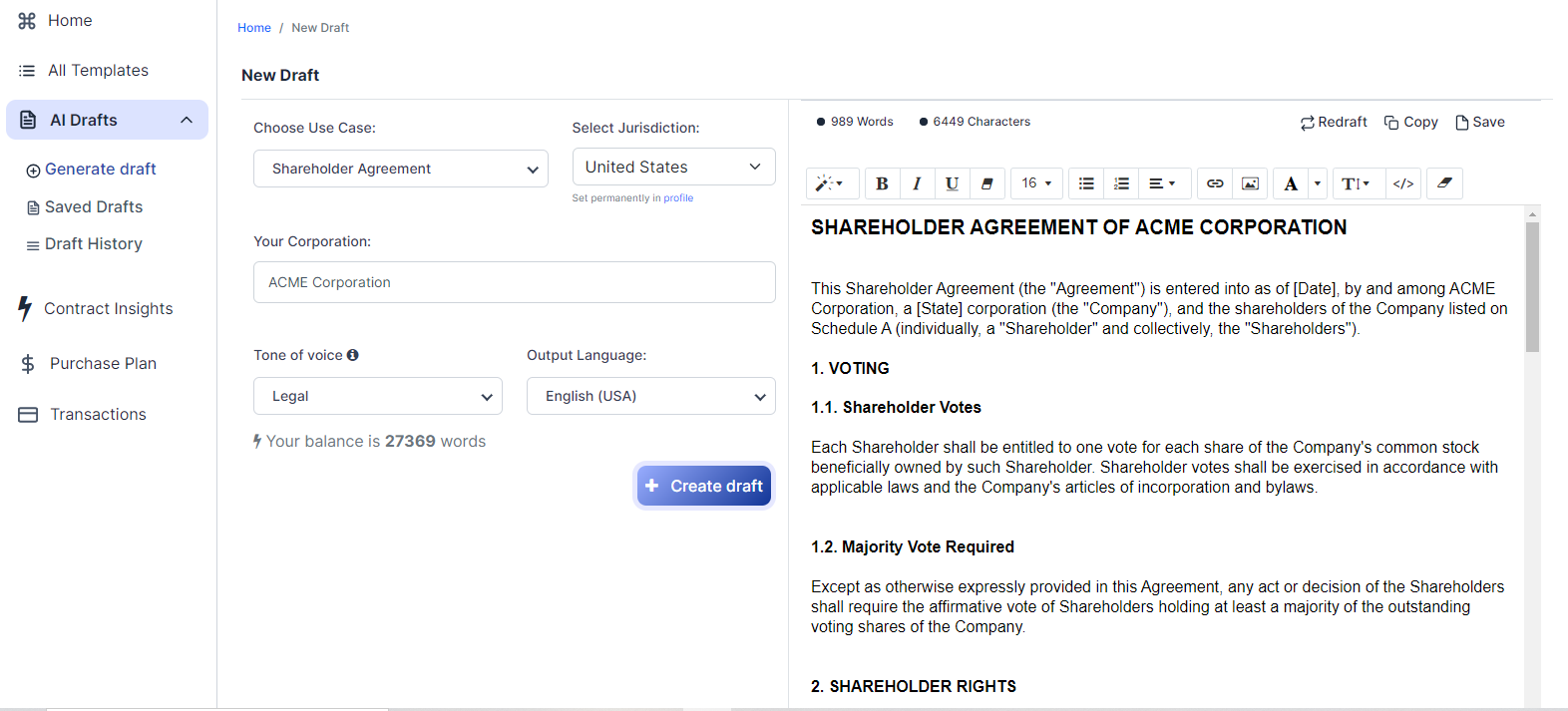

Free Shareholder Agreement (Template & Builder)

What is Shareholder Agreement?

Shareholder Agreement Outlines rights and responsibilities of shareholders in a corporation.

Sample template (2026):

SHAREHOLDER AGREEMENT

This Shareholder Agreement (the "Agreement") is made and entered into as of [Date], by and among VentureWise Enterprises, Inc., a corporation organized under the laws of the United States (the "Company"), and the undersigned shareholders (each, a "Shareholder" and collectively, the "Shareholders").

1. DEFINITIONS

1.1. Capitalized Terms. Unless otherwise defined herein, all capitalized terms used herein shall have the meanings ascribed to them in writing.

2. SHAREHOLDER RIGHTS AND REPRESENTATIONS

2.1. Shareholder Rights. Each Shareholder shall have the right and authority to vote their Shares, in person or by proxy, on all matters requiring a vote of the Shareholders of the Company, subject to the provisions of this Agreement and applicable law.

2.2. Shareholder Approval. The approval of the Shareholders holding at least a majority of the outstanding Shares shall be required for any of the following actions: (a) any amendment, modification, or repeal of any provision of the Company's articles of incorporation or bylaws; (b) any increase or decrease in the authorized capital stock of the Company; (c) the issuance of any additional Shares; (d) any merger, consolidation, sale, or other disposition of all or substantially all of the assets of the Company; (e) any liquidation, dissolution, or winding up of the affairs of the Company; and (f) any other actions requiring Shareholder approval under applicable law.

2.3. Representations. Each Shareholder represents and warrants to the Company and each other Shareholder that: (a) such Shareholder has the legal capacity and authority to enter into this Agreement; (b) such Shareholder is the record and beneficial owner of the Shares held by such Shareholder; (c) such Shareholder has good and marketable title to such Shares, free and clear of any liens, encumbrances or other adverse claims; and (d) such Shareholder will not take any action that would cause a breach of this Agreement.

