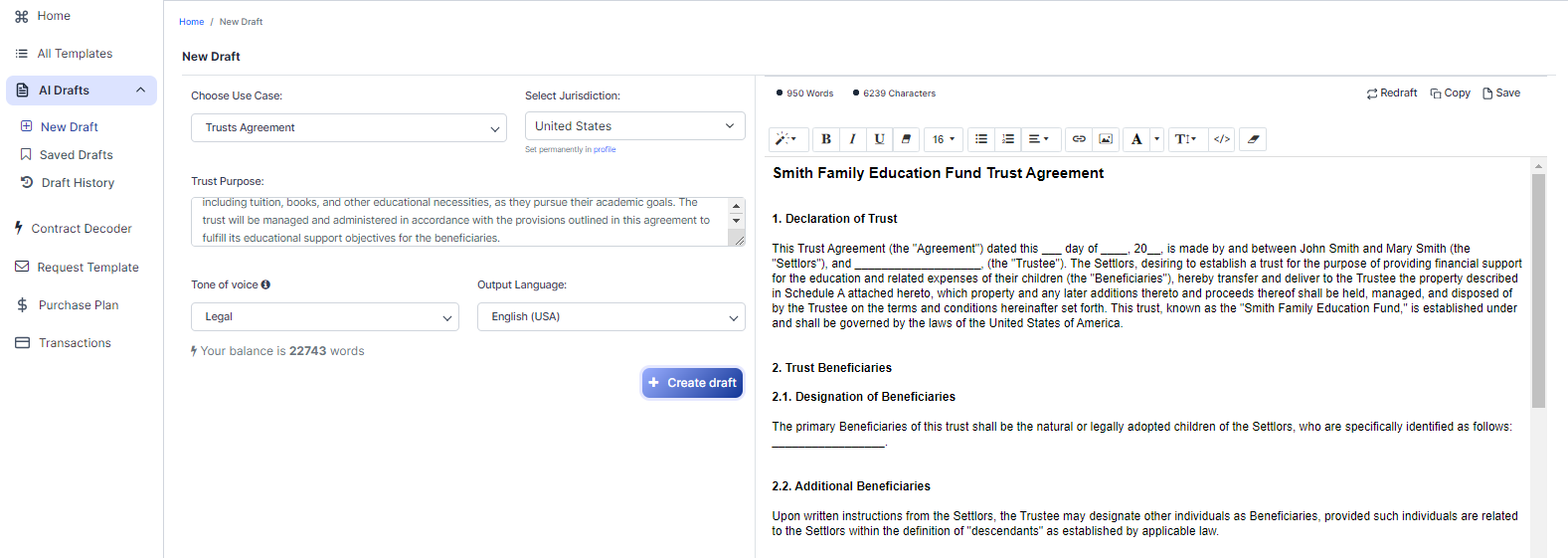

Free Trusts Agreement (Template & Builder)

What is Trusts Agreement?

Trusts Agreement A Trusts Agreement defines the terms and conditions of a trust, specifying the trustee's responsibilities, beneficiaries, and how trust assets are managed and distributed.

Sample template (2026):

Smith Family Education Fund Trust Agreement

1. Declaration of Trust

This Trust Agreement (the "Agreement") dated this ___ day of ____, 20__, is made by and between John Smith and Mary Smith (the "Settlors"), and ___________________, (the "Trustee"). The Settlors, desiring to establish a trust for the purpose of providing financial support for the education and related expenses of their children (the "Beneficiaries"), hereby transfer and deliver to the Trustee the property described in Schedule A attached hereto, which property and any later additions thereto and proceeds thereof shall be held, managed, and disposed of by the Trustee on the terms and conditions hereinafter set forth. This trust, known as the "Smith Family Education Fund," is established under and shall be governed by the laws of the United States of America.

2. Trust Beneficiaries

2.1. Designation of Beneficiaries

The primary Beneficiaries of this trust shall be the natural or legally adopted children of the Settlors, who are specifically identified as follows: _________________.

2.2. Additional Beneficiaries

Upon written instructions from the Settlors, the Trustee may designate other individuals as Beneficiaries, provided such individuals are related to the Settlors within the definition of "descendants" as established by applicable law.

3. Trustee's Duties, Powers, and Discretions

3.1. Trust Administration

The Trustee agrees to accept, hold, manage, and administer the trust property, and to perform all duties and responsibilities with regard to the Trust, including but not limited to: the collection of income; investment and reinvestment; management and responsible handling of funds; distribution of income and principal; record keeping; and filing any required tax returns in a manner consistent with the best interests of the Beneficiaries and in accordance with the terms of this Agreement and applicable law.

3.2. Asset Management

The Trustee shall ensure that trust assets are reasonably invested, in the Trustee's discretion, with the goal of preserving and increasing the value of the trust property, and generating income to be available for the purposes of the Trust. The Trustee shall have the power to hold, invest, and reinvest trust assets in any lawful investments and activities reasonably deemed essential to the proper management of the trust property, subject to any restrictions or limitations imposed by law.

