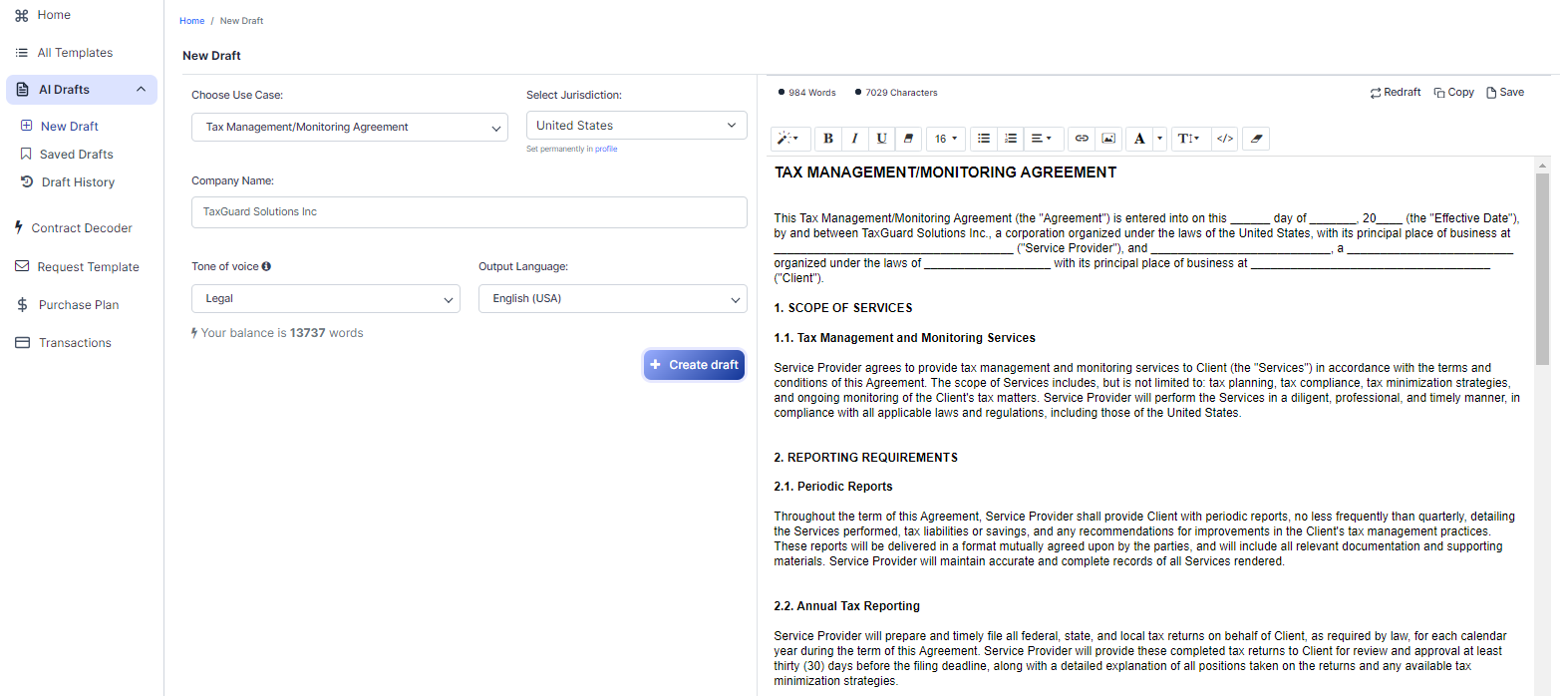

Free Tax Management/Monitoring Agreement (Template & Builder)

What is Tax Management/Monitoring Agreement?

Tax Management/Monitoring Agreement A Tax Management/Monitoring Agreement outlines the terms for managing and monitoring tax matters, often used by businesses to ensure compliance and optimize tax strategies.

Sample template (2026):

TAX MANAGEMENT/MONITORING AGREEMENT

This Tax Management/Monitoring Agreement (the "Agreement") is entered into on this ______ day of _______, 20____ (the "Effective Date"), by and between TaxGuard Solutions Inc., a corporation organized under the laws of the United States, with its principal place of business at ____________________________________ ("Service Provider"), and ___________________________, a _________________________ organized under the laws of ___________________ with its principal place of business at ____________________________________ ("Client").

1. SCOPE OF SERVICES

1.1. Tax Management and Monitoring Services

Service Provider agrees to provide tax management and monitoring services to Client (the "Services") in accordance with the terms and conditions of this Agreement. The scope of Services includes, but is not limited to: tax planning, tax compliance, tax minimization strategies, and ongoing monitoring of the Client's tax matters. Service Provider will perform the Services in a diligent, professional, and timely manner, in compliance with all applicable laws and regulations, including those of the United States.

2. REPORTING REQUIREMENTS

2.1. Periodic Reports

Throughout the term of this Agreement, Service Provider shall provide Client with periodic reports, no less frequently than quarterly, detailing the Services performed, tax liabilities or savings, and any recommendations for improvements in the Client's tax management practices. These reports will be delivered in a format mutually agreed upon by the parties, and will include all relevant documentation and supporting materials. Service Provider will maintain accurate and complete records of all Services rendered.

2.2. Annual Tax Reporting

Service Provider will prepare and timely file all federal, state, and local tax returns on behalf of Client, as required by law, for each calendar year during the term of this Agreement. Service Provider will provide these completed tax returns to Client for review and approval at least thirty (30) days before the filing deadline, along with a detailed explanation of all positions taken on the returns and any available tax minimization strategies.

