Free Trust Deed (Template & Builder)

What is Trust Deed?

Trust Deed A Trust Deed is a legal document that creates a trust and defines its terms, including the trust's purpose, trustee's duties, and distribution of trust assets to beneficiaries.

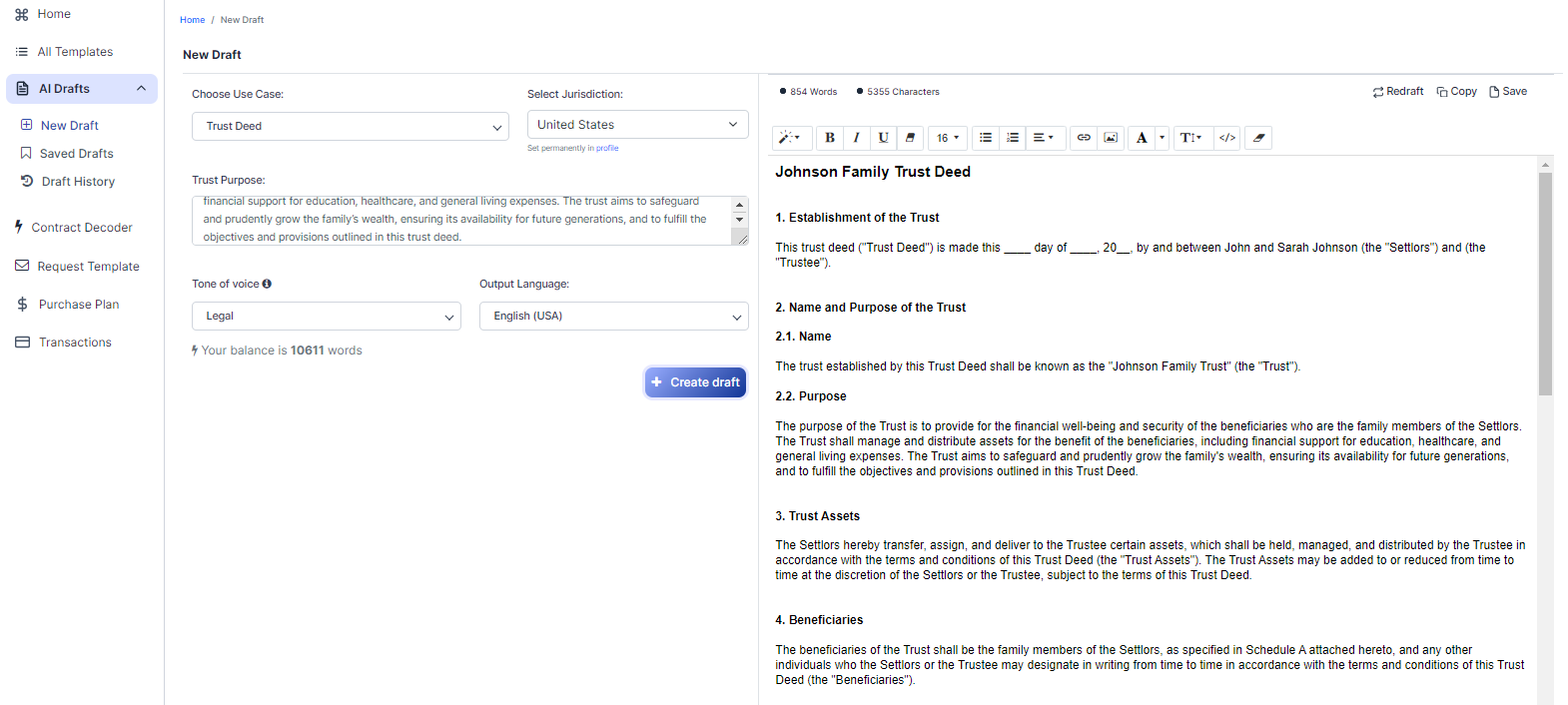

Sample template (2026):

Johnson Family Trust Deed

1. Establishment of the Trust

This trust deed ("Trust Deed") is made this ____ day of ____, 20__, by and between John and Sarah Johnson (the "Settlors") and (the "Trustee").

2. Name and Purpose of the Trust

2.1. Name

The trust established by this Trust Deed shall be known as the "Johnson Family Trust" (the "Trust").

2.2. Purpose

The purpose of the Trust is to provide for the financial well-being and security of the beneficiaries who are the family members of the Settlors. The Trust shall manage and distribute assets for the benefit of the beneficiaries, including financial support for education, healthcare, and general living expenses. The Trust aims to safeguard and prudently grow the family's wealth, ensuring its availability for future generations, and to fulfill the objectives and provisions outlined in this Trust Deed.

3. Trust Assets

The Settlors hereby transfer, assign, and deliver to the Trustee certain assets, which shall be held, managed, and distributed by the Trustee in accordance with the terms and conditions of this Trust Deed (the "Trust Assets"). The Trust Assets may be added to or reduced from time to time at the discretion of the Settlors or the Trustee, subject to the terms of this Trust Deed.

