest thereon, and all other amounts payable hereunder.

2.2. Prepayment

The Borrower may prepay, at its option and without penalty, the whole or any part of the outstanding principal amount of this Promissory Note at any time, provided that any such payment shall be accompanied by payment of all accrued and unpaid interest on the principal amount being prepaid, up to the date of prepayment.

3. DEFAULT

3.1. Events of Default

The occurrence of any of the following shall constitute an "Event of Default":

a) Failure of the Borrower to make any payment of principal or interest on this Promissory Note when due and payable;

b) Breach by the Borrower of any representation or warranty made herein or any other agreement, document or instrument entered into in connection herewith;

c) The Borrower becomes insolvent or bankrupt, or a receiver, trustee or other similar officer is appointed in respect of the Borrower or its property, or any substantial part thereof;

d) A court of competent jurisdiction enters an order or decree approving a plan of reorganization, arrangement, adjustment or composition involving the Borrower;

or e) Any other event or circumstance which the Lender, in its reasonable discretion, deems materially adverse to the Borrower's ability to perform its obligations under this Promissory Note.

3.2. Remedies

Upon the occurrence of an Event of Default, and at any time thereafter, the Lender may, in its sole discretion, declare the entire unpaid principal amount of this Promissory Note, together with all accrued and unpaid interest thereon and all other amounts payable hereunder, to be immediately due and payable without notice or demand, and the Lender shall have all rights and remedies provided by law.

4. MISCELLANEOUS

4.1. Waiver

The Borrower hereby waives presentment, demand, notice of nonpayment, protest and all other demands and notices in connection with the delivery, acceptance, performance, default, or enforcement of this Promissory Note, and consents to any extension or postponement of the time of payment, release of any collateral, or any other indulgence, without affecting liability hereunder.

4.2. Governing Law

This Promissory Note shall be governed by and construed in accordance with the laws of the United States of America.

4.3. Successors and Assigns

This Promissory Note shall be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns, provided that the Borrower may not assign or transfer any of its rights or obligations hereunder without the prior written consent of the Lender.

4.4. Severability

If any term or provision of this Promissory Note is invalid, illegal, or unenforceable in any jurisdiction, such invalidity, illegality, or unenforceability shall not affect any other term or provision of this Promissory Note or invalidate or render unenforceable such term or provision in any other jurisdiction.

4.5. Entire Agreement

This Promissory Note constitutes the entire agreement between the Borrower and the Lender with respect to the subject matter hereof and supersedes all prior negotiations, understandings or agreements, whether written or oral, between the parties hereto relating to the subject matter hereof.

IN WITNESS WHEREOF, the Borrower has duly executed this Promissory Note on [Date].

Summit Solutions LLC

_______________________________

[Authorized Signatory]

[Name of Authorized Signatory]

[Title of Authorized Signatory]

Ready to Create your own Promissory Note?

Common Sections of a Promissory Note

In this Promissory Note, you will see the following sections:

- Interest

- Term & Repayment

- Default

- Miscellaneous

Summary of each section:

- Interest : This section outlines the interest rate that the Borrower (Summit Solutions LLC) agrees to pay on the outstanding principal amount. The interest is calculated based on a 360-day year and the actual number of days elapsed.

- Term & Repayment : This section explains the repayment schedule, including the monthly payment amount, the day of the month payments are due, and the maturity date (when the entire unpaid principal balance and interest must be paid). It also allows the Borrower to prepay the outstanding principal amount without penalty, as long as all accrued and unpaid interest is also paid.

- Default : This section lists the events that would constitute a default, such as failure to make payments, breach of representations or warranties, insolvency, or any other event that the Lender deems materially adverse to the Borrower's ability to perform its obligations. If a default occurs, the Lender has the right to declare the entire unpaid principal amount, interest, and other amounts due immediately, and exercise any legal remedies available.

- Miscellaneous : This section covers various additional provisions, such as the Borrower waiving certain rights, the governing law, binding effect on successors and assigns, severability of terms, and the entire agreement between the parties. It also states that the Borrower cannot assign or transfer its rights or obligations without the Lender's prior written consent.

Ready to get started?

Create your Promissory Note now