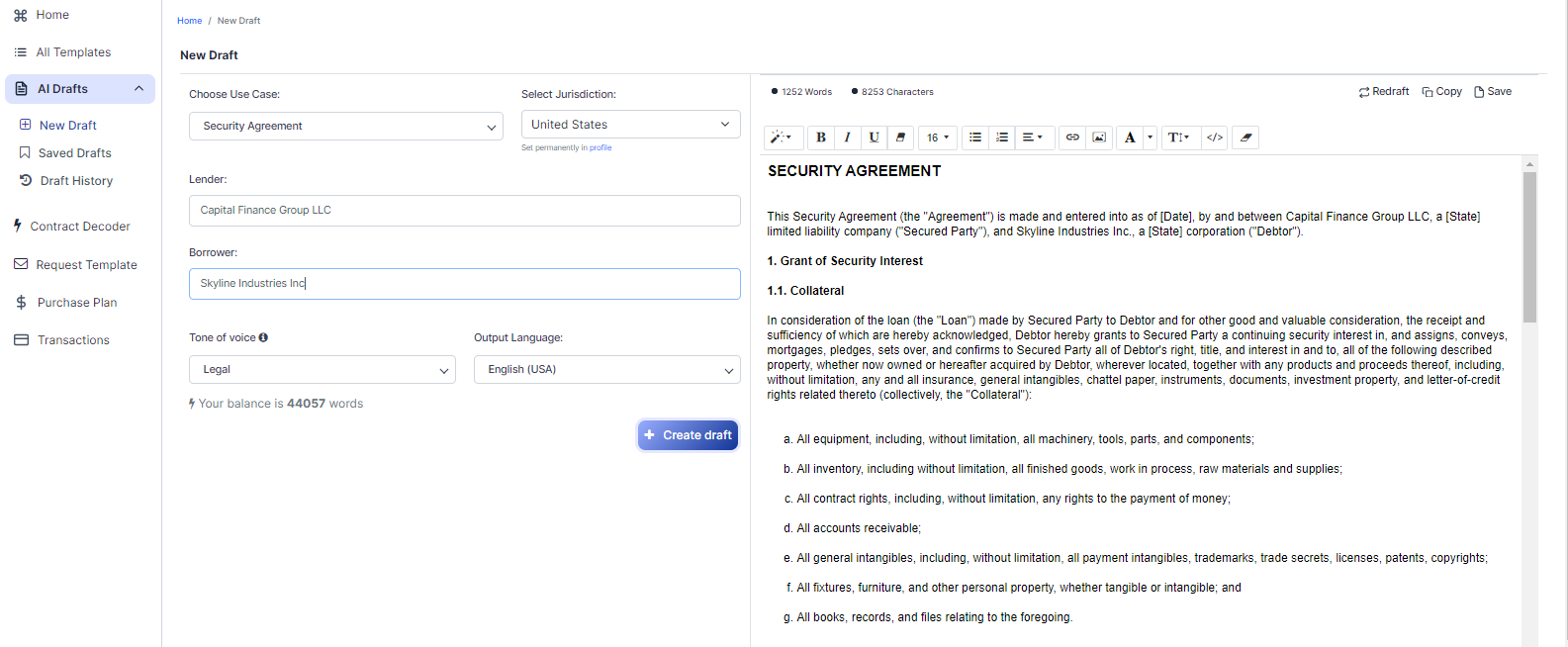

Free Security Agreement (Template & Builder)

What is Security Agreement?

Security Agreement Creates a security interest in collateral to secure a loan, outlining collateral details, default consequences, and lender rights.

Sample template (2026):

SECURITY AGREEMENT

This Security Agreement (the "Agreement") is made and entered into as of [Date], by and between Capital Finance Group LLC, a [State] limited liability company ("Secured Party"), and Skyline Industries Inc., a [State] corporation ("Debtor").