3.3. Distribution of Funds

The Trustee shall distribute funds to the Beneficiaries for the purpose of providing financial support for education and related expenses, including tuition, books, and other educational necessities, as they pursue their academic goals. The Trustee shall exercise discretion in determining the amount, timing, and method of such distributions, considering the needs and circumstances of each Beneficiary and the availability of trust funds. The Trustee may impose reasonable conditions on such distributions, such as requiring proof of enrollment in an accredited educational institution, progress towards a degree or educational program, or maintaining a minimum grade point average.

3.4. Restrictions on Distributions

No distribution of funds shall be made by the Trustee to a Beneficiary for non-educational purposes, or in a manner that would result in any trust income being subject to tax for the benefit of the Settlors under applicable law. The Trustee shall ensure that all distributions are made in compliance with the applicable tax and legal requirements, and in accordance with the purposes of the Trust.

3.5. Liability

Provided that the Trustee acts in good faith, the Trustee shall not be liable for any loss or liability arising from any act or omission in the performance of the Trustee's duties, including the investment of trust assets or the exercise of any power, authority, or discretion conferred by this Agreement or by law.

4. Termination of Trust

The Trust shall continue in existence until the earlier of the following events: (a) all Beneficiaries have completed their education and no funds remain in the Trust, or (b) twenty-one (21) years from the date of this Agreement, at which time the Trust shall terminate. Upon termination, the remaining trust property, if any, shall be distributed to the then living Beneficiaries in equal shares, or if none, to the Settlors or their heirs according to the laws governing intestate succession.

5. Amendment and Revocation

This Trust may be amended or revoked only by written instrument signed by all Settlors and the Trustee, and only to the extent permitted by applicable law. No amendment or revocation shall have the effect of diverting trust property to any non-charitable purpose or causing any trust income to be taxable to the Settlors.

6. Successor Trustee

If the Trustee resigns, becomes incapacitated, or is otherwise unable or unwilling to serve, the Settlors may designate a successor Trustee by written instrument. If the Settlors are unable or unwilling to so designate, a successor Trustee may be appointed by a court having jurisdiction over the Trust. The successor Trustee shall have all the powers, rights, and duties conferred upon the original Trustee under this Agreement.

7. Governing Law

This Agreement, and all questions relating to its validity, construction, performance, and enforcement shall be governed by and construed in accordance with the laws of the United States and, to the extent not preempted thereby, the laws of the State in which the Trust property is located at the time of execution.

IN WITNESS WHEREOF, the Settlors and Trustee have executed this Trust Agreement effective as of the date first above written.

_____________________________ _____________________________

John Smith, Settlor Trustee

_____________________________

Mary Smith, Settlor

Ready to Create your own Trusts Agreement?

Sections of a Smith Family Education Fund Trust Agreement

In this Trust Agreement, you will see the following sections:

- Declaration of Trust

- Trust Beneficiaries

- Trustee's Duties, Powers, and Discretions

- Termination of Trust

- Amendment and Revocation

- Successor Trustee

- Governing Law

Going indepth - Analysis of each section:

- Declaration of Trust : This section establishes the trust, called the "Smith Family Education Fund," and outlines its purpose: to provide financial support for the education and related expenses of the Settlors' children. The Settlors (John and Mary Smith) transfer property to the Trustee, who will manage it according to the terms of the agreement and the laws of the United States.

- Trust Beneficiaries : This section identifies the primary beneficiaries of the trust as the natural or legally adopted children of the Settlors. It also allows the Settlors to designate additional beneficiaries, as long as they are related to the Settlors within the definition of "descendants" as established by applicable law.

- Trustee's Duties, Powers, and Discretions : This section outlines the Trustee's responsibilities, including managing the trust property, investing assets, distributing funds for education-related expenses, and ensuring compliance with tax and legal requirements. The Trustee is not liable for any loss or liability arising from their actions, as long as they act in good faith.

- Termination of Trust : This section states that the trust will continue until either all beneficiaries have completed their education and no funds remain in the trust, or 21 years from the date of the agreement. Upon termination, any remaining trust property will be distributed to the living beneficiaries or the Settlors' heirs.

- Amendment and Revocation : This section explains that the trust can only be amended or revoked by a written instrument signed by all Settlors and the Trustee, and only to the extent permitted by law. No amendment or revocation can divert trust property to a non-charitable purpose or cause trust income to be taxable to the Settlors.

- Successor Trustee : This section outlines the process for appointing a successor Trustee if the current Trustee resigns, becomes incapacitated, or is otherwise unable or unwilling to serve. The Settlors can designate a successor Trustee, or if they are unable or unwilling to do so, a court can appoint one. The successor Trustee will have the same powers, rights, and duties as the original Trustee.

- Governing Law : This section states that the agreement and any questions relating to its validity, construction, performance, and enforcement will be governed by the laws of the United States and, if not preempted, the laws of the State where the trust property is located at the time of execution.

Ready to get started?

Create your Trusts Agreement now