2.3. Communication and Consultation

Service Provider will maintain an open and collaborative communication with Client throughout the term of this Agreement, ensuring that Client remains informed of any significant tax issues, changes in tax laws or regulations, or potential tax liabilities. In addition, Service Provider will be available to consult with Client on any tax matters or questions that Client may have during the term of this Agreement.

3. FEES

3.1. Fee Structure

In consideration of the Services provided by Service Provider under this Agreement, Client shall pay Service Provider fees in accordance with the fee structure agreed upon by the parties, as set forth in Exhibit A attached hereto and incorporated herein by reference. Such fees may include, without limitation, hourly rates, fixed fees for specific services, or a retainer for ongoing Services.

3.2. Invoices

Service Provider shall provide Client with written invoices, setting forth in reasonable detail the Services provided, the fees associated therewith, and any expenses incurred. Invoices shall be submitted to Client on a monthly basis or as otherwise agreed upon by the parties. Client shall pay all undisputed invoiced amounts within thirty (30) days of receipt of each invoice.

4. TERM AND TERMINATION

4.1. Term

This Agreement shall commence on the Effective Date and continue for an initial term of one (1) year, unless earlier terminated in accordance with the provisions of this Agreement. This Agreement may be renewed for successive one (1) year terms upon mutual written agreement of the parties.

4.2. Termination for Convenience

Either party may terminate this Agreement, without cause, upon sixty (60) days written notice to the other party.

4.3. Termination for Cause

Either party may terminate this Agreement immediately for cause if the other party breaches any material term or condition of this Agreement and fails to cure such breach within thirty (30) days after written notice thereof.

5. CONFIDENTIALITY

5.1. Confidentiality Obligations

Service Provider shall maintain the confidentiality of all information provided by Client in connection with the Services and shall not disclose such information to any third party without the prior written consent of Client, except as required by law or court order. Upon termination of this Agreement, Service Provider shall, upon Client's request, return or destroy all confidential information and any copies thereof in its possession or control.

6. INDEMNIFICATION

6.1. Indemnification Obligations

Service Provider shall indemnify, defend, and hold harmless Client, its officers, directors, employees, and agents, from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable attorneys' fees and costs) arising out of or in connection with Service Provider's negligence, willful misconduct, or breach of this Agreement.

7. GOVERNING LAW

7.1. Choice of Law

This Agreement shall be governed by and construed in accordance with the laws of the United States and the State of _____________________, without regard to any conflicts of laws principles.

8. MISCELLANEOUS

8.1. Entire Agreement

This Agreement, including any exhibits attached hereto, constitutes the entire agreement between the parties with respect to the subject matter hereof and supersedes all prior and contemporaneous agreements, representations, and understandings, whether written or oral.

8.2. Severability

If any provision of this Agreement is held invalid or unenforceable, the remainder of this Agreement will remain in full force and effect, and the invalid or unenforceable provision will be replaced by a valid and enforceable provision that achieves the original intent of the parties.

IN WITNESS WHEREOF, the parties have executed this Tax Management/Monitoring Agreement as of the Effective Date.

_____________________________________ _____________________________________

[Client Name] TaxGuard Solutions Inc.

By: ___________________________ By: ____________________________

Title: _________________________ Title: __________________________

Date: __________________________ Date: __________________________

Ready to Create your own Tax Management/Monitoring Agreement?

Common Sections of a Tax Management/Monitoring Agreement

In this Tax Management/Monitoring Agreement, you will see the following sections:

- Scope of Services

- Reporting Requirements

- Fees

- Term and Termination

- Confidentiality

- Indemnification

- Governing Law

- Miscellaneous

Going indepth - Summary of each section:

- Scope of Services : This section outlines the tax management and monitoring services that the Service Provider will provide to the Client. These services include tax planning, tax compliance, tax minimization strategies, and ongoing monitoring of the Client's tax matters. The Service Provider must perform these services professionally, diligently, and in compliance with all applicable laws and regulations.

- Reporting Requirements : This section details the reporting obligations of the Service Provider. They must provide periodic reports (at least quarterly) to the Client, detailing the services performed, tax liabilities or savings, and any recommendations for improvements. The Service Provider is also responsible for preparing and filing all required tax returns on behalf of the Client and maintaining open communication with the Client regarding any significant tax issues or changes in tax laws.

- Fees : This section explains the fees the Client will pay the Service Provider for their services. The fee structure is outlined in Exhibit A and may include hourly rates, fixed fees for specific services, or a retainer for ongoing services. The Service Provider must provide the Client with detailed invoices, and the Client must pay undisputed invoiced amounts within 30 days of receipt.

- Term and Termination : This section specifies the duration of the agreement, which begins on the Effective Date and continues for an initial term of one year. The agreement may be renewed for successive one-year terms upon mutual written agreement. Either party may terminate the agreement without cause with 60 days written notice, or immediately for cause if the other party breaches any material term or condition and fails to cure the breach within 30 days after written notice.

- Confidentiality : This section requires the Service Provider to maintain the confidentiality of all information provided by the Client and not disclose it to any third party without the Client's prior written consent, except as required by law or court order. Upon termination of the agreement, the Service Provider must return or destroy all confidential information and any copies in their possession or control.

- Indemnification : This section states that the Service Provider must indemnify, defend, and hold harmless the Client from any claims, liabilities, damages, losses, or expenses arising out of the Service Provider's negligence, willful misconduct, or breach of the agreement.

- Governing Law : This section establishes that the agreement will be governed by and construed in accordance with the laws of the United States and the specific state mentioned, without regard to any conflicts of laws principles.

- Miscellaneous : This section covers various miscellaneous provisions, such as the agreement being the entire agreement between the parties, the severability of any invalid or unenforceable provisions, and the execution of the agreement by both parties.

Ready to get started?

Create your Tax Management/Monitoring Agreement now