Free Shareholder Buy Sell Agreement (Template & Builder)

What is Shareholder Buy Sell Agreement?

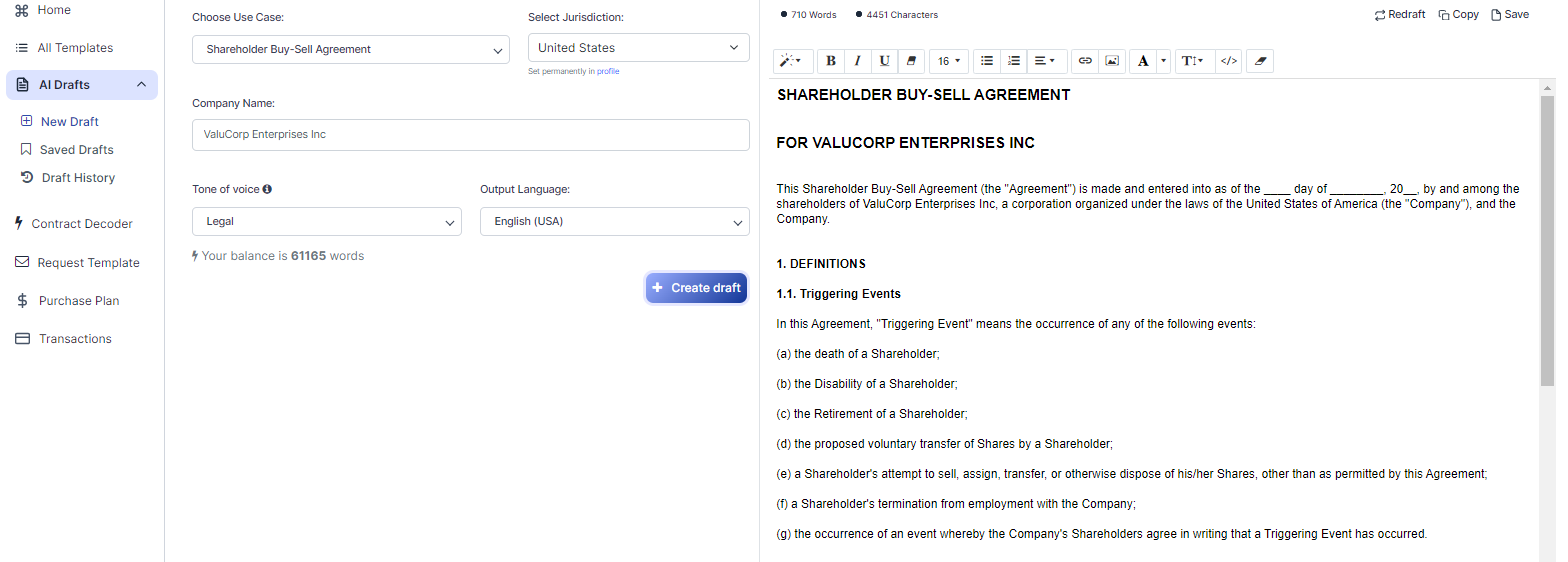

Shareholder Buy Sell Agreement A Shareholder Buy-Sell Agreement outlines the terms for buying or selling shares among shareholders, specifying triggering events, purchase price, and purchase conditions.

Sample template (2026):

SHAREHOLDER BUY-SELL AGREEMENT

FOR VALUCORP ENTERPRISES INC

This Shareholder Buy-Sell Agreement (the "Agreement") is made and entered into as of the ____ day of ________, 20__, by and among the shareholders of ValuCorp Enterprises Inc, a corporation organized under the laws of the United States of America (the "Company"), and the Company.

1. DEFINITIONS

1.1. Triggering Events

In this Agreement, "Triggering Event" means the occurrence of any of the following events:

(a) the death of a Shareholder;

(b) the Disability of a Shareholder;

(c) the Retirement of a Shareholder;

(d) the proposed voluntary transfer of Shares by a Shareholder;

(e) a Shareholder's attempt to sell, assign, transfer, or otherwise dispose of his/her Shares, other than as permitted by this Agreement;

(f) a Shareholder's termination from employment with the Company;

(g) the occurrence of an event whereby the Company's Shareholders agree in writing that a Triggering Event has occurred.

