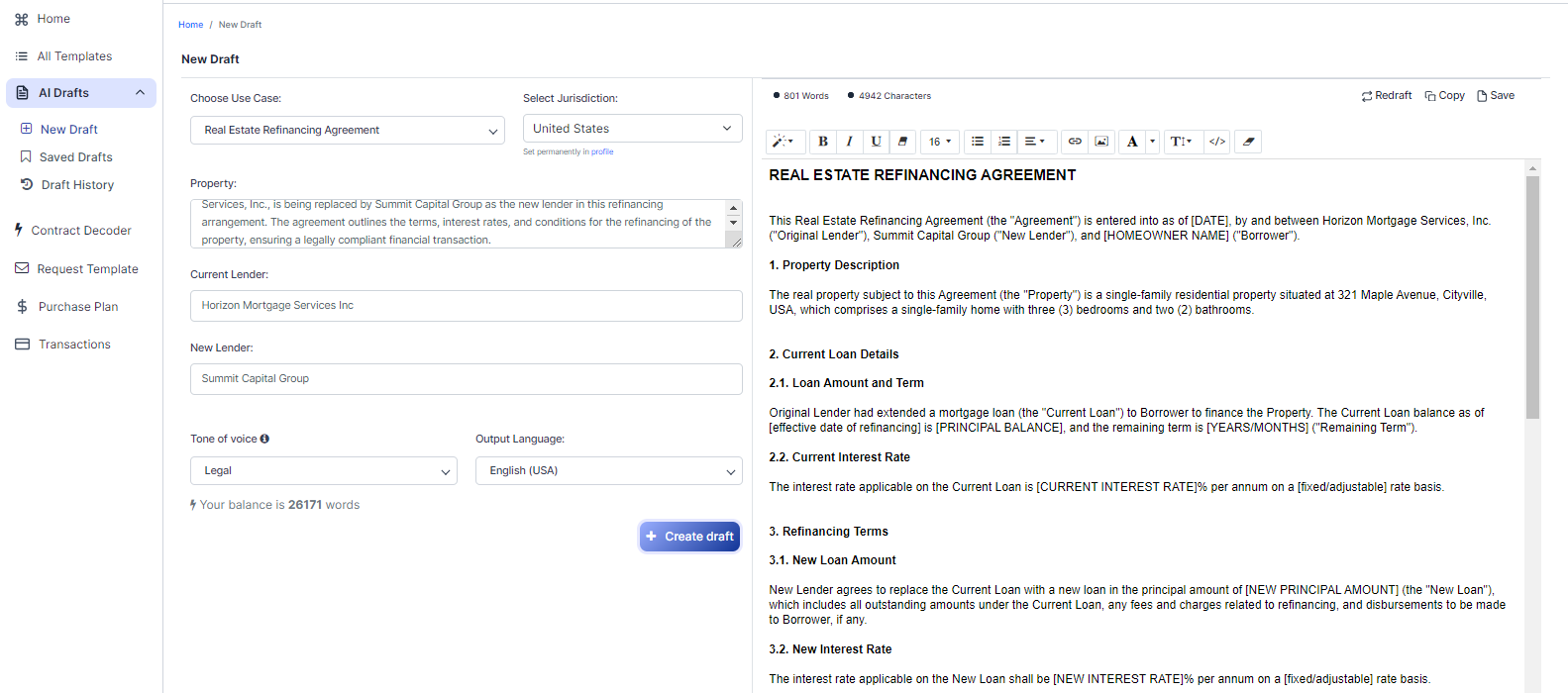

Free Real Estate Refinancing Agreement (Template & Builder)

What is Real Estate Refinancing Agreement?

Real Estate Refinancing Agreement An agreement refinancing existing real estate loans or mortgages, specifying new financing terms, interest rates, and repayment schedules to replace the original financing arrangement.

Sample template (2026):

REAL ESTATE REFINANCING AGREEMENT

This Real Estate Refinancing Agreement (the "Agreement") is entered into as of [DATE], by and between Horizon Mortgage Services, Inc. ("Original Lender"), Summit Capital Group ("New Lender"), and [HOMEOWNER NAME] ("Borrower").

1. Property Description

The real property subject to this Agreement (the "Property") is a single-family residential property situated at 321 Maple Avenue, Cityville, USA, which comprises a single-family home with three (3) bedrooms and two (2) bathrooms.

2. Current Loan Details

2.1. Loan Amount and Term

Original Lender had extended a mortgage loan (the "Current Loan") to Borrower to finance the Property. The Current Loan balance as of [effective date of refinancing] is [PRINCIPAL BALANCE], and the remaining term is [YEARS/MONTHS] ("Remaining Term").

2.2. Current Interest Rate

The interest rate applicable on the Current Loan is [CURRENT INTEREST RATE]% per annum on a [fixed/adjustable] rate basis.

