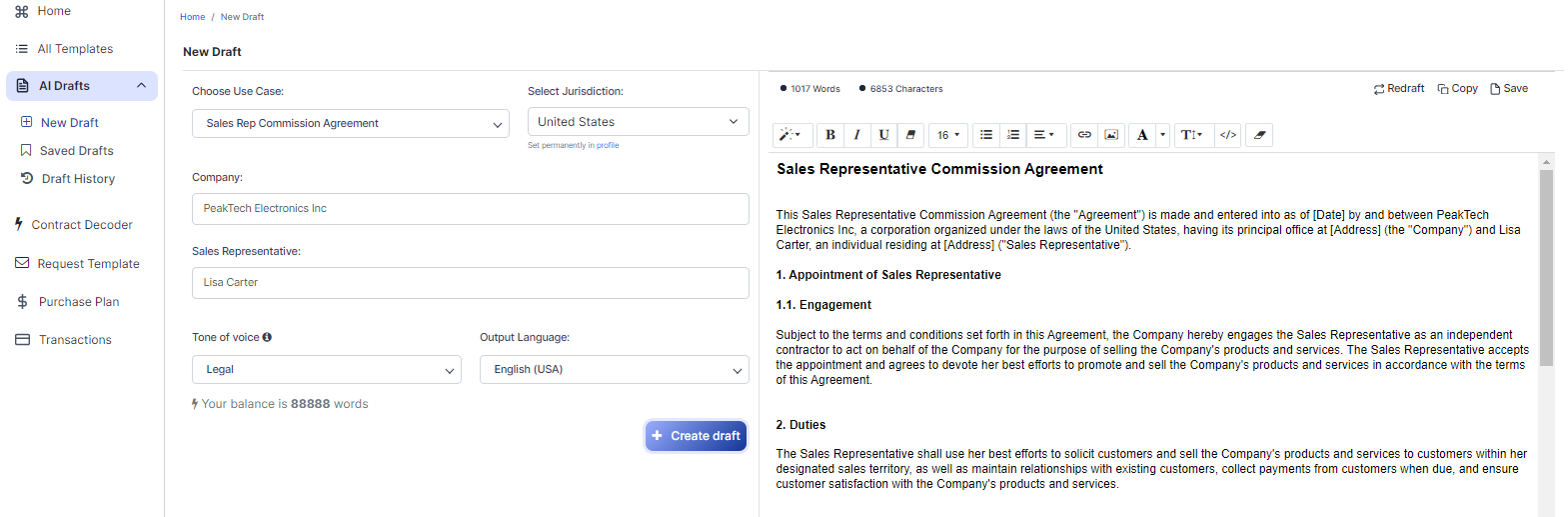

Free Sales Rep Commission Agreement (Template & Builder)

What is Sales Rep Commission Agreement?

Sales Rep Commission Agreement A Sales Representative Commission Agreement outlines terms for commission-based sales, specifying commission rates, sales targets, payment schedules, and commission calculation methods for sales representatives.

Sample template (2026):

Sales Representative Commission Agreement

This Sales Representative Commission Agreement (the "Agreement") is made and entered into as of [Date] by and between PeakTech Electronics Inc, a corporation organized under the laws of the United States, having its principal office at [Address] (the "Company") and Lisa Carter, an individual residing at [Address] ("Sales Representative").

1. Appointment of Sales Representative

1.1. Engagement

Subject to the terms and conditions set forth in this Agreement, the Company hereby engages the Sales Representative as an independent contractor to act on behalf of the Company for the purpose of selling the Company's products and services. The Sales Representative accepts the appointment and agrees to devote her best efforts to promote and sell the Company's products and services in accordance with the terms of this Agreement.

2. Duties

The Sales Representative shall use her best efforts to solicit customers and sell the Company's products and services to customers within her designated sales territory, as well as maintain relationships with existing customers, collect payments from customers when due, and ensure customer satisfaction with the Company's products and services.

3. Territory

The Sales Representative shall be responsible for sales activities within the following geographical territory (the "Territory"): [Description of Territory]. This Territory may be amended from time to time by the mutual written agreement of the parties.

4. Commission

4.1. Commission Rate

The Company shall pay Sales Representative a commission on all sales completed by the Sales Representative within the Territory, based on the following commission rates and sales targets:

- For the first $0 - $50,000 in sales revenue per quarter: [X] % commission rate

- For sales revenue between $50,001 - $100,000 per quarter: [Y] % commission rate

- For sales revenue exceeding $100,000 per quarter: [Z] % commission rate

4.2. Calculation of Commission

Commission shall be calculated based on the invoice price, net of taxes, shipping, and handling charges, and any discounts, allowances, or returns granted to the customer. Any product returns shall be deducted from the Sales Representative's commission in the quarter during which the return occurs.

5. Payment of Commission

5.1. Payment Schedule

Commission payments shall be paid to the Sales Representative on a quarterly basis, within thirty (30) days following the end of each calendar quarter. The Company shall provide a statement, showing the calculation of the commission payable, detailing all sales transactions completed by the Sales Representative during the relevant quarter.

5.2. Withholding Taxes

As an independent contractor, the Sales Representative is responsible for reporting and payment of all federal and state income taxes, social security and Medicare taxes, and any other applicable taxes for commissions earned under this Agreement. The Company will not withhold any taxes or make any additional tax payments on behalf of the Sales Representative.

