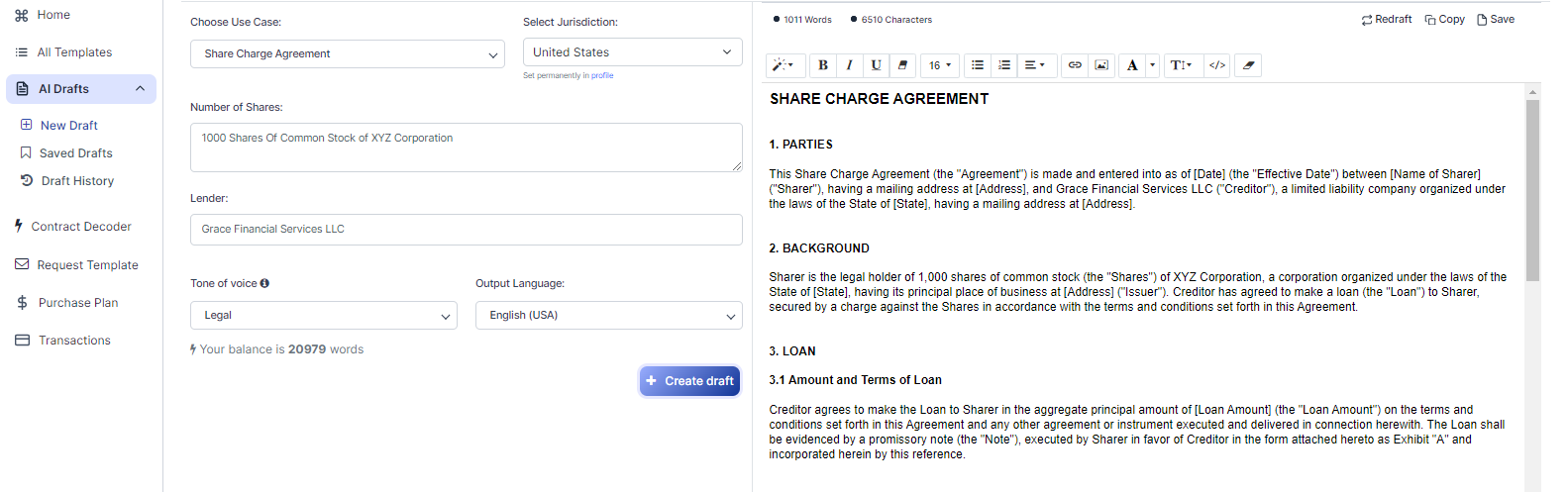

Free Share Charge Agreement (Template & Builder)

What is Share Charge Agreement?

Share Charge Agreement A Share Charge Agreement allows a party to create a charge on shares as security for a loan or obligation, specifying terms for the charge, repayment, and enforcement.

Sample template (2026):

SHARE CHARGE AGREEMENT

1. PARTIES

This Share Charge Agreement (the "Agreement") is made and entered into as of [Date] (the "Effective Date") between [Name of Sharer] ("Sharer"), having a mailing address at [Address], and Grace Financial Services LLC ("Creditor"), a limited liability company organized under the laws of the State of [State], having a mailing address at [Address].

2. BACKGROUND

Sharer is the legal holder of 1,000 shares of common stock (the "Shares") of XYZ Corporation, a corporation organized under the laws of the State of [State], having its principal place of business at [Address] ("Issuer"). Creditor has agreed to make a loan (the "Loan") to Sharer, secured by a charge against the Shares in accordance with the terms and conditions set forth in this Agreement.

3. LOAN

3.1 Amount and Terms of Loan

Creditor agrees to make the Loan to Sharer in the aggregate principal amount of [Loan Amount] (the "Loan Amount") on the terms and conditions set forth in this Agreement and any other agreement or instrument executed and delivered in connection herewith. The Loan shall be evidenced by a promissory note (the "Note"), executed by Sharer in favor of Creditor in the form attached hereto as Exhibit "A" and incorporated herein by this reference.

4. CREATION OF CHARGE

4.1 Charge over Shares

As security for the timely performance of Sharer's obligations under the Note and this Agreement, Sharer hereby charges the Shares in favor of Creditor and grants to Creditor a first priority security interest in, and lien upon, the Shares (the "Charge").

4.2 Registration of Charge

Sharer shall take all steps necessary and shall execute, acknowledge, verify under oath, deliver, and file all necessary financing statements, continuation statements, transfers, and other documents necessary to create, preserve, and perfect the Charge under applicable law or as may be otherwise reasonably required by Creditor.