1. Grant of Security Interest

1.1. Collateral

In consideration of the loan (the "Loan") made by Secured Party to Debtor and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Debtor hereby grants to Secured Party a continuing security interest in, and assigns, conveys, mortgages, pledges, sets over, and confirms to Secured Party all of Debtor's right, title, and interest in and to, all of the following described property, whether now owned or hereafter acquired by Debtor, wherever located, together with any products and proceeds thereof, including, without limitation, any and all insurance, general intangibles, chattel paper, instruments, documents, investment property, and letter-of-credit rights related thereto (collectively, the "Collateral"):

- All equipment, including, without limitation, all machinery, tools, parts, and components;

- All inventory, including without limitation, all finished goods, work in process, raw materials and supplies;

- All contract rights, including, without limitation, any rights to the payment of money;

- All accounts receivable;

- All general intangibles, including, without limitation, all payment intangibles, trademarks, trade secrets, licenses, patents, copyrights;

- All fixtures, furniture, and other personal property, whether tangible or intangible; and

- All books, records, and files relating to the foregoing.

2. Loan and Obligations Secured

The security interest granted herein secures the payment and performance of all obligations, debts, undertakings, covenants, and liabilities of Debtor to Secured Party of any kind or nature, present or future, whether direct, indirect, absolute, contingent, liquidated, unliquidated, or otherwise, and whether now or hereafter owing, however evidenced (collectively, the "Obligations"), arising under, out of, or in connection with (a) the Loan, (b) any other loans, advances, or extensions of credit made by Secured Party to Debtor, and (c) any and all documents, instruments, and agreements evidencing or securing any of the Obligations.

3. Debtor's Representations and Warranties

Debtor represents and warrants to the Secured Party that:

- Debtor has good title to the Collateral, free and clear of all liens, claims, and encumbrances, except for the security interest granted herein;

- Debtor has full power and authority to grant the security interest in the Collateral and to execute, deliver, and perform this Agreement;

- No consents or approvals are required for the execution, delivery, or performance of this Agreement or the granting of the security interest in the Collateral, except for those consents and approvals that have been obtained and are in full force and effect;

- The execution, delivery, and performance of this Agreement does not violate any law, regulation, court order, or agreement by which Debtor is bound; and

- All information furnished by Debtor to Secured Party in connection with this Agreement is true, accurate, and complete in all material respects.

4. Covenants of Debtor

Debtor covenants and agrees with Secured Party to:

- Ensure that the Collateral is kept free and clear of all liens, security interests, claims, and encumbrances, except for the security interest granted herein;

- Promptly notify Secured Party of any event that would have a material adverse effect on the Collateral, including any levy, attachment, or other encumbrance upon the Collateral;

- Perform all acts and execute and deliver all documents and instruments necessary, from time to time, to perfect and maintain the security interest granted herein, and upon request, to execute and file any financing statements or amendments thereto necessary to perfect and maintain the validity, priority, and enforceability of the security interest granted herein;

- Maintain accurate books and records relating to the Collateral;

- Permit Secured Party and its representatives to inspect the Collateral and Debtor's books and records at any reasonable time, upon reasonable notice to Debtor; and

- Comply with all applicable laws, rules, and regulations concerning the ownership, use, and maintenance of the Collateral.

5. Default and Remedies

5.1. Events of Default

An event of default ("Event of Default") shall occur under this Agreement if:

- Debtor fails to pay when due any of the Obligations;

- Debtor breaches any representation, warranty, covenant, or other agreement contained in this Agreement;

- Debtor becomes insolvent, makes an assignment for the benefit of creditors, or admits in writing its inability to pay its debts as they become due;

- Bankruptcy, receivership, or similar proceedings are commenced by or against Debtor; or

- Any material part of the Collateral is lost, stolen, or destroyed.