3. Refinancing Terms

3.1. New Loan Amount

New Lender agrees to replace the Current Loan with a new loan in the principal amount of [NEW PRINCIPAL AMOUNT] (the "New Loan"), which includes all outstanding amounts under the Current Loan, any fees and charges related to refinancing, and disbursements to be made to Borrower, if any.

3.2. New Interest Rate

The interest rate applicable on the New Loan shall be [NEW INTEREST RATE]% per annum on a [fixed/adjustable] rate basis.

3.3. Repayment Terms

The New Loan shall be repaid by Borrower to New Lender through monthly payments over a term of [NEW LOAN TERM LENGTH], commencing from the date of disbursement of the New Loan ("Loan Disbursement Date"), on such dates, and in such amounts, as specified in a repayment schedule to be prepared by New Lender and attached to this Agreement (the "Repayment Schedule").

3.4. Application of Payments

All payments made by Borrower under the New Loan shall be applied first to the payment of interest or fees, if any, and then to the reduction of the outstanding principal balance of the New Loan.

4. Prepayment

Borrower may prepay all or a portion of the New Loan at any time without penalty, provided that Borrower gives written notice to New Lender at least thirty (30) days prior to such prepayment.

5. Security for the New Loan

Borrower shall provide a mortgage on the Property in favor of New Lender to secure the repayment of the New Loan. The mortgage shall be on such terms and conditions and in such form as may be required by New Lender, and shall be registered against the title to the Property in accordance with the applicable laws of the location of the Property.

6. Replacement of Original Lender by New Lender

Upon the execution of this Agreement, disbursement of the New Loan, and registration of the mortgage in favor of New Lender, Original Lender shall (i) release its security interest, if any, in the Property; (ii) provide Borrower and New Lender with a written acknowledgment of the full satisfaction of the Current Loan; (iii) execute any necessary documents to effect the foregoing; and (iv) take any other actions as may be reasonably requested by Borrower or New Lender in connection with the refinancing.

7. Representations and Warranties

Borrower, Original Lender, and New Lender each represent and warrant to the others that each has full authority to enter into this Agreement and perform its obligations hereunder, and that this Agreement and the transactions contemplated hereby do not and will not violate any agreement, law, or regulation to which it is subject or by which it is bound.

8. Governing Law and Jurisdiction

This Agreement shall be governed by and construed in accordance with the laws of the United States of America and the state in which the Property is located. Any disputes arising out of or relating to this Agreement shall be resolved by a court of competent jurisdiction located in the state in which the Property is situated.

9. Entire Agreement

This Agreement contains the entire understanding of the parties with respect to the subject matter hereof and supersedes all prior agreements, oral or written, with respect thereto. This Agreement may not be amended or modified in any manner except by a written instrument executed by all the parties hereto.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

___________________________

[HOMEOWNER NAME], Borrower

___________________________

Horizon Mortgage Services, Inc., Original Lender

___________________________

Summit Capital Group, New Lender

Ready to Create your own Real Estate Refinancing Agreement?

Main Sections of a Real Estate Refinancing Agreement

In this Real Estate Refinancing Agreement, you will see the following sections:

- Property Description

- Current Loan Details

- Refinancing Terms

- Prepayment

- Security for the New Loan

- Replacement of Original Lender by New Lender

- Representations and Warranties

- Governing Law and Jurisdiction

- Entire Agreement

About each Section - Analysis and Summary:

- Property Description : This section describes the property being refinanced, including its address and features. Think of it as the "who" and "where" of the agreement.

- Current Loan Details : This section provides information about the existing mortgage loan, such as the loan amount, remaining term, and interest rate. It's like a snapshot of the borrower's current financial situation with the original lender.

- Refinancing Terms : This section outlines the terms of the new loan, including the new loan amount, interest rate, repayment terms, and how payments will be applied. It's the "new deal" that the borrower is getting with the new lender.

- Prepayment : This section explains the borrower's right to prepay the new loan without penalty, as long as they provide proper notice. It's like an "early exit" option for the borrower if they want to pay off the loan sooner.

- Security for the New Loan : This section states that the borrower will provide a mortgage on the property as security for the new loan. It's like the "collateral" that the new lender requires to protect their investment.

- Replacement of Original Lender by New Lender : This section outlines the steps that the original lender must take to release their security interest in the property and acknowledge the full satisfaction of the current loan. It's like the "handover" process between the original lender and the new lender.

- Representations and Warranties : This section contains promises made by the borrower, original lender, and new lender that they have the authority to enter into the agreement and that it doesn't violate any other agreements, laws, or regulations. It's like a "trust-building" section to ensure all parties are acting in good faith.

- Governing Law and Jurisdiction : This section specifies the laws that will govern the agreement and the courts that will handle any disputes. It's like the "rulebook" and "referee" for any disagreements that may arise.

- Entire Agreement : This section states that the agreement contains the entire understanding of the parties and supersedes any prior agreements. It's like a "clean slate" that ensures all parties are on the same page.

Ready to get started?

Create your Real Estate Refinancing Agreement now