3. VOTING PROVISIONS

3.1. Voting Agreement. Shareholders shall vote their Shares in accordance with this Agreement and applicable laws.

4. BUY-SELL PROVISIONS

4.1. Right of First Refusal. If a Shareholder (the "Selling Shareholder") desires to sell, assign, transfer, pledge or otherwise dispose of any or all of its Shares (a "Proposed Transfer"), the Selling Shareholder shall first provide written notice to the Company and the other Shareholders (the "Right of First Refusal Notice") of the proposed terms and the identity of the proposed transferee. The Company and the other Shareholders shall have the right of first refusal to purchase the Shares proposed for transfer on the same terms and conditions set forth in the Right of First Refusal Notice. This right shall be exercisable for a period of thirty (30) days from the date of receipt of the Right of First Refusal Notice.

4.2. Tag-Along Rights. If the Selling Shareholder proposes to sell Shares to a third party (the "Third Party Purchaser") on terms more favorable to the Third Party Purchaser than those offered to the Company and the other Shareholders under the Right of First Refusal, the remaining Shareholders shall have the right to participate in the Proposed Transfer, on a pro rata basis, by selling a portion of their Shares to the Third Party Purchaser on the same terms and conditions offered to the Selling Shareholder.

5. DISPUTE RESOLUTION

5.1. Mediation. In the event of any dispute or claim arising out of or in connection with this Agreement, the disputing parties shall first attempt in good faith to resolve such dispute through non-binding mediation administered by a mutually agreed-upon mediator. The mediation shall be held in a location mutually agreed upon by the disputing parties.

5.2. Arbitration. If the disputing parties cannot resolve the dispute through mediation pursuant to Section 5.1, they shall submit the dispute or claim to final and binding arbitration in accordance with the rules of the American Arbitration Association (the "AAA") then in effect. The arbitration shall be held in a location mutually agreed upon by the disputing parties. Each party shall bear its own costs and expenses in connection with the arbitration, and the costs and expenses of the arbitrator(s) shall be borne equally.

6. AMENDMENT AND TERMINATION

6.1. Amendment. This Agreement may be amended or modified only by a written instrument signed by the Company and Shareholders holding at least two-thirds (2/3) of the issued and outstanding Shares.

6.2. Termination. This Agreement shall terminate upon the occurrence of any of the following events: (a) the unanimous written agreement of all Shareholders; (b) the dissolution, liquidation, or winding up of the Company; or (c) the sale of all or substantially all of the assets of the Company, or the merger or consolidation of the Company with or into another entity.

7. GOVERNING LAW

7.1. Governing Law; Jurisdiction; Venue. This Agreement shall be governed by and construed in accordance with the laws of the United States and the laws of the state in which the Company is incorporated, without regard to its conflicts of laws principles. The parties hereby agree to the exclusive jurisdiction and venue of the federal and state courts located in such state for the resolution of any disputes arising out of or in connection with this Agreement.

8. MISCELLANEOUS

8.1. Entire Agreement. This Agreement, together with any exhibits, schedules, or other attachments, constitutes the entire agreement between the parties with regard to the subject matter hereof and thereof and supersedes all prior and contemporaneous agreements and understandings, whether written or oral, concerning such subject matter.

8.2. Severability. If any provision of this Agreement is found by a court of competent jurisdiction to be invalid, illegal, or unenforceable, that provision shall be limited or eliminated to the minimum extent necessary so that this Agreement shall otherwise remain in full force and effect and enforceable.

8.3. Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument. A facsimile or electronic copy of a signed counterpart of this Agreement shall be deemed an original for all purposes.

IN WITNESS WHEREOF, the parties have executed this Shareholder Agreement as of the date first above written.

_________________________

VentureWise Enterprises, Inc.

By: ______________________

Name: ____________________

Title: ____________________

_________________________

Shareholder 1

_________________________

Shareholder 2

Ready to Create your own Shareholder Agreement?

Common Sections of a Shareholder Agreement

In this Shareholder Agreement, you will see the following sections:

- Definitions

- Shareholder Rights and Representations

- Voting Provisions

- Buy-Sell Provisions

- Dispute Resolution

- Amendment and Termination

- Governing Law

- Miscellaneous

Analysis/Summary of each section

- Definitions : This section explains the meanings of specific terms used throughout the agreement. It helps to clarify the language and avoid misunderstandings.

- Shareholder Rights and Representations : This section outlines the rights of each shareholder, such as voting rights and the requirement for majority approval on certain actions. It also includes the representations and warranties made by each shareholder, like their legal capacity to enter the agreement and their ownership of the shares.

- Voting Provisions : This section explains how shareholders should vote their shares in accordance with the agreement and applicable laws. It ensures that shareholders follow the rules set out in the agreement when voting on company matters.

- Buy-Sell Provisions : This section covers the rules for selling or transferring shares, including the right of first refusal and tag-along rights. It ensures that other shareholders have the opportunity to buy shares before they are sold to an outside party and allows them to participate in a sale if more favorable terms are offered to a third party.

- Dispute Resolution : This section outlines the process for resolving disputes between shareholders, starting with mediation and moving to arbitration if necessary. It helps to provide a clear path for resolving disagreements without resorting to litigation.

- Amendment and Termination : This section explains how the agreement can be amended or terminated, such as by a written agreement signed by a certain percentage of shareholders or upon specific events like the dissolution of the company. It provides a way for the agreement to be changed or ended when necessary.

- Governing Law : This section establishes the laws that will govern the agreement and the jurisdiction and venue for resolving disputes. It helps to ensure that any legal issues are handled consistently and in a specific location.

- Miscellaneous : This section covers various additional provisions, such as the entire agreement clause, severability, and the use of counterparts. These provisions help to clarify the overall understanding of the agreement and address any potential issues that may arise.

Ready to get started?

Create your Shareholder Agreement now