5.2. Remedies

Upon the occurrence of an Event of Default, and at any time thereafter, Secured Party may, at its option, exercise any one or more of the following remedies, in addition to any other rights and remedies available to it at law, in equity, or otherwise:

- Declare the entire unpaid principal balance of the Loan, together with all accrued and unpaid interest, costs, fees, and other amounts due under the Loan Documents, to be immediately due and payable;

- Take possession of the Collateral or any part thereof;

- Sell or otherwise dispose of the Collateral, in whole or in part, at any public or private sale, for cash, upon credit, or for other property, in such manner and upon such terms as Secured Party may deem commercially reasonable;

- Setoff and apply any and all deposits, credits, or other amounts held by or owing from Secured Party to Debtor to or for the payment of any or all of the Obligations;

- Exercise any and all rights and remedies accorded to a secured party under the Uniform Commercial Code as adopted in the applicable jurisdiction; and

- Seek and obtain any other legal or equitable relief, including, without limitation, the appointment of a receiver, specific performance, and the enforcement of money judgments.

6. Governing Law

This Agreement and the rights and obligations of the parties hereunder shall be governed by, and construed and interpreted in accordance with, the laws of the United States and the State of [State], without regard to conflicts of law principles.

7. Amendments

This Agreement may be amended, modified, or supplemented only by a written instrument executed by Debtor and Secured Party.

8. Counterparts

This Agreement may be executed in any number of counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

9. Entire Agreement

This Agreement, together with any other documents and instruments executed in connection herewith, constitutes the entire agreement and understanding of the parties with respect to the subject matter hereof and supersedes all prior and contemporaneous agreements, representations, and understandings, whether oral or written.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

______________________________ ______________________________

[Secured Party Name] [Debtor Name]

Capital Finance Group LLC Skyline Industries Inc.

Ready to Create your own Security Agreement?

Common Sections of a Security Agreement

In this Security Agreement, you will see the following sections:

- Grant of Security Interest

- Loan and Obligations Secured

- Debtor's Representations and Warranties

- Covenants of Debtor

- Default and Remedies

- Governing Law

- Amendments

- Counterparts

- Entire Agreement

Going indepth - Summary of each section:

- Grant of Security Interest : This section explains that the Debtor (Skyline Industries Inc.) is giving the Secured Party (Capital Finance Group LLC) a security interest in specific property (called "Collateral") as a guarantee for the loan. The Collateral includes equipment, inventory, contract rights, accounts receivable, general intangibles, fixtures, and related records.

- Loan and Obligations Secured : This section outlines the various obligations, debts, and liabilities that the security interest covers. These include the loan itself, any other loans or advances made by the Secured Party to the Debtor, and any documents or agreements related to these obligations.

- Debtor's Representations and Warranties : In this section, the Debtor makes several promises to the Secured Party, such as having good title to the Collateral, having the authority to grant the security interest, not violating any laws or agreements, and providing accurate information about the Collateral.

- Covenants of Debtor : This section lists the Debtor's ongoing responsibilities, such as keeping the Collateral free of other claims, notifying the Secured Party of any issues affecting the Collateral, maintaining accurate records, allowing inspections, and complying with applicable laws.

- Default and Remedies : This section defines what constitutes a default (e.g., failure to pay, breach of agreement, insolvency) and the remedies available to the Secured Party in case of default. These remedies include declaring the loan due, taking possession of the Collateral, selling the Collateral, applying deposits to the debt, and seeking legal relief.

- Governing Law : This section states that the agreement is governed by the laws of the United States and the specific state mentioned in the agreement, without regard to conflicts of law principles.

- Amendments : This section explains that any changes to the agreement must be made in writing and signed by both the Debtor and the Secured Party.

- Counterparts : This section allows the agreement to be signed in multiple copies, each considered an original, but together forming one complete agreement.

- Entire Agreement : This section states that the Security Agreement, along with any related documents, represents the entire understanding between the Debtor and the Secured Party and supersedes any previous agreements or understandings.

Ready to get started?

Create your Security Agreement now