6. Expenses

The Sales Representative shall be solely responsible for any and all expenses incurred in connection with her performance of duties under this Agreement, including, but not limited to, travel, lodging, meals, communications, and other business expenses. The Company shall not reimburse the Sales Representative for any such expenses unless expressly agreed upon in writing by the parties in advance of incurring such expenses.

7. Independent Contractor

Nothing herein shall be deemed to establish a partnership, joint venture, or employer-employee relationship between the parties. The Sales Representative is an independent contractor, and shall not be deemed an employee of the Company. The Sales Representative shall have no authority to bind or represent the Company in any transaction, contract, or agreement, except as specifically authorized in writing by the Company.

8. Confidentiality

During the term of this Agreement and for a period of two (2) years thereafter, the Sales Representative shall not, without the prior written consent of the Company, disclose to any person, firm, or corporation any confidential information related to the operations, products, services, or customers of the Company, except as necessary to perform her duties under this Agreement.

9. Termination

Either party may terminate this Agreement without cause by giving the other party thirty (30) days written notice. This Agreement may be terminated immediately by either party upon written notice if the other party breaches any material term or condition of this Agreement. Upon termination, the Sales Representative shall be paid all commissions earned up to the effective date of termination, subject to any applicable commission adjustments as provided for in Section 4.2.

10. Indemnification

Each party shall indemnify, defend, and hold the other party, its officers, directors, employees, and agents harmless from and against any third party claims, demands, or lawsuits arising out of or in connection with its breach or alleged breach of this Agreement, or its infringement or alleged infringement of any third party intellectual property rights.

11. Governing Law and Jurisdiction

This Agreement shall be governed by and construed in accordance with the laws of the United States and the state in which the Company's principal place of business is located, without regard to any conflict of law principles. Any disputes arising out of or in connection with this Agreement shall be subject to the exclusive jurisdiction of the courts in the same state as the Company's principal place of business.

12. Entire Agreement

This Agreement constitutes the entire agreement between the parties with respect to the subject matter herein, and supersedes and replaces all prior or contemporaneous understandings or agreements, written or oral, regarding such subject matter. This Agreement may be amended only in writing, signed by both parties.

IN WITNESS WHEREOF, each party has caused its duly authorized representative to execute this Sales Representative Commission Agreement as of the date first written above.

___________________________ ___________________________

[Company Name] [Sales Representative's Name]

By: [Authorized Company Officer] By: Lisa Carter

Ready to Create your own Sales Rep Commission Agreement?

Main Sections of a Sales Rep Commission Agreement

In this Sales Rep Commission Agreement, you will see the following sections:

- Appointment of Sales Representative

- Duties

- Territory

- Commission

- Payment of Commission

- Expenses

- Independent Contractor

- Confidentiality

- Termination

- Indemnification

- Governing Law and Jurisdiction

- Entire Agreement

About each Section - Analysis and Summary:

- Appointment of Sales Representative : This section outlines the agreement between the company and the sales representative. The sales representative is hired as an independent contractor to sell the company's products and services, and they agree to do their best to promote and sell these products and services.

- Duties : This section describes the sales representative's responsibilities, such as soliciting customers, selling products and services, maintaining relationships with existing customers, collecting payments, and ensuring customer satisfaction.

- Territory : This section defines the geographical area where the sales representative will be responsible for sales activities. The territory can be changed by mutual agreement between both parties.

- Commission : This section explains how the sales representative will be paid based on their sales performance. It provides commission rates and sales targets, as well as how the commission will be calculated (based on invoice price, net of taxes, shipping, and handling charges, and any discounts, allowances, or returns granted to the customer).

- Payment of Commission : This section outlines the payment schedule for commissions (quarterly basis) and the sales representative's responsibility for reporting and paying taxes on their earnings. The company will not withhold any taxes or make any additional tax payments on behalf of the sales representative.

- Expenses : This section states that the sales representative is responsible for all expenses related to their duties, such as travel, lodging, meals, and other business expenses. The company will not reimburse the sales representative for these expenses unless agreed upon in writing beforehand.

- Independent Contractor : This section clarifies that the sales representative is an independent contractor, not an employee of the company. They have no authority to bind or represent the company in any transaction, contract, or agreement, except as specifically authorized in writing by the company.

- Confidentiality : This section requires the sales representative to keep the company's confidential information private during the term of the agreement and for two years after its termination. They cannot disclose this information without the company's written consent.

- Termination : This section explains how either party can terminate the agreement without cause by giving 30 days written notice. The agreement can also be terminated immediately if either party breaches any material term or condition. Upon termination, the sales representative will be paid all earned commissions up to the effective date of termination, subject to any applicable commission adjustments.

- Indemnification : This section states that each party will indemnify, defend, and hold the other party harmless from any third-party claims, demands, or lawsuits arising out of or in connection with their breach or alleged breach of the agreement, or their infringement or alleged infringement of any third-party intellectual property rights.

- Governing Law and Jurisdiction : This section establishes that the agreement will be governed by the laws of the United States and the state where the company's principal place of business is located. Any disputes will be subject to the exclusive jurisdiction of the courts in the same state as the company's principal place of business.

- Entire Agreement : This section states that the agreement constitutes the entire understanding between the parties and supersedes any previous agreements or understandings. The agreement can only be amended in writing, signed by both parties.

Ready to get started?

Create your Sales Rep Commission Agreement now