4. Beneficiaries

The beneficiaries of the Trust shall be the family members of the Settlors, as specified in Schedule A attached hereto, and any other individuals who the Settlors or the Trustee may designate in writing from time to time in accordance with the terms and conditions of this Trust Deed (the "Beneficiaries").

5. Trustee's Powers and Duties

5.1. General Powers and Duties

The Trustee shall have all powers necessary to accomplish the objectives and purposes for which the Trust is established, as set forth in this Trust Deed, including, but not limited to, the following:

5.1.1. To invest the Trust Assets in a manner consistent with the purposes of the Trust, the preservation of capital, and the objective of producing income for the Beneficiaries;

5.1.2. To sell, transfer, exchange, or otherwise dispose of the Trust Assets in accordance with the provisions of this Trust Deed;

5.1.3. To distribute Trust Assets or income therefrom to the Beneficiaries, in accordance with the terms of this Trust Deed;

5.1.4. To perform all other acts necessary or appropriate to carry out the objectives and purposes of the Trust, including the engagement of professional advisors and the maintenance of books and records;

5.2. Standard of Care

In exercising the powers conferred by this Trust Deed, the Trustee shall act with the care, skill, prudence, and diligence that a prudent person acting in a similar capacity and familiar with such matters would use in the conduct of an enterprise of a like character and with like aims.

6. Asset Management Guidelines

6.1. Investment Policy

Subject to the provisions of this Trust Deed, the Trustee shall develop, implement, and maintain an investment policy that is designed to achieve the investment objectives of the Trust while adhering to the principles of diversification, risk management, and preservation of capital.

6.2. Reporting and Review

The Trustee shall at least annually (or more frequently as required by applicable law) provide the Beneficiaries with a written report on the status and performance of the Trust Assets, including a detailed account of all investment transactions, income earned, and distributions made.

7. Distributions to Beneficiaries

The Trustee shall, in its discretion and subject to the provisions of this Trust Deed, distribute income and/or principal of the Trust Assets to the Beneficiaries for their education, healthcare, and general living expenses, and shall consider the individual needs, circumstances, and best interests of each Beneficiary.

8. Governing Law

This Trust Deed shall be governed by and construed in accordance with the laws of the United States and the state in which the Trust is administered, without regard to its conflicts of law provisions.

9. Amendments and Termination

9.1. Amendments

This Trust Deed may be amended by a written instrument executed by the Settlors and the Trustee, provided such amendment is consistent with the purposes of the Trust and does not impair the rights of any Beneficiary.

9.2. Termination

This Trust may be terminated by the written agreement of the Settlors and the Trustee, provided that all Trust Assets have been distributed to the Beneficiaries or otherwise disposed of in accordance with the provisions of this Trust Deed.

IN WITNESS WHEREOF, the Settlors and the Trustee have executed this Trust Deed as of the date first above written.

________________________ ________________________

John Johnson, Settlor Sarah Johnson, Settlor

________________________

Trustee

SCHEDULE A – Beneficiaries

[Insert list of Beneficiaries]

Ready to Create your own Trust Deed?

Sections of the Johnson Family Trust Deed

In this Trust Deed, you will see the following sections:

- Establishment of the Trust

- Name and Purpose of the Trust

- Trust Assets

- Beneficiaries

- Trustee's Powers and Duties

- Asset Management Guidelines

- Distributions to Beneficiaries

- Governing Law

- Amendments and Termination

Going indepth - Analysis of each section:

- Establishment of the Trust : This section sets up the trust, identifying the people involved (John and Sarah Johnson as the Settlors, and the Trustee) and the date the trust is created.

- Name and Purpose of the Trust : This section names the trust as the "Johnson Family Trust" and explains its purpose, which is to provide financial support for the family members of the Settlors, including education, healthcare, and general living expenses. The trust aims to protect and grow the family's wealth for future generations.

- Trust Assets : This section describes the assets that the Settlors are transferring to the Trustee to be managed and distributed according to the Trust Deed. The assets can be added to or reduced over time.

- Beneficiaries : This section identifies the family members of the Settlors who will benefit from the trust, as well as any other individuals the Settlors or Trustee may designate in writing.

- Trustee's Powers and Duties : This section outlines the Trustee's responsibilities, such as investing the trust assets, selling or transferring assets, distributing assets to beneficiaries, and maintaining records. The Trustee must act with care, skill, and diligence in managing the trust.

- Asset Management Guidelines : This section requires the Trustee to develop an investment policy that achieves the trust's objectives while adhering to principles of diversification, risk management, and preservation of capital. The Trustee must also provide regular reports on the status and performance of the trust assets to the beneficiaries.

- Distributions to Beneficiaries : This section gives the Trustee discretion to distribute income and/or principal from the trust assets to the beneficiaries for their education, healthcare, and general living expenses, considering each beneficiary's individual needs and circumstances.

- Governing Law : This section states that the Trust Deed will be governed by the laws of the United States and the state where the trust is administered.

- Amendments and Termination : This section explains how the Trust Deed can be amended (with a written agreement between the Settlors and the Trustee) and how the trust can be terminated (with a written agreement between the Settlors and the Trustee, after all trust assets have been distributed or disposed of according to the Trust Deed).

Ready to get started?

Create your Trust Deed now