5. REPRESENTATIONS AND WARRANTIES

5.1 Sharer's Representations and Warranties

Sharer represents and warrants to Creditor as follows:

(a) Title; Sharer is the sole legal and beneficial owner of the Shares, free and clear of any liens, encumbrances, or security interests;

(b) Authority and Enforceability; Sharer has full authority to enter into this Agreement and to create the Charge;

(c) Compliance with Laws; This Agreement has been duly executed and delivered by Sharer and constitutes a valid and binding agreement enforceable against Sharer in accordance with its terms; and,

(d) No Default; The execution, delivery, and performance of this Agreement by Sharer will not violate any law or result in a default under any contract to which Sharer is a party.

6. COVENANTS

6.1 Sharer's Covenants

Until the Charge is satisfied and released:

(a) Maintain Ownership; Sharer shall maintain ownership of the Shares;

(b) Preserve Security; Sharer hereby agrees not to sell, assign, transfer, pledge, or otherwise dispose of or encumber any of the Shares;

(c) Compliance with Laws; Sharer shall comply with all laws, rules, and regulations applicable to the Shares;

(d) Further Assurances; If required by Creditor at any time, Sharer shall execute and deliver to the Creditor such further instruments and take such further action as may be reasonably necessary or desirable to perfect or protect the Charge and this Agreement.

7. EVENTS OF DEFAULT AND REMEDIES

7.1 Events of Default

The occurrence of any of the following shall be an "Event of Default" under this Agreement: (a) Sharer fails to perform or observe any agreement, term, covenant, or condition of this Agreement or the Note, (b) any representation or warranty made by Sharer in this Agreement shall prove to have been materially false or misleading when made, or (c) the occurrence of any event of default as specified in the Note.

7.2 Remedies

Upon the occurrence and during the continuation of any Event of Default, Creditor shall have the right (without notice to or demand upon Sharer) to declare the entire unpaid principal balance of the Loan immediately due and payable, and to exercise all rights and remedies available to the Creditor under applicable law, including, without limitation, the right to sell or dispose of any or all of the Shares (by any manner permitted by law).

8. MISCELLANEOUS

8.1 Notices

All notices, requests, and other communications hereunder shall be in writing and shall be deemed to have been duly given when delivered or mailed by certified or registered mail, postage prepaid, to the parties at their respective addresses set forth in the introductory paragraph of this Agreement.

8.2 Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the United States and the State of [State].

8.3 Entire Agreement

This Agreement, together with any other documents or instruments executed in connection herewith, constitutes the entire agreement between the parties with respect to the subject matter hereof and supersedes all prior oral or written negotiations, commitments, understandings, and agreements.

8.4 Amendment and Waiver

This Agreement may only be amended, or any term or provision of it waived, by a writing signed by both parties.

8.5 Binding Effect

This Agreement shall be binding upon and inure to the benefit of the parties and their respective transferees, successors, and assigns.

IN WITNESS WHEREOF,

the parties have executed and delivered this Agreement as of the Effective Date.

________________________ ________________________

[Name of Sharer] Grace Financial Services LLC

("Sharer") ("Creditor")

By: ________________________ By: _______________________

Title: ______________________ Title: ______________________

Date: _______________________ Date: _______________________

Ready to Create your own Share Charge Agreement?

Sections of a Share Charge Agreement

In this Share Charge Agreement, you will see the following sections:

- Parties

- Background

- Loan

- Creation of Charge

- Representations and Warranties

- Covenants

- Events of Default and Remedies

- Miscellaneous

Going indepth - Analysis of each section:

- Parties : This section introduces the two parties involved in the agreement: the Sharer (the person who owns the shares) and the Creditor (the company providing the loan). It also provides their respective addresses.

- Background : This section explains the purpose of the agreement. The Sharer owns shares in a company (XYZ Corporation) and wants to borrow money from the Creditor. The loan will be secured by a charge against the shares.

- Loan : This section outlines the terms and conditions of the loan, including the loan amount and the promissory note (a document that outlines the borrower's promise to repay the loan).

- Creation of Charge : This section explains how the Sharer is using their shares as security for the loan. The Sharer grants the Creditor a first priority security interest in the shares, which means the Creditor has the right to sell the shares if the Sharer fails to repay the loan. The Sharer also agrees to register the charge and take any necessary steps to perfect it.

- Representations and Warranties : This section contains statements made by the Sharer to assure the Creditor that they have the legal right to enter into the agreement and that the information they provided is accurate. It also states that the agreement is legally binding and enforceable.

- Covenants : This section lists the promises made by the Sharer to the Creditor. These include maintaining ownership of the shares, not selling or encumbering the shares, complying with laws related to the shares, and providing any necessary documents or actions to protect the charge and the agreement.

- Events of Default and Remedies : This section defines what constitutes a default on the loan (e.g., failure to repay, providing false information) and the remedies available to the Creditor in case of default. These remedies include declaring the entire loan due immediately and selling the shares to recover the loan amount.

- Miscellaneous : This section covers various additional terms, such as how notices should be sent, the governing law, the entire agreement clause, amendment and waiver provisions, and the binding effect of the agreement on the parties and their successors.

Ready to get started?

Create your Share Charge Agreement now