2. PURPOSE

This Agreement sets forth the terms and conditions upon which the Shares of the Company held by the Shareholders shall be purchased and sold in the event of a Triggering Event.

3. PURCHASE PRICE

3.1. Determination of Purchase Price

In the event of a Triggering Event, the purchase price for the Shares to be transferred (the "Purchase Price") shall be determined as follows:

(a) by mutual agreement of the Shareholders, or

(b) if the Shareholders cannot agree within thirty (30) days of the occurrence of a Triggering Event, by a valuation conducted by a qualified and independent appraiser (the "Appraiser") selected by mutual agreement of the Shareholders. The Appraiser shall determine the fair market value of the Shares as of the date of the Triggering Event, taking into consideration all relevant factors, including the financial condition of the Company, the earning capacity of the Company, and the value of the Company's shares in a sale of the entire business as a going concern.

3.2. Payment of Purchase Price

Upon the occurrence of a Triggering Event, and the determination of the Purchase Price, the Purchase Price shall be payable by the purchasing Shareholder(s) or the Company, as applicable, in cash, except that the parties may agree to alternative payment terms based on the financial position of the Company or for other valid reasons.

4. TRANSFER OF SHARES

4.1. Offer to Company

Upon the occurrence of a Triggering Event, the affected Shareholder or his/her legal representative shall first offer the Shares (the "Offered Shares") to the Company for purchase at the Purchase Price. The offer shall be made in writing ("Offer Notice") and shall state the number of Offered Shares, the Purchase Price, and any agreed-upon payment terms. The Company shall have thirty (30) days from receipt of the Offer Notice to accept the offer to purchase the Offered Shares by giving written notice to the affected Shareholder or his/her legal representative.

4.2. Offer to Remaining Shareholders

If the Company does not accept the offer to purchase the Offered Shares within the thirty (30) day period, the affected Shareholder or his/her legal representative may offer the Offered Shares to the remaining Shareholders at the Purchase Price. The remaining Shareholders may unanimously accept the offer to purchase the Offered Shares by giving written notice to the affected Shareholder or his/her legal representative within thirty (30) days from receipt of the Second Offer Notice.

4.3. Redemption by the Company

If neither the Company nor the remaining Shareholders accept the offer to purchase the Offered Shares within the relevant thirty (30) day period, the Company may, at its option, redeem the Offered Shares at the Purchase Price, subject to applicable laws and regulations, and the Company's constitutional documents.

4.4. Rights of First Refusal and Preemptive Rights

Notwithstanding any other provision of this Agreement, no Shareholder shall sell, assign, transfer, or otherwise dispose of his/her Shares, other than to the Company.

Ready to Create your own Shareholder Buy Sell Agreement?

Sections of a Shareholder Buy Sell Agreement

In this Shareholder Buy Sell Agreement, you will see the following sections:

- Definitions

- Purpose

- Purchase Price

- Transfer of Shares

Going indepth - Analysis of each section:

- Definitions : This section explains the meaning of "Triggering Event" and lists various situations that can trigger the buy-sell process, such as death, disability, retirement, or termination of a shareholder. Think of it as a dictionary for the terms used in the agreement.

- Purpose : This section outlines the main goal of the agreement, which is to establish the rules for buying and selling shares in the company when a triggering event occurs. It's like the mission statement of the agreement, explaining why it exists.

- Purchase Price : This section describes how the price for the shares will be determined in the event of a triggering event. It explains that the shareholders can either agree on a price or hire an appraiser to determine the fair market value. It also covers how the purchase price will be paid. Think of it as the rulebook for figuring out the price tag and payment method for the shares.

- Transfer of Shares : This section lays out the process for transferring shares when a triggering event occurs. It explains that the affected shareholder must first offer the shares to the company, then to the remaining shareholders if the company doesn't accept the offer, and finally, the company may redeem the shares if neither the company nor the remaining shareholders accept the offer. It also states that shareholders cannot sell or transfer their shares to anyone other than the company. This section is like a step-by-step guide for what to do with the shares when a triggering event happens.

Ready to get started?

Create your Shareholder Buy Sell Agreement now